Over the last few months, I think most investors can agree it’s gotten a lot harder to find the best stocks to buy now. Almost every stock has rallied, and even every category of investment. First, many growth stocks rallied, then it was top Canadian dividend stocks, and most recently, value stocks have seen a major increase in their share prices.

So with the economy well on its way to recovery, the forward-looking stock market has been reaching new highs.

And while there are certainly far fewer opportunities for investors today, there are still several attractive investments that exist.

Over the past year, many stocks were clearly below their fair value. So it was a lot easier to buy stocks. Furthermore, it was fairly easy to make a massive return in a short period of time.

If you had invested in just the TSX index exactly one year ago, that investment would have gained more than 30% in value. Returns like that only usually ever happen after a market pullback, and you can’t expect the stock market to grow 30% every year.

So the best stocks to buy now are the ones with the most long-term growth potential as the economy begins to expand again. Here is one of the top Canadian dividend stocks that also happens to be trading significantly undervalued.

One of the best Canadian dividend stocks to buy now

If you’re a dividend investor, I would strongly consider Enbridge Inc (TSX:ENB)(NYSE:ENB). Whether you already own shares or not, Enbridge is one of the cheapest stocks in Canada, but it won’t stay that way forever. So now is the time to consider an investment in this incredible blue-chip stock.

One of the main reasons Enbridge is so cheap is because it has exposure to the highly cyclical energy industry. However, the company has highly diversified operations, plus it has some of the most competitive assets in its industry.

This diversification and highly competitive operations are the key reasons why the Canadian dividend stock is so robust.

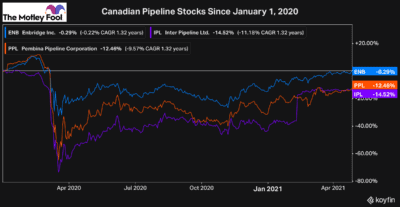

You can see from the chart over the last 16 months comparing Enbridge to two of its Canadian competitors, Pembina Pipeline and Inter Pipeline, that Enbridge is far less volatile.

At the worst point in the market pullback, Enbridge lost just 33% of its value. Pembina, on the other hand, lost 65%, and Inter was down 74%.

Enbridge’s resiliency is one of the main reasons the Canadian dividend stock is one of the best to buy now. However, in addition to all the benefits an investment offer, the stock is still notably undervalued.

Not only is Enbridge trading at a 17% discount to its consensus analyst target price, but it also pays a 7.1% dividend. So the stock is offering investors nearly 25% return potential over the next year.

Plus, that dividend has been increased for 26 consecutive years, too, including through the pandemic. So you can expect your income from an investment in Enbridge to continue to grow for years.

Bottom line

It’s clear that Enbridge is one of the top Canadian dividend stocks to buy for the long term. However, with the stock up 30% over the last six months, it continues to rally. So I don’t expect this attractive discount will last much longer.