It is earnings season for the largest financial stocks on the TSX. So far, the results look good. The fact is, Canadians love their banks. They are well-capitalized and they generally pay a nice, well-funded, and generally growing dividend.

While the Big Five banks are great, there are also a number of alternative financial stocks that could be a better fit for an investor’s portfolio. Here are four of the best financial stocks you can own on the TSX right now.

A top global asset manager

Funnily enough, the first TSX financial stock is not a bank at all. Rather, it is one of the world’s largest alternative asset managers. I am talking about Brookfield Asset Management (TSX:BAM.A)(NYSE:BAM). Some of its largest clients include banks, pension plans, and sovereign wealth funds. In a time where interest rates are at all-time lows, money managers are running to alternative assets for higher-yielding cash flows.

Consequently, demand for Brookfield’s funds of real estate, infrastructure, renewable power, insurance, and distressed debt has been surging. Over the past five years, assets under management and distributable earnings per share expanded by a compound annual growth rate (CAGR) of 25% and 35%, respectively. Not many banks are regularly growing at that rate, so this is a top stock I would buy any day over a big bank.

A top TSX alternative finance stock

In a sense, goeasy (TSX:GSY) is a bank of last resort. It provides high-interest loans and leasing products for individuals who would not qualify for traditional bank loans. While it services the sub-prime, higher-risk market, it is compensated with +20% interest rates.

The company has been utilizing technology to rapidly expand its service offerings and put its loans at people’s fingertips. It has a very large addressable market and opportunity to diversify its product base (auto loans, point-of-sales loans, etc.). It has grown revenues and earnings per share by a CAGR of 19% and 43% over the past five years. Despite a strong run-up this year, this TSX stock trades with an earnings multiple of just 15 times.

An up-and-coming financial player

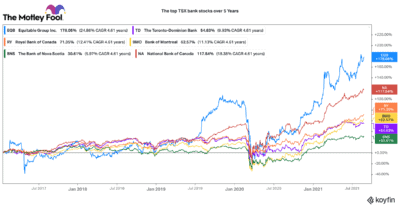

If I asked you what the best-performing TSX bank stock was over the past five years, you probably wouldn’t guess Equitable Group (TSX:EQB). Since 2017, it is up 184%. The likes of Royal Bank or TD Bank delivered only half that return in that time frame.

While it is only the eighth largest Schedule 1 bank in the country, it has found a way to consistently create value for shareholders. Like goeasy, Equitable has embraced technology to keep costs low and reach a broader market.

In its most recent second quarter, revenues and earnings per share grew year-over-year by 21% and 33%. Despite a faster historical and current growth rate, this stock trades at a discount to the big banks. It looks attractive even today.

A top TSX Big Five bank stock

A top TSX Big Five bank stock

The only Big Five bank that gave Equitable a run for its money in the five-year return category is National Bank (TSX:NA). It has delivered a 117% return in that period. With a 2.85% dividend, it has the highest yield of these four top picks. It recently disrupted the norm by becoming the first Canadian bank to announce zero-commission investment trading. It also announced an interesting investment in fintech financial data player, Flinks.

If you catch any theme from the above stocks, technology and innovation are major differentiators in their growth trajectory. National Bank just exceeded the market’s expectations with an earnings beat this quarter. It reported $2.36 per diluted share of earnings, a 42% increase year over year! For a well-managed bank that consistently beats its peers, this is a great bank to own.