Most often, when we think about life-changing investment returns, phenomenal capital growth rates like Shopify stock’s 4,260% return over the past five years often come to the fore. The truth is, such returns often come with sizeable risks to capital that a good number of us wouldn’t sit comfortably with.

Alternatively, investing in tried and tested dividend growth stocks like Enbridge (TSX:ENB)(NYSE:ENB) and holding positions for the longest time in a retirement portfolio could steadily grow one’s net wealth to desired levels by retirement.

Could investing in Enbridge stock help you achieve your financial goals?

Enbridge is a dividend investor‘s favourite stock. The energy infrastructure giant that operates massive stretches of liquids pipelines, gas transmission, distribution and storage assets, and renewable power generation facilities. The company has a proven history of revenue growth, massive cash flow generation, and dividend growth.

Financial goals do vary from one individual to another, but investors who designed their investment portfolios with expectations of receiving reliable quarterly income from Enbridge stock positions haven’t been let down over the past 66 years.

Enbridge currently pays a quarterly dividend yielding 7% annually. It has grown the payout at a compound annual growth rate (CAGR) of 10% per annum over the past 26 years. The company pays out between 60-70% of its distributable cash flow.

There is ample room to maintain quarterly dividend payouts even if growth projects were suddenly canceled, which is unlikely given the company’s funded $17 billion capital investment program that promises significant cash flow growth as early as 2022.

Most noteworthy, Enbridge’s dividend growth has not come at the expense of the company’s financial strength. The company’s balance sheet is among the strongest in the industry. It’s so strong that credit rating agencies maintained their investment-grade rating on the company when market jitters increased lately due to politically motivated threats to shut down the company’s major Line 5 pipeline and to derail construction progress on its Line 3 expansion project.

Investors could confidently invest in ENB stock for financial growth and have the dividend pay their bills during retirement.

What about the Line 5 troubles?

Well, investors shouldn’t necessarily speculate on political and legal outcomes, but attempts to shut down Enbridge’s Line 5 have sparked a court battle that could take years to resolve.

A May 12 deadline to shut down Line 5 has since passed, and increased uncertainty temporarily weakened ENB’s stock price. However, there is a serious economic impact to shutting down the pipeline. Job losses and product supply issues need resolution before a shutdown.

Given the strong recovery in Enbridge’s stock price in June, investors are discounting Line 5 shut-down as a distant possibility.

It was reported in May that Enbridge has received massive support from powerful entities with vested interests in the matter, including the Government of Canada, Attorneys General of Ohio and Louisiana, Chambers of Commerce from the U.S., Canada, Michigan, and Ohio, and trade unions.

Affected parties aren’t taking the matter lying down, and we can all speculate on potential outcomes of a lengthy legal battle. Until then, the oil will continue to flow.

It can be said that no harm has been done to Enbridge’s cash flows thus far, and the status quo could hold for several years to come. During this time, the company could not only replace the old Line 5 asset, the company could significantly increase its pipelines’ total carrying capacity.

Can ENB returns change your life?

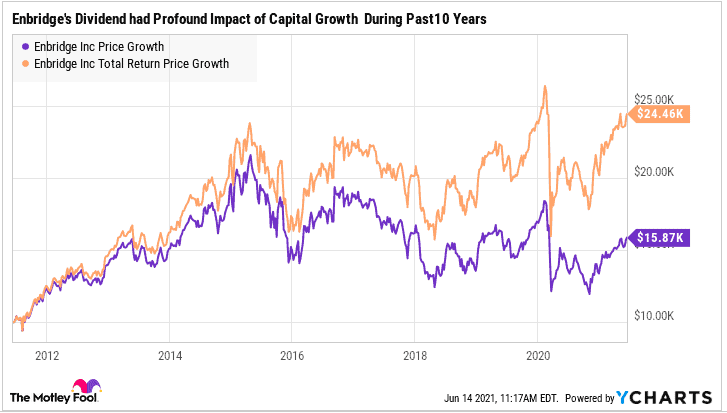

Enbridge remains a strong long-term investment candidate. $10,000 invested in ENB stock 10 years ago has grown to about $24,500 today, thanks mostly to growing dividends.

Assuming the company maintains its current dividend payout flat, the 7% yield alone could grow $10,000investment to over $19,000 in 10 years, assuming full reinvestment of quarterly dividends.

If the company maintains a targetted 5-7% near-term growth in distributable cash flows over the decade we may be looking at annual returns in excess of 12% between now and 2030. Such returns can triple a $10,000 investment in a decade – not exactly life-changing returns, but still great.

The pipeline giant has the potential to sustain its strong dividend growth streak, and shares could generate stable capital gains over the next decade. Given Enbridge management’s strong commitment to income-oriented shareholders, the company’s dividend could reliably pay bills during retirement.

ENB shares currently trade cheaply at under $50 at writing.