If there’s one thing we learned over the last 18 or so months is that it’s tough to predict the future. With so much uncertainty, there are a lot of facts that are difficult to predict. This is one of the reasons a stock like Cineplex (TSX:CGX) is still so cheap.

Cineplex is in a unique position. It’s not often we face a global pandemic, where companies like Cineplex are so badly impacted and through no fault of its own.

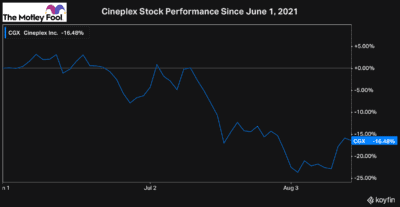

The movie theatre and entertainment venue operator has already shut down and reopened on numerous occasions. And with COVID cases rising, ahead of a potential fourth wave, the stock has been selling off once again.

So if you’re wondering what to do about investment in Cineplex, let’s look at how the stock performed last year.

Will Cineplex stock have to shut down again?

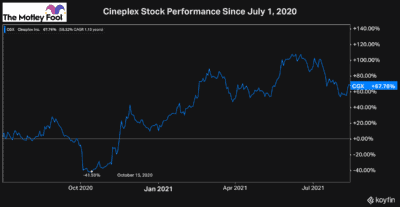

Last summer, the first wave of COVID cases had passed, and the summer had a lot fewer restrictions. However, by the early fall, it was already clear there would be a second wave, and stocks like Cineplex were sold off as new shutdowns were announced.

The stock was flat through July and began to rally slightly in August. However, by October, the rising case counts had gotten concerning and Cineplex ended up falling another 40%.

This has been the story with stocks like Cineplex since the pandemic began. Uncertainty continues to persist, and no matter what developments we make on the vaccine front or with the economy, there will always be risks until we are fully out of the woods.

With that said, just because there are risks doesn’t mean these stocks aren’t worth an investment at the right price. If you can buy the stock undervalued and are willing to hold for the long-term, you could see some major returns.

For example, investors who bought last July and held for the long-term would have already made a 68% return in just over a year.

And as you can see by the chart, that’s 68% today. However, only a few weeks ago, investors were up more than 110%. What’s more important, though, is that in the middle of October, where the first chart ends, you can see Cineplex stock was at its worst point.

So while it looks like many investors would have bailed at that time, it was actually the best time to scoop up some shares.

And long-term investors who bought more at that price could have made returns above 100% by now. This goes to show how important long-term investing is.

Why you should always invest for the long run

Nobody knows what prices are going to do in the short term. So you shouldn’t try to predict their movements, which many investors still do.

Furthermore, even if you focus on the long run, some stocks that are quite volatile will move rapidly in price anyway.

So while an investor could buy a stock with the intention of holding it long-term, just as we saw in the first chart, it’s entirely possible that after your first month of owning a stock, it plummets by 40%.

Of course, if the situation changed with the stock, you may want to think about your investment. Last year in October, though Cineplex was in the same position, it had always been in — dealing with the pandemic.

So if you had believed in Cineplex stock being able to recover in July, there’s no reason not to believe it can recover when it crashed in October.

And as you can see by the chart, for those investors who held on — and especially those who bought more — they have been rewarded quite handsomely.

Bottom line

Cineplex stock is in a similar position today to last August. The stock has been recovering well, especially with the Canadian economy on the rebound and our vaccination rates among the highest in the world.

With a potential fourth wave looming, though, the stock has once again been selling off in recent weeks. However, Cineplex stock is in a much better position today and far closer to the full recovery of the pandemic.

So if you believe this stock is worth a lot more than $13 a share, in the long run, I’d buy some shares today.