Now that markets have recovered, besides the occasional company-specific news that causes a stock to rally or decline, stocks are moving in tandem with their industry peers. The days of finding the top Canadian stocks to buy and having them rally are over.

Nowadays, you have to be more selective with the stocks you’re buying. We still want to buy the best Canadian stocks for the long term.

However, we also don’t want to overpay when there are other opportunities to find stocks that are still trading undervalued.

So, if you’re looking to add to your portfolio this month, these are two industries and the top Canadian stocks in each to buy this month.

A top Canadian tech stock to buy now

Some of the top Canadian stocks to buy now are tech stocks that look to be trading undervalued.

Earlier in the year, many tech stocks saw a significant selloff. This resulted in much of the sector being extremely cheap. However, recently, the top large-cap stocks in the industry, like Shopify, have started to rally again.

So, while Shopify has already recovered, there are still several Canadian tech stocks trading mighty cheap. One stock that’s prime for a major recovery and a top Canadian stock to buy today is AcuityAds Holdings (TSX:AT)(NASDAQ:ATY)

AcuityAds is a high-potential stock in the AdTech space. It’s still a company in its early stages and only has a market cap of roughly $750 million.

Stocks, especially in the tech sector that are in an early stage like AcuityAds, are difficult to price for certain reasons.

First off, the growth that you expect is a major guestimate, unlike an established business whose sales you can better estimate. Secondly, the valuation multiple that you use with those revenue and profit estimates can also vary considerably by market conditions.

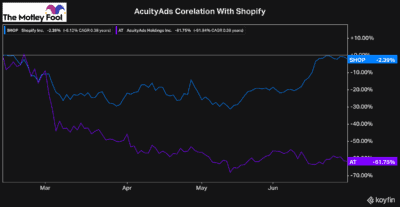

Back in February, as Shopify and all the other tech stocks began to sell off, so too did AcuityAds.

As you can see, though, Shopify has now recovered. Meanwhile, AcuityAds is still trading extremely cheap.

This selloff wasn’t necessarily company specific. All these stocks just saw a hit to their valuation multiples.

Not only does AcuityAds have significant potential to rally long-term as its business grows, but it also has the potential to rally, as market conditions for small-cap tech stocks improve.

Trading at just $12 a share, it doesn’t get much cheaper than this. And given this stock could rally any day, I’d take advantage of the discount and buy the Canadian stock hand over fist in July.

Renewable energy stocks

In addition to tech stocks, another industry that saw a significant pullback earlier in the year was green energy stocks. One of the top Canadian stocks in the renewable energy space to buy for the long term is Brookfield Renewable Partners (TSX:BEP.UN)(NYSE:BEP).

Green energy stocks have a tonne of potential to grow long term. Governments around the world continue to make pledges to improve the environment. And often, these pledges get pushed up, meaning that there could be even more potential in the coming years than investors are expecting.

After record-breaking temperatures in Canada this week and a report showing the world is trapping twice as much in greenhouse gasses as in 2005, clean energy will be one of the first and most important steps to saving the environment.

So, these stocks are not just cheap today; they offer massive growth potential over the coming years.

Brookfield is specifically one of the best, because it has a massive portfolio with solar, wind, and hydro assets, a competent management team, and assets diversified worldwide.

Brookfield has the funds and ability to source some of the best investments around the world. That’s why it’s no surprise, even after the recent pullback in its stock price, investors have still earned a more than 200% return in the last five years.

Several renewable energy stocks are worth a buy today. Brookfield is just one of the Canadian stocks that’s the best in its industry and a top stock to buy now.