TD Bank (TSX:TD)(NYSE:TD) stock is the second-largest Canadian bank in terms of market cap after Royal Bank of Canada. Is it a good stock to buy now? There are many reasons why TD Bank is a good stock to buy now. Let’s look at them.

TD Bank stock is cheap

Toronto-Dominion Bank has recently received the title of “Best Investment Bank in Canada” by Euromoney’s Awards for Excellence 2021.

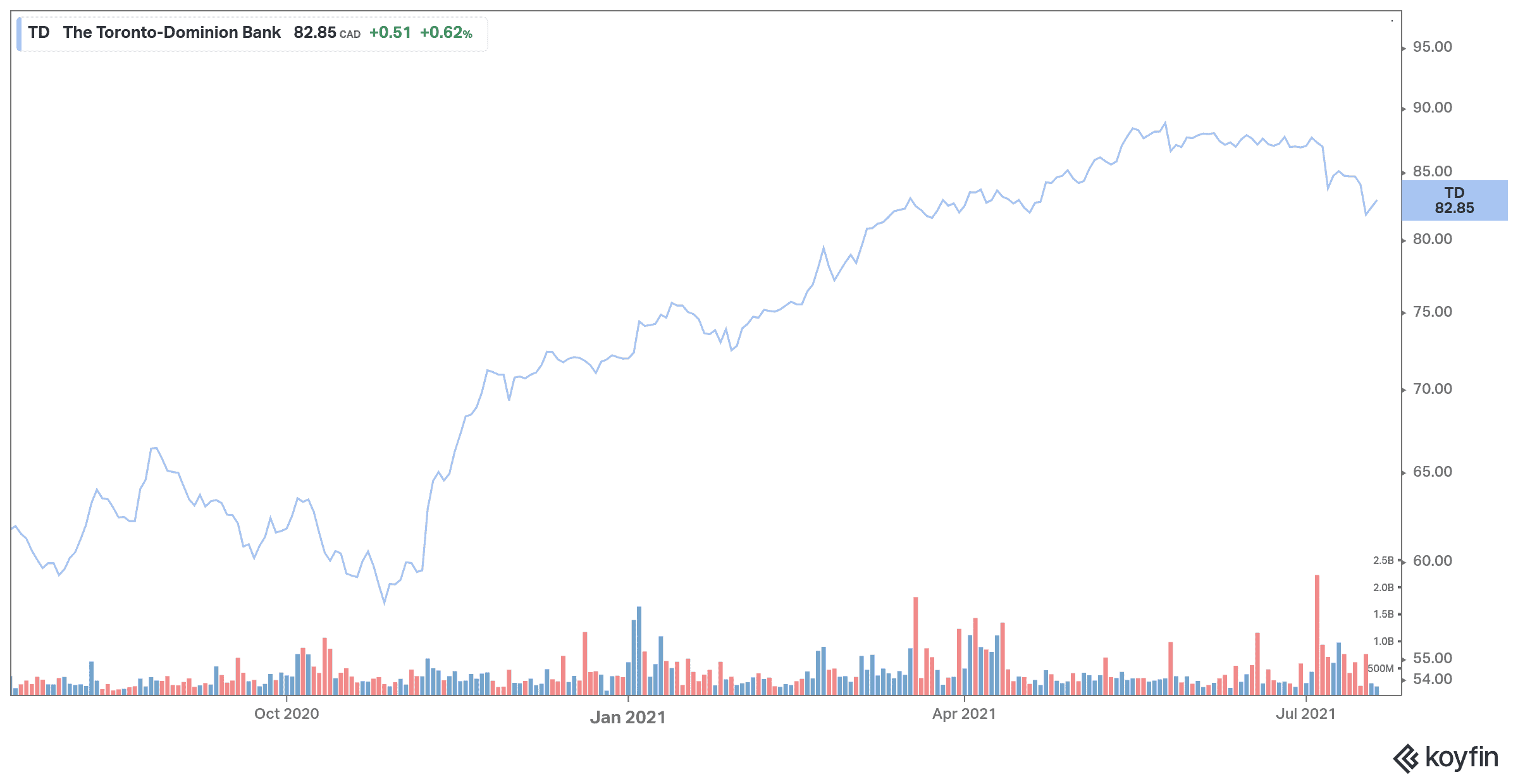

TD Bank is a high-quality bank that trades for cheap, as the stock has a P/E ratio of only 10.7 and a five-year PEG of only 0.73. The stock has gained more than 30% over one year and has more upside, as the bank has a few catalysts in the medium term.

TD is expanding its global presence, especially in the U.S. market. Recent acquisitions in the U.S. include Headlands Tech Global Markets LLC, a Chicago-based quantitative fixed-income trading firm. The bank is also expanding its real estate investment banking services presence in the United States through the acquisition of Kimberlite Group, a mergers and acquisitions consultancy boutique.

Management has made it clear that they are eager for an acquisition, possibly in the U.S. market. Given management’s prudence, the next transaction will likely be one where the potential for synergies far outweighs the risks of integration; such a transaction creates value for shareholders.

Of the six major banks in the country, TD Bank is the one with the largest exposure in the United States, with more than 40% of its revenues coming south of the border. The more successful vaccine deployment in the United States compared to that in Canada may push the stock to outperform.

TD Bank appears to be more sensitive to interest rates than many of its peers. With rates likely to rise over the next few years, it bodes well for the Canadian bank. TD Bank stock could very well be the ultimate hedge against rising rates.

This bank stock gives you growth and income

With the economic outlook improving and credit demand increasing, shares of the TD Bank could generate solid growth and income for its investors. Its high-quality earnings base has driven its stock up and supported steady increases in dividends. TD Bank has paid regular dividends for a very long time. Indeed, it has increased them by 11% for 25 consecutive years.

TD Bank has seen an average annual profit growth of 6.83% and 8.79% over the past five years, including 2020, which has been hit hard by the pandemic.

These are the highest growth rates among the Big Six banks. This is one of the main reasons TD Bank has been able to grow its dividend at a rapid rate and has the highest dividend-growth rate of its peers. The dividend yield, close to 4%, is also very interesting.

The bank looks well positioned to generate solid positive earnings growth over the next few quarters. Improving consumer demand and economic expansion bode well for future growth. In addition, TD Bank’s diverse business mix, strong balance sheet, strong credit performance, conservative expense management, and higher loans and deposits are expected to boost results and earnings, which will support higher dividend payouts.