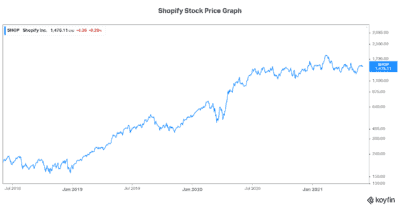

Shopify (TSX:SHOP)(NYSE:SHOP) has been a big winner for the Motley Fool, and maybe for you, too. Shopify stock continues to climb higher, dispelling the idea that it’s a pandemic stock. The market is roaring, as investors are increasingly pricing in the end of lockdowns. And they’re taking Shopify stock higher, along with the rest of the market.

Without further ado, let’s take a look at why Shopify stock is up 16% since its May lows.

Shopify stock: Not just a pandemic stock

Well before the pandemic hit, we knew that there was a trend toward digital commerce. We knew the value that it brings. A greater selection, greater convenience, and a global marketplace was already luring in many. Clearly, the pandemic and resulting lockdowns accelerated this trend. It introduced some of us to the e-commerce world, and it made others more closely acquainted with it. Simply put, it helped everyone see the win-win proposition that e-commerce brings to us.

So, it’s understandable if some of us think that Shopify stock will languish as things return to normal. I mean, the company pretty much said that growth will slow as we come out of lockdowns. For now, earnings are blowing past expectations. But once the pandemic is over, Shopify’s growth rate will head back down to pre-pandemic levels. Don’t get me wrong; those were very robust growth rates. They’re just not the growth rates we may have become accustomed to.

Yet, Shopify is setting itself up for continued growth. This will ensure its relevance for years to come. It will maintain Shopify’s place in the e-commerce chain. And it’ll build on its number one, market-leading position.

Shop Pay expands to Google: Shopify stock rallies as a result

With a partner like Google, Shop Pay is further solidifying its place in e-commerce. In fact, one billion shopping sessions take place across Google each day, which compares to over 130 million orders on Shop Pay last year. So, this gives Shop Pay access to another level of checkout transactions. It’s a major win for Shopify and a testament to its leading-edge offering.

A tale of two truths, as Shopify continues its e-commerce journey

On the one hand, Shopify continues to grab a disproportionately large share of the e-commerce solutions market. On the other hand, Shopify stock is trading at pretty lofty valuations. Today, it trades at valuations that imply that this stock is priced for perfection.

In my view, investors are trying to reconcile two truths. First is the truth that Shopify is a company that has excelled in the world of e-commerce. It came at the right time, and consumers have embraced it. This trend toward e-commerce is not going away. And Shopify is the leader. The second truth is that Shopify stock is really expensive, meaning that the expectations that are priced in are really high. And no matter how good a company’s results are, when expectations are not met, the stock will come tumbling down.

I think we can agree on the fact that this implies that there’s a contradiction here between the short-term outlook for the stock and the long-term outlook for the stock and the company. For those of us that are comfortable with focusing on the long term, this is a small problem. But we can’t ignore the fact that when a stock is factoring in the good news that’s to come many years in the future, this brings many risks with it. The risk of a major selloff in the short term should be factored into our analysis. For example, if you’ll need the money in the next couple of years, you must pay attention to this short-term risk.

Motley Fool: The bottom line

We at the Motley Fool stress the importance of a long-term focus. It’s very difficult to predict short-term movements, but the long term levels the playing field. Shopify stock continues to rally. It’s doing so because this company continues to secure its leading position in the very lucrative e-commerce world. But valuations are rich and lofty. We can expect a levelling off here in the short term, but the long-term outlook remains strong.