The year 2021 might be remembered for the strong recovery in Canadian value stocks. However, certain undervalued growth stocks could also be primed for a bounce back in the second half of the year. The stock market is often short-sighted. It rises and collapses on quarterly earnings reports and daily news.

Yet for investors willing to own high-quality businesses as partners and shareholders, that short-term volatility matters much less. In fact, the volatility can offer attractive opportunities to swipe up quality stocks while they are undervalued and underappreciated. Over the passage of time, market value always catches up with fundamentals. Consequently, this can be a great opportunity for patient investors.

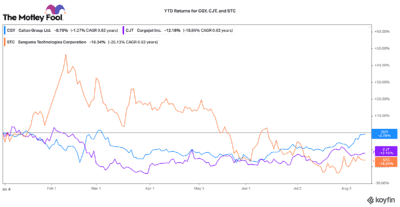

If you don’t mind short-term volatility with some long-term upside, here are three cheap Canadian growth stocks that are down but certainly not out!

Calian Group: A top Canadian conglomerate stock

Calian Group (TSX:CGY) is one Canadian stock that just doesn’t seem to get the love it deserves. It operates a conglomerate of four diverse businesses. These operate in education, healthcare, IT/cybersecurity, and advanced technologies (think satcom). While many institutional investors don’t like such a diverse business mix, they might appreciate it a little more if they knew each segment grew by between 15% and 65% this quarter.

Calian just announced very strong third-quarter results. Revenues, adjusted EBITDA, and adjusted net profits per share surged 29%, 66%, and 69%, respectively! And don’t forget, it also raised its 2021 guidance for the second time this year.

For a company that expects to grow adjusted EBITDA by 32% this year, its stock only trades with an enterprise value-to-EBITDA ratio of 18 times. Likewise, its price-to-adjusted earnings ratio is around 18 times. This Canadian stock has growth and value here. It also pays a decent 1.8% dividend, so it is an all-in-one solid investment today.

Cargojet: The best airline you can own

Another misunderstood Canadian growth stock is Cargojet (TSX:CJT). Many investors probably don’t realize it, but this stock has an amazing growth record. Since 2012, it has returned nearly 2,500% to long-standing shareholders!

Generally, I don’t like airlines. However, Cargojet dominates the overnight air freight market in Canada. In fact, its routes reach nearly 90% of the Canadian population. It has taken years to build the customer relationships, infrastructure, airplane capacity, and routing expertise to make its business a lean, cash flow machine.

Compared with any other airline, this Canadian stock has a premium balance sheet. Consequently, it is in a very strong position to continue building out its fleet and gradually expand its presence into international markets. It just acquired a small stake in a U.S. cargo carrier that could help it do that.

This Canadian stock has pulled back year to date. Likewise, it is trading below its historic valuation multiples, so it looks attractive now.

Sangoma Technologies: A top Canadian small cap stock

A smaller cap Canadian stock I would buy for some big growth potential is Sangoma Technologies (TSXV:STC). Like Cargojet, this stock is down in 2021. Yet, largely since the start of the year, its business fundamentals have only improved. It just acquired a similar-sized American peer called Star2Star.

It may take some time for the deal to become accretive. However, the combined company will have broader customer and geographic diversification, larger operational scale, higher-quality margins and recurring revenues, and an expansive array of communication solutions for its customers.

The company just increased its earnings outlook for 2021. Yet it appears like 2022 and beyond are when its business synergies become really impactful. This Canadian growth stock trades at a material discount to its larger peers. I expect this stock could see a substantial valuation re-rating in the years ahead.