Cineplex (TSX:CGX) has been a top recovery stock to consider for over a year now. Cineplex is a great business and has been impacted by no fault of its own. So with the stock down over 50% from its pre-pandemic high, it definitely offers value for long-term investors.

The company, the largest movie theatre operator in Canada, also owns other businesses. Cineplex had been investing in these to help diversify its business away from solely movie theatres.

Unfortunately, though, each business in Cineplex’s portfolio requires gathering indoors. So ultimately, Cineplex has been one of the heaviest impacted stocks throughout the pandemic.

But the discount in its stock has continued to make it one to consider. And with Canada reaching a significant portion of the population vaccinated, you could be wondering if it’s worth an investment today.

Is Cineplex stock worth an investment today?

Cineplex stock could definitely be worth an investment today, as long as investors buy for the long-term. In Canada, we have had an impressive vaccination program and great response from our fellow citizens to do their part. So while this has resulted in a great summer and falling case counts, the pandemic is still a real threat.

Already variants continue to wreak havoc around the world, and now top doctors in Canada are warning about a fourth wave this fall.

So although Cineplex stock could be worth an investment while it’s trading undervalued, you don’t want to invest too early, ahead of another potential fall in the stock.

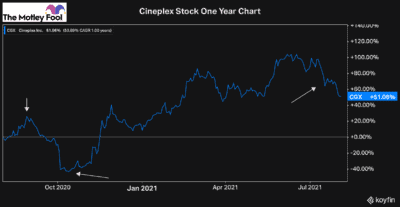

As you can see, the stock was rallying on optimism this time last year. Then the second wave hit in the fall, and the stock tanked severely. This is the risk that an investment in Cineplex poses today. And if you look toward the right side of the chart, Cineplex is in another downtrend in this current market environment.

So, for now, you may want to hold off on investment and monitor the stock’s progress.

You can’t wait forever, though, and short-term volatility shouldn’t be a major concern as you can mitigate it by investing for the long run.

At some point, Cineplex can’t get any cheaper, so while it continues to sell off, I’d be preparing to make an investment in the top recovery stock.

Bottom line

Cineplex is an incredible business that’ been impacted through no fault of its own. However, even analysts are being cautious with Cineplex, at least until there is more certainty about the future of the pandemic.

For now, the stock has a target price of just $15, with two analysts calling it a buy and three analysts rating it a hold. So, the stock may continue to sell off in the short term. However, once the pandemic starts to ease, Cineplex will have a massive road to recovery ahead of it and a tonne of potential to gain value.

So it’s certainly worth an investment today if you’re willing to commit long-term. Just be sure you understand the risks. With all the uncertainty in the near future, there’s no telling what might happen.