Energy stocks have been on fire in 2021. Oil and natural gas prices have risen significantly. This commodity price strength has driven one of the biggest energy rallies in many years and all indications point to continued strength.

The following three energy stocks to buy are the best buys to position your portfolio for this move.

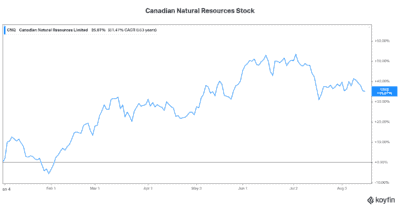

Canadian Natural Resources: An energy stock to buy for its operational excellence

It was the culmination of many factors. The bottom line is that demand is strong and supply has been falling. This is the perfect storm. And it’ll likely continue to drive energy stocks even higher. Take Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) for example. The stock is up 32% in 2021. On top of this, Canadian Natural Resources has paid a generous and stable dividend for many years.

So here we are today with oil and gas prices continuing to benefit from strengthening demand. CNQ’s long life and low decline assets have enabled the company to remain resilient. This company generates strong cash flows through all commodity cycles. Today, cash flows are simply soaring. Canadian Natural Resources is in the sweet spot. Its operationally solid and efficient assets are leading the company into good years.

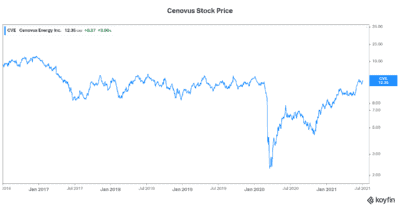

Cenovus Energy stock: An energy stock benefitting from its Husky Energy acquisition

Cenovus Energy (TSX:CVE)(NYSE:CVE) is another top performer in the oil and gas industry. It’s up almost 30% in 2021. Its differentiating factor is also in its high-quality operations and assets. In addition to this, its move last year to acquire Husky Energy was a winner. This acquisition was made at the lows of the oil and gas cycle – very much on the cheap!

Rising oil and gas prices have boosted Cenovus’s results. In fact, its latest quarter was also characterized by soaring cash flows. A key part of the company’s results was its Husky acquisition synergies. Specifically, Cenovus is well along the way to achieving its target of $1 billion in synergies in 2021.

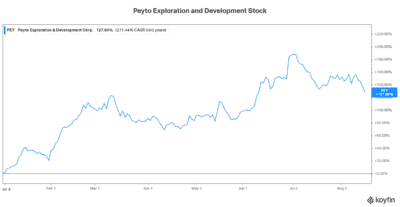

Peyto Exploration and Development stock will benefit from strong natural gas fundamentals

Peyto Exploration and Development (TSX:PEY) is one of Canada’s lowest-cost natural gas producers. The company has an exceptional asset base that’s benefitting from soaring natural gas prices. In fact, this energy stock is up 125% in 2021. And Peyto’s cash flow from operations soared 150% in its latest quarter.

Going forward, we can expect Peyto to continue to benefit from the positive outlook for natural gas prices. Natural gas is a relatively low-carbon, low-emitting fuel. It is the easiest replacement for high-carbon fuels such as coal. It will certainly be a key transition fuel as we fight to reduce our carbon footprint. Gas powers an estimated 44% of America’s electricity and will continue to power our lives for the foreseeable future.

The bottom line

It’s been a long wait. But the time is right for energy stocks. Consider adding the three top energy stocks discussed in this article. The future of oil and gas is still bright. We have a window of opportunity to act now.