Sun Life Financial (TSX:SLF)(NYSE:SLF) and Bank of Nova Scotia (TSX:BNS)(NYSE:BNS) are two very cheap stocks to buy now, as they likely won’t stay that cheap for long. Let’s look at each of these companies in more detail.

Sun Life Financial

Sun Life is the second-largest insurance provider in Canada with a market capitalization of close to $40 billion. However, its clientele extends far beyond the country.

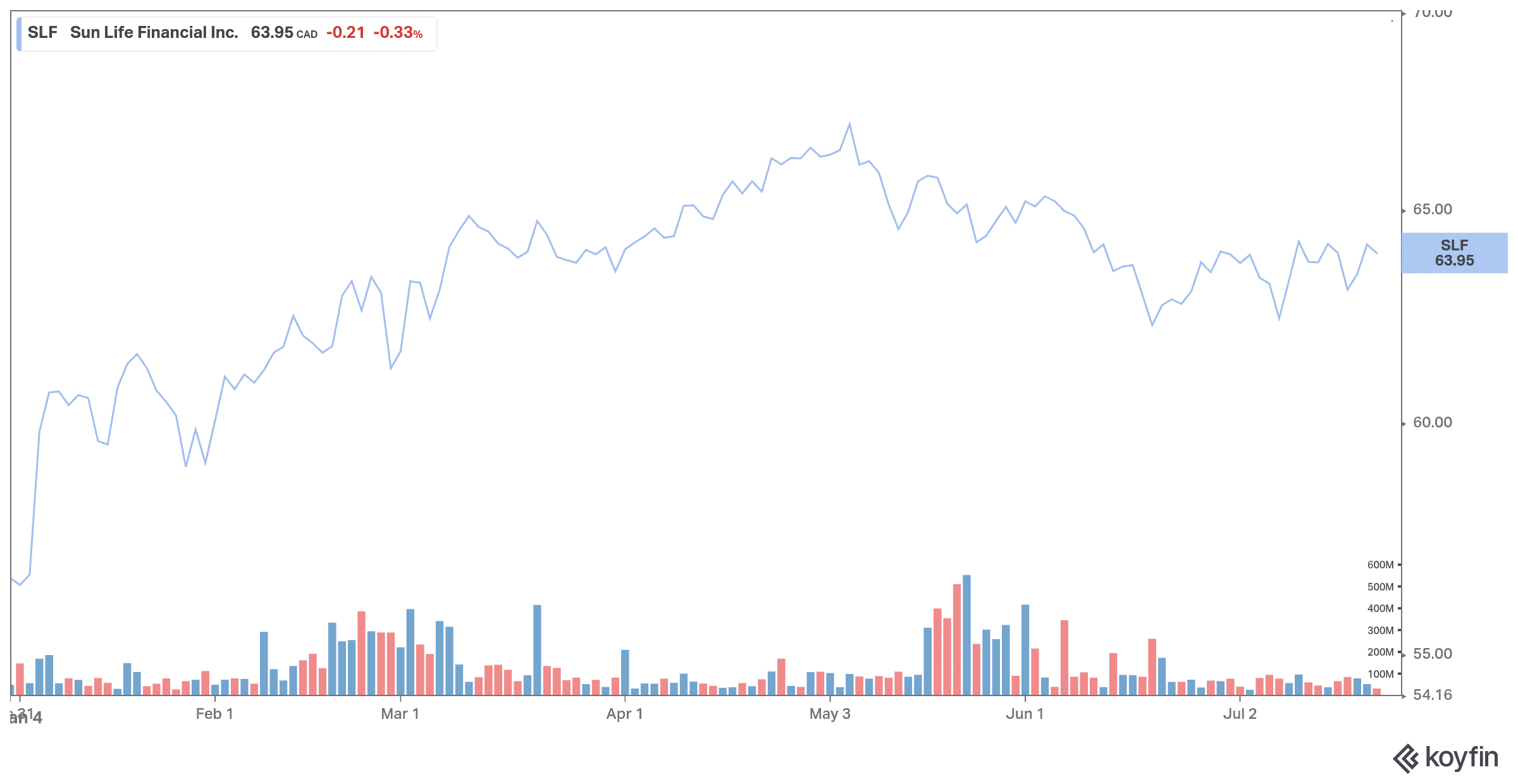

Over the past decade, it has significantly outperformed the TSX. Its solid activity in Asia, growth in wealth and asset management businesses, and strategic acquisitions have pushed Sun Life’s stock higher. Shares have gained more than 10% year to date.

Sun Life is currently trading at an attractive forward P/E ratio of 9.72. Based on past performance, it’s a bargain. Basically, Sun Life stock offers value and stability. It has many tailwinds.

Sun Life is well positioned to benefit from the expanding U.S. economy and growth in Asia, fueled by attractive demographics and strong momentum from Sun Life Canada.

Expected earnings growth, new business gains, and favourable market impacts are expected to strengthen operations in Asia.

Wealth sales in Asia are expected to benefit from mutual fund sales in India, retirement business in Hong Kong, and money market sales in the Philippines.

Sun Life also continues to benefit from favourable equity markets. Higher business growth and larger investment gains are expected to boost net income in Canada.

The life insurer is targeting underlying earnings-per-share growth of 8-10% per year over the medium term.

Sun Life sees acquisitions as a prudent approach to accelerate growth. In 2021, it bought a controlling stake in Crescent Capital Group, a credit manager. In 2020, it acquired an 80% stake in InfraRed Capital Partners. The buyout of InfraRed is expected to boost Sun Life SLC Management’s alternative asset management business investment solutions for institutional clients to include infrastructure stocks and advance sustainable investment options.

The insurer has healthy capital and cash flow, reflecting its financial flexibility and opportunities for capital deployment. Its financial leverage remains below the long-term target of 25%.

Sun Life is looking at a dividend payout of 40-50% over the medium term. The insurer boasts an impressive 3.4% dividend yield.

Bank of Nova Scotia

Scotiabank is one of the best dividend stocks trading on the TSX, and one of the cheapest. Its dividend track record is really impressive. Plus, its dividend yield of 4.6% is one of the highest among its peers. And its business is seeing strong growth in profits.

As Scotiabank returns to dividend hikes and share buybacks, investors benefit. The stock is currently very cheap with a forward P/E ratio of 9.75, but it may not stay that cheap for long. Scotiabank stock has jumped by approximately 15% year to date.

The Canadian bank has a diversified business profile. Scotiabank’s international banking division has a strong and diverse franchise with more than 10 million retail and commercial customers. Scotiabank customers serve a network of more than 1,400 branches and 22 contact centres.

The international banking division continues to provide a strong potential for the bank, with a geographic footprint in many countries including the Pacific Alliance of Mexico, Colombia, Peru, Chile, Central America, and the Caribbean.