Over the last few weeks, we have seen some of the top Canadian stocks sell off quite significantly, causing many investments to trade undervalued. And, as many investors know by now, any time high-quality stocks are selling off, it’s one of the best opportunities to buy.

The key is making sure that you’re buying high-quality stocks that you plan to hold long term. If you want to take advantage of the discount in stocks, you need to make sure you are buying at a price that you’re happy to own the stock at long term.

It’s impossible to tell what may happen. Stocks could continue to sell off, or they could rally back and not see another selloff for months.

Therefore, once your target companies have gotten cheap enough, it’s time to pull the trigger and buy the undervalued Canadian stocks. And if you’re looking for some of the best deals on the market today, here are two top Canadian stocks trading well undervalued.

A top Canadian growth stock to buy undervalued

There’s no question that one of the best Canadian stocks to buy undervalued today is Parkland (TSX:PKI). As of Thursday’s close, Parkland’s stock was down more than 20% off its 52-week high, offering an excellent discount for investors.

Parkland is predominantly a fuel supplier with operations in Canada, the U.S., as well as internationally. The company has been an excellent performer in recent years but was impacted quite significantly by the pandemic.

Now that the economy has been recovering for some time, though, Parkland’s financials show a clear recovery. However, it could still recover more in its international segment, especially through the summer months, as consumers are keener on travelling.

This should offer some potential for the Canadian stock to rally in the short term, especially since it’s already trading undervalued. Plus, in addition to the 20% discount that shares trade at today, Parkland trades at a forward price-to-earnings ratio of just over 15 times. That’s considerably cheap for such an excellent long-term growth stock.

On top of everything else, the stock also pays a dividend that yields just under 3.5% today. So, if you’re looking for a high-quality Canadian stock that’s trading undervalued, Parkland offers one of the best opportunities for investors today.

A cheap gold stock to buy for passive income

In addition to Parkland, another high-quality Canadian stock that’s trading undervalued is B2Gold (TSX:BTO)(NYSE:BTG).

There’s no question that gold stocks have been getting cheap in recent months, but the price B2Gold trades at today is incredibly appealing.

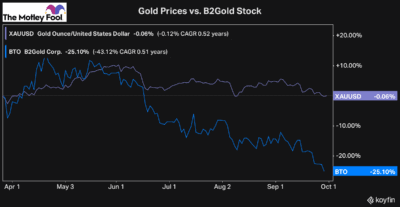

The whole reason gold stocks sell off when gold prices are falling is that the businesses have less potential to earn as much of a profit when gold prices are lower. However, as we can see from the chart above, gold prices have been mostly flat in recent months, while B2Gold stock has lost a quarter of its value.

This is creating incredible value for investors today. Even dividend investors could consider a position in B2Gold, as the Canadian stock’s dividend at these undervalued prices yields nearly 4.9%.

Currently, B2Gold stock trades at a forward price-to-earnings ratio of 6.4 times, showing just how cheap it is. So, if you’re looking for a high-quality Canadian stock that’s trading undervalued, B2Gold might just be the cheapest stock on the market.