Growth stocks are stocks that are expected to grow at a rate significantly higher than the average market growth. When you buy growth stocks, you can expect to make money through capital gains. Growth stocks sometimes pay a little dividend but most don’t pay a dividend at all. If you are looking for top growth stocks, goeasy (TSX:GSY) and Docebo (TSX:DCBO)(NASDAQ:DCBO) are two of the best Canadian growth stocks to buy right now.

goeasy

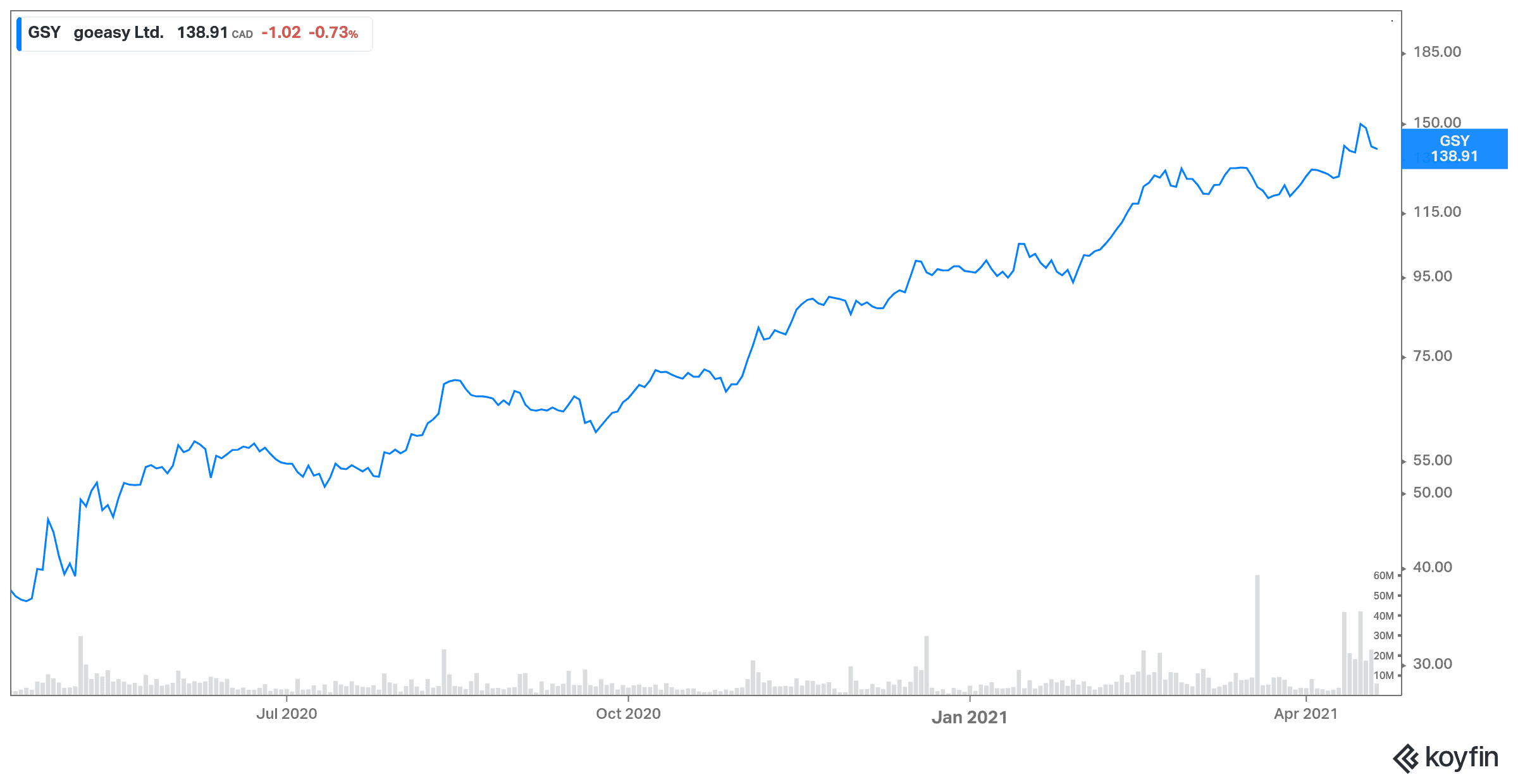

goeasy has become the leading alternative finance company in Canada and is one of the best growth stocks to buy right now. It boasts operations in all 10 provinces, over one million customers served, and exceptional long-term growth. Shares have jumped close to 45% year to date.

Since 2001, goeasy has increased its revenue by 13% each year. In 2021, its revenue grew from $66 million to $652 million.

Net income grew even faster from $0.11 per share to $8.76 per share during the same period.

Analysts expect the impressive growth rate to continue, with earnings expected to exceed $11 per share in 2022. Revenue is expected to be over $900 million next year.

Management’s ultimate goal is to dominate the Canadian non-senior credit market — a segment the company valued at some $30 billion per year. Besides its branded loan, the company also offers loans secured by real estate and things like furniture financing.

The business may also sell ancillary products with its loans, including layoff insurance and life insurance on secured loans. It has barely begun to tap this lucrative source of income.

Despite its awesome growth potential, goeasy has a cheap valuation, with stocks trading at just 12.5 times forward earnings. The company has increased its dividend payout every year since 2015. The current dividend yield is 1.3%.

Docebo

The world is becoming more and more digital. Businesses around the world are quickly moving towards digitizing many of their processes if they haven’t already. This means that tech companies offering them solutions that make digital migration more convenient are booming right now.

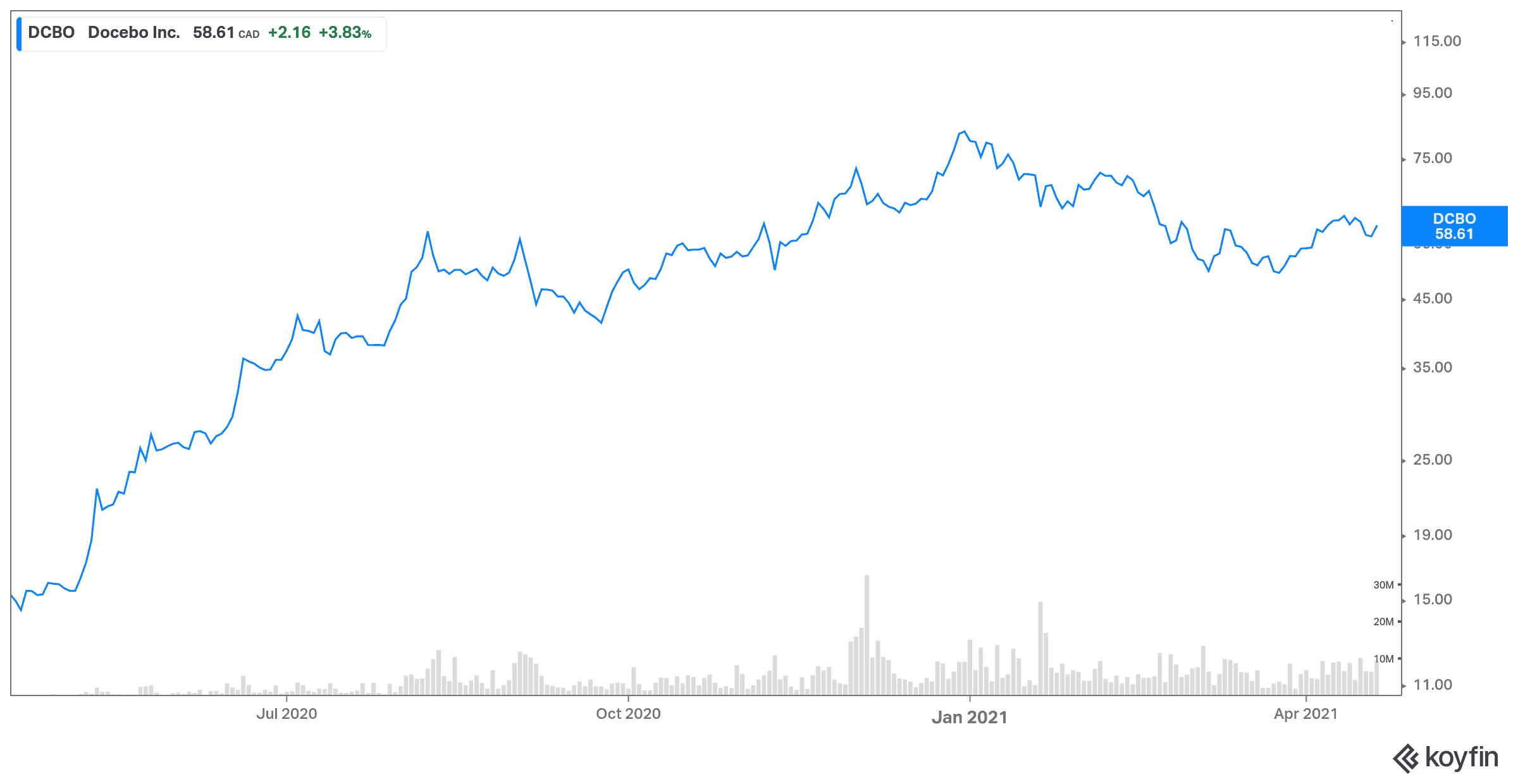

Docebo provides a cloud-based, AI-powered e-learning platform for companies at the enterprise level. Companies and training managers can use its software to easily assign, monitor, and modify training exercises for their employees. Fueled by growing demand for its learning management platform amid the pandemic, Docebo’s shares have jumped nearly 266% in the past year.

But Docebo stock has fallen by almost 30% since the start of 2021. However, the recent decline could be overstated. There is a growing demand for Docebo’s services, offering a lot of growth potential in the future. The company has recently strengthened its partnership with Amazon Web Services (AWS).

Docebo revealed in its latest financial results that its subscription revenue of US$57.4 million represented 91% of its total revenue for fiscal 2020. Revenue totalled US$62.9 million in 2020, an increase of 52% over the prior year comparative period. It reported a net loss of US$7.7 million, or US$0.26 per share, compared to a net loss of US$11.9 million, or US$0.49 per share, for the comparative period last year. For 2021, Docebo is expected to report a loss of US$0.16 per share and revenue above US$93 million.