As the market starts to get back to normal, and pandemic news has less and less of an effect on the direction of stocks, it can be difficult to decide what the top TSX stocks to buy right now are.

Growth stocks were some of the top businesses for a while during the initial months of the pandemic. Once it was clear the economy was in recovery mode, the market switched to looking for stocks that were still undervalued and had recovery potential.

Since the market is getting back to normal now, investors should consider doing the same as well. In general, you want to keep the same kind of mindset and long-term investing plan throughout the ups and downs of markets.

Of course, it’s understandable to add more defence and lower your exposure to risk during an unprecedented pandemic. However, today, while still keeping the current risks in mind, the forward-looking market is being impacted less and less by the pandemic.

So, if you’re wondering whether you should look for growth or value stocks, the best stocks to buy are going to be a mix of both. TSX stocks offering exceptional long-term growth potential that trade at a reasonable price will always be the best stocks to buy.

As Warren Buffett has put it before, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

With that in mind, here are two of the top TSX stocks to buy right now.

The top TSX tech stock to buy right now

If you’re looking for growth stocks, there is no better industry to start in than technology. Technology not only has the capabilities of disrupting sectors and creating entirely new products and services. It’s also a sector that, when a business catches on, can grow and scale rapidly.

There are always several high-potential investments in the tech industry. However, the best TSX tech stock to buy right now has to be Shopify (TSX:SHOP)(NYSE:SHOP).

Shopify is one of the most popular stocks in Canada, and rightly so. It’s one of those incredibly revolutionary stocks that only comes around every so often.

It’s exactly the type of stock I think about when Warren Buffett says “wonderful companies.” The problem for many investors when it comes to the tech stock is figuring out what price makes it a buy.

Because it’s so popular and revolutionary, the stock understandably trades with a premium. Recently, though, the stock has sold off from its 52-week high, and today it offers investors a great opportunity.

The stock is by no means cheap, but a stock like Shopify rarely will be. Today’s price is a fair value, though, and if you believe Shopify can continue to grow at an exceptional pace, then it’s one of the top TSX stocks to buy today.

Top real estate growth stock

Another great TSX growth stock you can buy at a reasonable price today is InterRent REIT (TSX:IIP.UN). InterRent has been an incredible growth stock in the real estate industry and one of the best long-term investments for years.

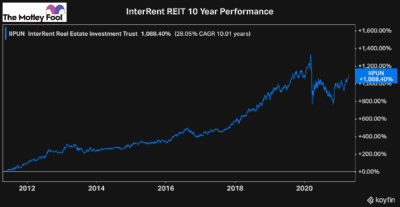

Over the last 10 years, shareholders have earned a total return of 1,088% or a compounded annual growth rate of over 28%.

The trust’s strategy involves buying properties that are undervalued and investing in upgrades and renovations. This not only increases the fund’s net asset value, but it also allows InterRent to charge higher rents, increasing its cash flow consistently.

InterRent has been incredible at executing this strategy, as you can see by its stock performance over the last 10 years in the chart above.

The pandemic delayed some growth and impacted the stock temporarily. It even still trades below its pre-pandemic price. However, not by much. That’s why it’s one of the top TSX stocks to buy today.

There’s no reason why InterRent can’t continue its impressive execution. So, while the stock still trades at a fair price, it’s one of the top TSX stocks to buy right now.