Passive income — all of us want it. The best way to get it is through buying high-quality dividend stocks. This can guarantee a dividend income stream for life. The trick is finding the right stock. We need a stock that has a strong dividend history. Also, we need a stock that has a stable and predictable cash flow profile. And lastly, we need a stock that will be around for the long term. Enbridge (TSX:ENB)(NYSE:ENB) is such a stock.

Here’s why Enbridge is a great source of passive income and how it could provide you with $280 per month in dividend income.

Enbridge stock could provide passive income for life

Enbridge is a critical piece of North America’s energy infrastructure. In fact, it is one of North America’s leading energy infrastructure companies. The company transports about 25% of the crude oil produced in North America. It also transports nearly 20% of the natural gas consumed in the United States. And to top this off, Enbridge Gas is North America’s third-largest natural gas utility.

It’s a company with a long history and an exciting future. Enbridge will, without a doubt, continue to be a big player in the energy sector. Conventional energy will continue to be needed for some time. And Enbridge is building up and readying itself for the transition to cleaner energy sources.

Today, Enbridge stock is yielding a very healthy 6.64%. So, if you invest $50,000 in the stock, you will make $280 per month in passive dividend income.

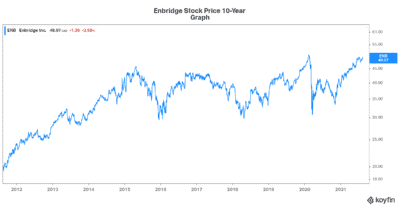

Enbridge stock: A history of solid returns and dividend growth

As an energy infrastructure giant, Enbridge has been very disciplined. Return on capital invested has been a priority for the company. I mean, its industry is very capital intensive. The only way to survive and thrive as long as Enbridge has is to prioritize returns. Enbridge has done this very successfully.

This is demonstrated by Enbridge’s dividend history. Specifically, Enbridge has 26 years of dividend growth at a 10% compound annual growth rate (CAGR). This has been driven by Enbridge’s predictable business, which has resilient and long-life cash flows.

Enbridge positions itself in clean energy

The energy transition to renewables is happening. But it has become widely recognized that natural gas will continue to play a big role. So, Enbridge’s natural gas infrastructure will remain an essential part of North America’s energy grid. Beyond this, Enbridge is also investing heavily in clean, renewable opportunities.

For example, the company has entered the offshore wind market. It has three French offshore wind projects due for completion soon. Also, one of Enbridge’s long-term goals is to make sure that its assets are leveraged for hydrogen. Finally, Enbridge is becoming involved with carbon capture and solar power. These renewable opportunities will also be supportive of Enbridge’s passive-income generation.

All of this will ensure that Enbridge remains at the forefront of the energy infrastructure business. Its extensive reach, connections, and assets will continue to be valuable as the energy industry transitions. New investment will go into the best projects. They will increasingly include renewable energy and natural gas projects. The future is clear. The transition won’t happen overnight. Enbridge will remain a big player.

Motley Fool: The bottom line

Passive-income streams are key for us to secure a comfortable financial future. We want to get our money working for us. This is where a quality company like Enbridge comes in. This company has a solid history. It also has a bright future, as it claims its spot in the energy transition.