If you’re a Canadian investor, then it’s likely you have a Tax-Free Savings Account (TFSA). While the TFSA is great, this year there is a total contribution room of $75,500. Now, if you’re interested in buying Bitcoin, you have a problem. Bitcoin currently trades at around $66,600 as of writing. So, even if you haven’t invested a penny into your TFSA, it means you can only put one solitary Bitcoin in your TFSA. Maybe it’s time to look at the bigger picture of cryptocurrency.

Let’s say you don’t have $66,600 lying around. But you want to get in on the cryptocurrency action. I don’t blame you! Luckily, there are other ways to invest in Bitcoin and cryptocurrency that won’t cost thousands. In fact, you can keep it all under $10 per share.

The Bitcoin ETF

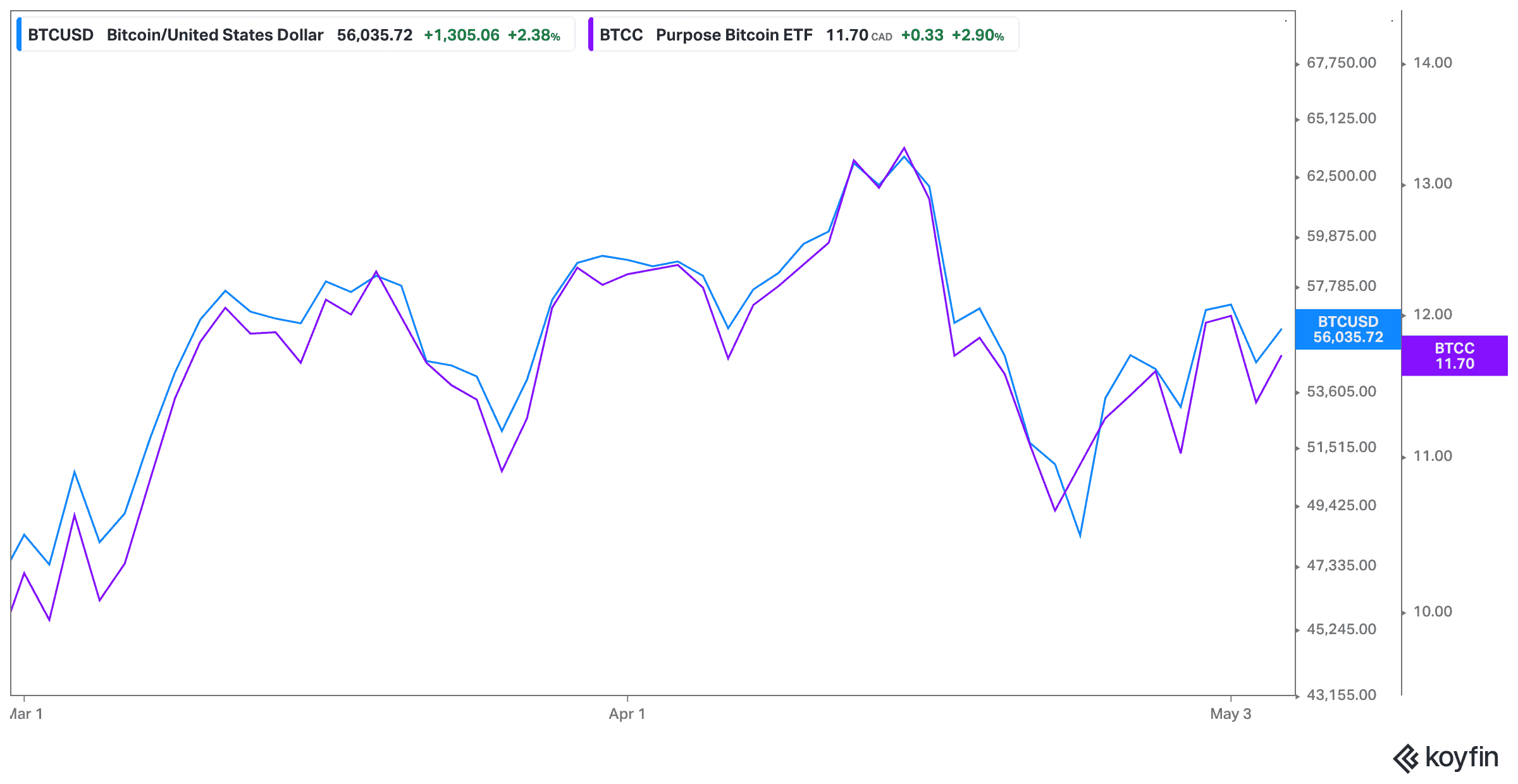

Canada now has several exchange-traded funds (ETF) exclusively focused on Bitcoin. The first official one was Purpose Bitcoin ETF (TSX:BTCC.B). It invests 100% into Bitcoin, using funds from investors to buy up Bitcoin, and then ETF investors get a share. So, basically, it’s like investing in Bitcoin for a fraction of the price. As you can see, the stock has performed almost exactly like Bitcoin since coming on the market.

As of writing, Purpose ETF has about $1.2 billion worth of Bitcoin on hand. Shares in the ETF are up 13% since coming on the market this year. If you’re one to believe that Bitcoin not only has a future but one that’s set to skyrocket, then Purpose is exactly what you want. Right now, you can pick up shares for about $10.25.

Bigger than Bitcoin?

Dogecoin has been exploding this year, though not by share price. Let’s do another side-by-side comparison to Bitcoin. While Bitcoin is currently up 545% in the last year, Dogecoin is up an insane 23,430% in the last year! That growth, of course, needs to be taken into context. While Bitcoin has been trading in the tens of thousands, Dogecoin went from $0.0034 per share to $0.80 per share. Yes, you could have made millions, but that would have been a rare occurrence.

The question is, can you still make millions? The cryptocurrency, which started out as a joke, is just like any other cryptocurrency stock. The entire market is volatile, so you’re likely to see massive fluctuation from this investment. That’s especially since a one-cent move could be a huge dent if you invest enough to make millions. So, this isn’t my favourite, but at $0.80 per share, it’s absolutely affordable to take a small stake.

HIVE stock

This is, by far, my favourite investment. Whether you’re interested in Dogecoin, Bitcoin, Ethereum, or any other cryptocurrency, HIVE Blockchain Technologies (TSXV:HIVE) is what you’ll need. The company invests in climate-controlled data centres to mine and sell cryptocurrency. It continues to grow through acquisition and is an actual business, not a currency.

What this means is, its performance is actually dependent on revenue. Most recently, that revenue increased to $13 million, up from $5 million the same time last year. And the stock keeps on rising. As of writing, shares in HIVE stock trade at $4.22 per share and are up 1,123% in the last year lone! So, here you get the middle ground in performance between the craziness of Dogecoin and stability of Purpose.

Bottom line

Cryptocurrency remains an area of investment with lots of volatility. While all three of these stocks trade under $12 per share, if you’re going to consider one, I would go with HIVE stock. The others are too dependent on the performance of an individual currency. HIVE stock, however, just depends on whether cryptocurrency will be around years from now. If today is any indicator, it looks like a likely future.