Air Canada (TSX:AC) is a stock that investors have watched closely for more than a year now. After initially selling off by 75% in the market pullback early last year, the stock recovered a bit of its ground.

And as many stocks were seeing huge recoveries last year, and many investors were earning significant returns, Air Canada stock continued to be amongst the most popular stocks. It was so popular that it was one of the highest searched items on google last year by Canadians.

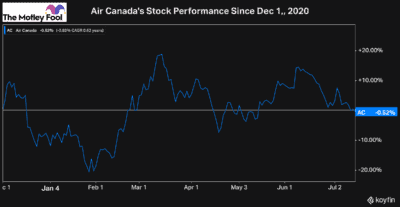

However, despite the recovery of the broader market and the potential many investors seemed to think Air Canada had, the stock has traded sideways for the last six months.

News of the vaccines only nudged the stock slightly, and even as the economy opens back up and stock markets hit all-time highs, Air Canada stock continues to underperform.

Why hasn’t Air Canada stock recovered more?

When the vaccines were announced last year, there was a lot of optimism among investors, and rightly so. The end of the pandemic was finally somewhat insight.

And while having vaccines has helped almost every stock as the economy recovers, Air Canada stock, which many would have thought would see the biggest benefit, has hardly seen any at all.

Since last December, just after the first of the vaccines were announced, Air Canada stock has traded sideways.

It’s clear that the stock is at fair value now as it’s hardly budged, despite the Canadian government continuing to get the pandemic under control.

There are a few main reasons for this. Investors know that the company has had to take on more debt and dilute shareholders through the pandemic.

There’s also a tonne of uncertainty, especially when you consider all the different travel restrictions to each country worldwide.

Another reason Air Canada stock has lagged is because investors have had much better options elsewhere. There has been no point in waiting around for a stock that’s struggling to rally when hundreds of others were trading undervalued.

So today, Air Canada stock seems to be trading close to its fair price. Therefore, it’s not surprising it hasn’t rallied much of late.

With the economy set to reopen, though, you may be wondering how much Air Canada can recover and what its fair value could be in a year from now?

Where will the airliner be in a year?

As with any business, Air Canada stock has a certain point of sales it will need to reach to break even. So while a recovery by the economy and corresponding increase in sales will be helpful for the airliner, if it’s not enough, it could take a while for Air Canada to reach profitability again.

Keep in mind it’s had to take on more debt during the pandemic, and now oil prices are making fuel costs, one of the biggest variable costs of airlines, rise rapidly.

This doesn’t bode well for Air Canada in the short term, which is likely why analysts don’t expect it to earn a profit over the next 12 months.

If a global recovery materialized, and travel demand picked up dramatically the stock could certainly skyrocket. However, at the moment, there just seem like too many headwinds for the stock to make a significant recovery.

What’s most important, though, for investors considering taking a position in Air Canada stock, now, is how much risk it has and what are the chances it could continue to lose value and actually be worth less a year from now than it is today.

If you’re going to take a chance on Air Canada and invest, that’s a serious risk to pay attention to. If the company continues to struggle, it could only continue to lose value. So while there is potential for a recovery, there is also potential for further losses.

Where Air Canada stock ends up a year from now will depend on many factors that impact how fast its sales can recover.

So whether you’re thinking of buying the stock today or watching it from the sidelines for a little longer, I’d pay close attention to any developments or management commentary. This way, you can make the most informed investment decisions possible.