Growth stocks like BlackBerry (TSX:BB)(NASDAQ:BB) can be the secret to making it rich one day. The challenge is finding the right ones. In this Motley Fool article, I will share three of the top growth stocks on the TSX today. Aren’t you tired of wishing for that lucky break? Let’s do something about it.

Without further ado, here are three top growth stocks to buy. They might make you rich one day.

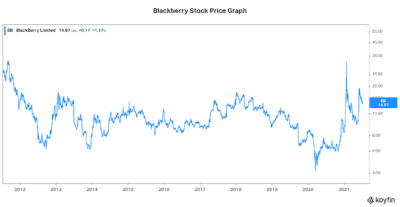

BlackBerry stock: The road is long, but the payoff could be huge

BlackBerry is one of Canada’s leading technology companies. It’s also a great play on two of the most lucrative businesses. The problem is that these businesses are in the early stages. By definition, this means that there’s a lot of risk attached to Blackberry’s stock price.

The first of BlackBerry’s lucrative business is cybersecurity. Essentially, BlackBerry has a host of technologies aimed at ensuring that computer systems are secure. Through the use of artificial intelligence and machine learning, BlackBerry is creating state-of-the-art security systems.

It’s a huge global industry worth about $165 billion in 2020. Many industry experts expect it to grow at a compound annual growth rate of above 10% in the next few years.

The second of BlackBerry’s lucrative businesses is the embedded systems. Essentially, BlackBerry provides software for embedded systems. This software enables machine-to-machine connectivity. You can find it being put to use in numerous industries. These connected systems are changing the way we do business and the way we live.

The company is best-known in this area for its success in creating connected and autonomous cars. But this technology is also used extensively in medical devices and robotics.

BlackBerry’s stock price has big upside given the extreme growth rates of its industries. It’s also set to ride higher as BlackBerry’s industries are taking part in true secular shifts that will be with us for a long time.

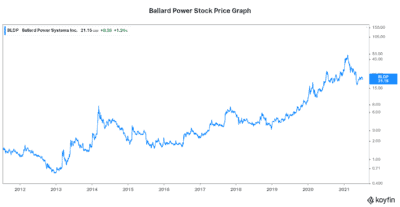

Ballard Power stock: An even longer road than Blackberry stock

Ballard Power (NASDAQ:BLDP)(TSX:BLDP) stock is a play on the exciting and lucrative business of fuel cells. And that’s a great thing because the fuel cell industry is rising. It took a really long time. But it’s finally coming to fruition.

Today, the global deployment of fuel cells is booming. From China to Europe to North America, the world is cluing in on the benefits of fuel cell heavy-duty motor vehicles.

For example, they are environmentally friendly. Also, they have greater power and reliability than batteries. They are fast becoming the choice of energy for trucks, buses, trains, and marine vehicles.

Ballard Power stock has really come alive as the fuel cell industry has gained traction. In fact, it’s rallied almost 300% in the last two years? The growth runway is so long and the upside is so huge.

This means that there’s much more to come for Ballard Power stock — just like there’s so much more upside to come for BlackBerry’s stock price. Ballard just has to maintain its competitive advantage and its leadership in the fuel cell race.

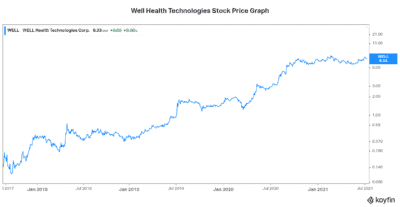

Well Health Technologies stock: A play on the future of health care

Well Health Technologies (TSX:WELL) is an omni-channel digital health company that’s changing healthcare. Like BlackBerry, Well Health is focused on using technology to shake up an industry. The role that Well Health has played in improving healthcare has been huge.

It’s not wise to run healthcare systems without the use of technology. Because technology changes everything. For example, it provides better outcomes. Also, it improves efficiencies and innovation. The pandemic was an impetus to changes that were already due and coming.

The bottom line

The three growth stocks discussed in this article are all disruptors – and we at Motley Fool like the disruptors. They’re changing the face of their industries. While Blackberry and Ballard have not seen the revenue growth yet, they’re setting it up.

This is the calm before the fireworks. Well Health Technologies, on the other hand, is further along. Its revenue growth is already well above 100%. It’s a preview of what we might see from Blackberry and Ballard one day soon.