As pandemic restrictions are lifted, we have much to celebrate. Vaccination rates are climbing. Death rates are plummeting. And life is resuming. Now, we at the Motley Fool Canada are searching for the best comeback stocks. Cineplex (TSX:CGX) stock and Air Canada (TSX:AC) stock come to mind. But while both are certainly plays on the reopening theme, they are not the same. So, which one is the better buy? What kind of upside exists? And what are the risks that we need to be aware of?

Without further ado, let’s take a look at these questions.

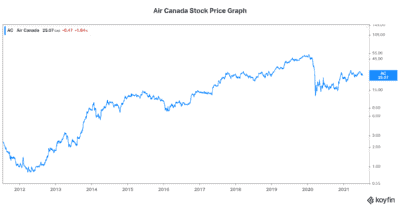

Air Canada stock: Took the airline business to new heights

In the last 10 years or so, Air Canada really transformed the airline business. What was once a very difficult, cyclical, and mostly unprofitable business was turned around. In the years before the pandemic. Air Canada was pumping out cash flow. Profitability was strong. And the airliner benefitted from strong travel demand to the maximum extent possible. It’s no surprise, then, to see the performance of Air Canada’s stock price during that time.

Then the pandemic hit. Travel was ground to a halt. And Air Canada was just trying to survive. And survive it did. Today, the airliner is gearing up for the return of travel. The stock market is forward looking. It really does not care all that much about the past. It’s concerned with the future. Air Canada’s stock price has stabilized in 2021. It seems to have brushed off its disastrous 2020. And it seems to be in a waiting pattern — waiting for news about an easing of restrictions and a return to some kind of normal.

Hopes for the return of domestic travel this summer are high. As the macro environment improves, Air Canada will operate as a leaner and more efficient airliner. This pandemic has forced the company to make improvements. Its cargo business has been booming. And its fuel efficiency and ESG performance have been dramatically improved.

The opportunity to Air Canada is significant as air travel returns. But even though developed countries are nearing the end of the pandemic, the global picture is not as bright. It will take longer for the pandemic to end globally. The return of air travel will therefore take time.

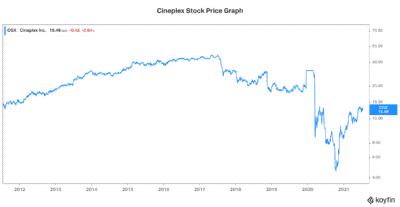

Cineplex stock: A great business that was evolving even before the pandemic hit

Cineplex stands to benefit significantly with the reopening. While it has been slow, we can start to expect better results. In fact, Cineplex stock is already starting to reflect this. Take a look at the graph below to see this in action.

It won’t be an easy road higher, but the stock will go higher. In my opinion, Cineplex will see movie goers return to its theatres. Unlike Air Canada, Cineplex only requires that the pandemic is under control in Canada. But that’s not all. Cineplex was already evolving into a more diversified entertainment company before the pandemic hit. The new realities of streaming options necessitated this. So, Cineplex will emerge with the benefits of this diversification.

For example, Cineplex Media is an advertising network with a presence that goes beyond movie theatres. It’s featured in high-traffic destinations, such as coffee shops, rest stops, and shopping centres. While it only represents 12% of total revenue, its revenue grew over 20% in the last quarter before the pandemic hit.

So, of course, the risk is that the movie exhibition business will die a slow death. Cineplex has taken steps to survive and maybe even thrive regardless. The stock price is still trading at less than half of pre- pandemic levels. It is not factoring in an optimistic scenario. The upside is therefore huge.

Motley Fool: The bottom line

Air Canada stock and Cineplex stock are both interesting comeback plays with big potential upside. Personally, I think that Cineplex is the better buy here today. I mean, the company only needs the virus to be controlled in Canada. And this is happening. We’re on the cusp of a full return to normal. Air Canada’s fortunes, however, are tied to the status of the pandemic globally. This will take more time to overcome.