There are plenty of high-quality growth stocks on the TSX with the potential to double your money.

What’s crucial, though, is that you find a stock with high growth potential, but also one without that much risk.

Many growth stocks, especially those that can double your money rapidly, offer these significant rewards because they come with so much risk.

So the challenge for investors is finding TSX growth stocks with a tonne of potential but are also high-quality businesses you can own for years.

To find a stock that can double your money in five years, we know by using the rule of 72 that our stocks need to earn a compound annual growth rate (CAGR) of roughly 14.4%.

So here are two of the top TSX growth stocks that should be able to continue to grow at a CAGR of 15% or more.

One of the top real estate growth stocks on the TSX

If you’re looking for a high-quality TSX growth stock that can double your money in five years or less, InterRent REIT (TSX:IIP.UN) is one of the best to consider.

Unlike most other growth stocks on the TSX, InterRent is a residential real estate stock, one of the safest industries to invest in. However, that doesn’t mean it can’t earn you incredible returns.

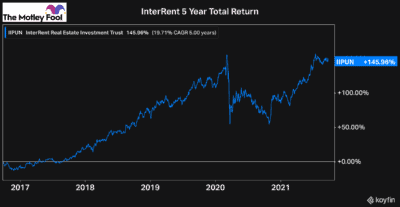

Over the last five years, InterRent investors have earned a total return of 145%. That’s well more than just doubling investors’ money. In fact, it’s a CAGR of nearly 20%.

InterRent has achieved this growth through numerous impressive investments. In addition to taking advantage of cheap debt lately and acquiring new suites for its portfolio, the company also invests in upgrades to its existing properties, growing its net asset value that way as well.

The results speak for themselves, and InterRent has shown it’s one of the most impressive and consistent growth stocks on the TSX.

So if you’re looking for an investment that can double your money soon, InterRent is definitely a stock to check out.

A top specialty finance company

Another of the best growth stocks on the TSX is goeasy (TSX:GSY), the specialty finance stock. goeasy is a lender that typically deals with consumers who are below prime borrowers.

Its stock has been on a roll lately, up by over 900% in just the last five years. Part of this is due to a tailwind from the pandemic. However, much of it is due to goeasy’s incredible strategy and highly resilient portfolio.

In fact, when the pandemic hit, many investors were concerned with the exposure goeasy could have had. And while tonnes of stimulus from the government certainly played a role, goeasy showed everyone how resilient its portfolio is and how well it can manage chargeoffs.

Plus, ever since, the company’s portfolio has grown rapidly, which is why the stock has also grown at such an impressive rate. Relatively speaking, though, the TSX growth stock is still a small company, worth just $3.5 billion.

So if you’re looking for a high-quality growth stock that could potentially double your money in five years or less, goeasy is one of the best to consider.