Elon Musk has brought satellite to internet to Canada — and soon it will be available nationwide.

Last year, Musk’s Starlink conducted beta tests in New Brunswick and British Columbia. After successful testing, the company decided to take the service live. As a result, Canadians can now pre-order Starlink almost anywhere in the country.

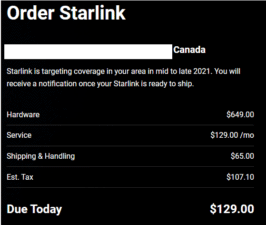

The image below as in an example of what you’ll see if you start an order for Starlink. As part of my research for this article, I visited Starlink.com, entered an address and clicked ‘order now.’ Here’s what I saw:

As you can see, I would be able to order Starlink if I wanted to. However, I’d have to wait until “mid to late 2021” to actually get service. I also tried addresses in other Canadian cities. The messages varied. For example, in some Toronto areas, you’ll get messages saying that the service area is over-capacity.

How fast is it?

Starlink internet is billed as being fast.

And according to at least one reviewer, it is.

According to a PC Magazine review, Starlink averaged an upload speed of 79 megabytes per second, compared to 19 and 24 for two competitors. Overall, Starlink won the side-by-side comparison. The service the reviewer received met Starlink’s promise of 50 to 150 megabytes per second.

The downsides

The idea of Starlink is certainly exciting. Bringing relatively fast internet to rural areas, it’s an improvement over internet service often available in these areas. However, Starlink has two downsides:

- Price. Starlink costs $129 a month and has up to $1,000 in startup costs. By contrast, Rogers Communications Inc (TSX:RCI.B)(NYSE:RCI) offers internet packages starting at $99 a month, with barely any signup costs.

- Wait times. If you sign up for Starlink, you probably won’t get service immediately. Instead, you’ll have to wait until the end of 2021 for most areas, and until 2022 for others. Overall, you could be waiting a while–yet you’ll still have to pay $129 up-front.

Can you invest?

If you’re a Canadian in a rural area, then Starlink might be an exciting opportunity for you. Certainly, it can improve your speeds if you’re in an area where service is poor. That includes rural areas, or even areas that conventional telcos won’t touch at all.

If you’re an investor, it’s a different story. Starlink is not publicly traded, nor is the company that owns it, SpaceX. You can invest in Elon Musk’s other venture, Tesla, but that has basically nothing to do with Starlink.

What you can do is invest in conventional telco stocks like Rogers Communications Inc.

I know, I know–telcos are boring old traditional businesses with nowhere near the growth potential of Elon Musk’s exciting projects. That’s true. But telecommunications is in the midst of an innovative period right now itself. All of the big Canadian telcos are in the process of rolling out 5G service nation-wide. Promising to increase cell data transfer speeds, 5G is going to change the game.

Right now, Rogers Communications has by far the biggest 5G network of any Canadian telco. And it’s only going to get bigger. If it maintains its early mover advantage, it might eventually pick up cellular subscribers from its competitors, and enjoy superior growth.

Does that in itself make Rogers Communications stock a buy?

Hardly. But it’s one exciting feature that makes Rogers a company that any Canadian investor should research.