It has been a rocky, but mostly profitable year for Canadian energy stocks. If you are looking for a safe, defensive energy play for the fall, you may want to consider Emera (TSX:EMA). It owns and operates regulated electric transmission and natural gas utilities in Florida, Atlantic Canada, and the Caribbean.

Everyone needs power

Power and natural gas are essential for society to function in our modern world. As a result, Emera captures a very stable baseline of cash flows in any economic environment. Yet, as society modernizes, electricity demand is only going to continue to rise. Consequently, there are ample opportunities to upgrade the electrical grid in North America.

Solid growth and strong earnings

Over the next three years, Emera is hoping to spend between $7.4 billion and $8.6 billion to modernize its infrastructure, transition away from coal power, and invest in renewables. It believes these investments could increase its rate base by around 6-7% a year for the next three years.

As a result, management believes operating cash flow could increase by as much as 42% or more over that period. So far, it looks like its growth plans are on track. In its second-quarter 2021 results, it grew adjusted earnings per share by 13% to $0.54. Year to date, adjusted earnings per share are up 17% over last year.

A great, growing dividend

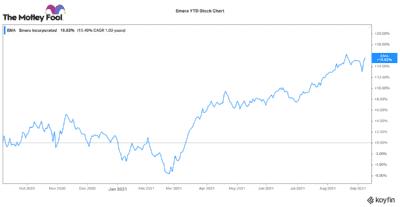

Today, this Canadian energy stock pays an attractive 4.36% dividend. Given the strong projected growth in its rate base, management is hoping to grow that payout by 4-5% annually. Since 2000, its dividend has a compounded annual growth rate (CAGR) of 6%, so it certainly has a strong track record to back up its projections.

Before investing, however, there are two concerns investors may want to consider. Firstly, almost all of its assets are in hurricane-prone jurisdictions (i.e., Florida, the Bahamas). Certainly, Emera has factored this into its business plan, but a severe weather event could drastically impair earnings. Likewise, around 68% of earnings are derived from the U.S., so Emera is subject to some currency fluctuations.

Is Emera a good Canadian energy stock to buy?

So, is Emera a solid Canadian energy stock to buy? Yes. For a defensive, steady dividend payer, it is a good anchor in any Canadian’s portfolio. It has some decent growth levers and should benefit as the world continues to decarbonize and electrify.