Both WELL Health Technologies (TSX:WELL) and HIVE Blockchain Technologies (TSXV:HIVE) are two of Canada’s most popular growth stocks. While HIVE is one of the top crypto stocks you can buy today, WELL Health is rapidly growing by acquisition in the highly crucial healthcare industry.

The main reason both of these stocks have become so popular over the last few years is due to the incredible growth they’ve both proven they can achieve.

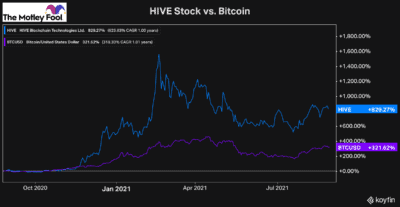

HIVE has shown investors just how much a leveraged mining stock can rally with the cryptocurrency industry growing significantly. Over the last year, HIVE has more than doubled the performance of Bitcoin.

And WELL Health stock has been growing rapidly by acquisition for a few years now. Even before the pandemic, it was an intriguing growth stock.

However, with the tailwinds created by the pandemic, most notably a massive increase in demand for telehealth and other digital health applications, the stock is now one of the best you can buy.

But of these two high-potential growth stocks, you may be wondering which is the better buy for your portfolio.

HIVE Blockchain stock

There’s a reason why HIVE is one of the most popular growth stocks in Canada. The stock is not just in the high-potential crypto industry. It’s one of the best mining stocks you can buy. And crypto mining is well known to have a tonne of growth potential.

Because these miners are leveraged to the price of the cryptocurrencies they mine, and cryptocurrencies can rally rapidly, they are some of the best businesses you can buy. In fact, HIVE has a lot more growth potential than WELL stock, especially if cryptocurrencies can see another massive rally in the coming years.

However, there will certainly be a lot of volatility in the short term, which may not be for some investors. But if you have the time to buy and hold, it could be one of the best growth investments you ever make.

HIVE is particularly attractive, because it mines both Bitcoin and Ether. Plus, it holds a lot of the coins it mines, which rapidly adds value as cryptocurrency prices rise.

So, if you’re bullish on cryptocurrency, can stomach short-term volatility, and are looking for one of the highest-potential growth stocks, HIVE is one you should seriously consider adding to your portfolio.

WELL Health stock

WELL Health still offers investors a tonne of long-term growth potential, just not as much as a stock like HIVE. Healthcare is always an industry that’s full of great investments. And right now, WELL offers some of the most opportunities for growth in the space.

For starters, it has multiple lines of business, which it continues to grow rapidly through acquisition. The company isn’t just buying any companies, though. It’s strategically buying companies that add value to its current business model.

This is part of the reason why it’s grown so rapidly and continues to impress investors and analysts with its progress.

Even before the pandemic, WELL was a high-potential growth stock. The business had always had a goal to improve the massively obsolete healthcare industry in Canada.

And while the pandemic has certainly acted as a tailwind, the execution from management to find and source so many value accretive acquisitions has been impressive.

In addition, WELL stock is still considerably cheap, too. There are many more opportunities to expand its digital businesses and telehealth operations, as they continue to catch on and grow in popularity. Furthermore, it can continue to expand its physical clinics, which will help add a tonne of revenue.

It’s worth noting, though, that the stock may still be volatile given it’s a highly popular growth stock in Canada. However, it will be a lot less volatile than HIVE stock.

So, if you’re looking for a stock with a bit less short-term risk and similar long-term growth potential, WELL Health is certainly worth consideration.