You seldom find them on high-flying trending stocks lists, but analysts agree on these two Canadian construction stocks being Strong Buy candidates right now. Although they recently rallied on news of a historic construction budget south of the border, the potential for sizeable gains remains as they convert another $350 billion market opportunity.

To start with, President Joe Biden’s infrastructure bill was passed last month. About US$550 billion could flow into federal investments in U.S. infrastructure over the next five years. Investors are bullish on the North American construction industry and related stocks’ business prospects. That’s great.

But the United States isn’t our focus today.

A $350 billion market opportunity

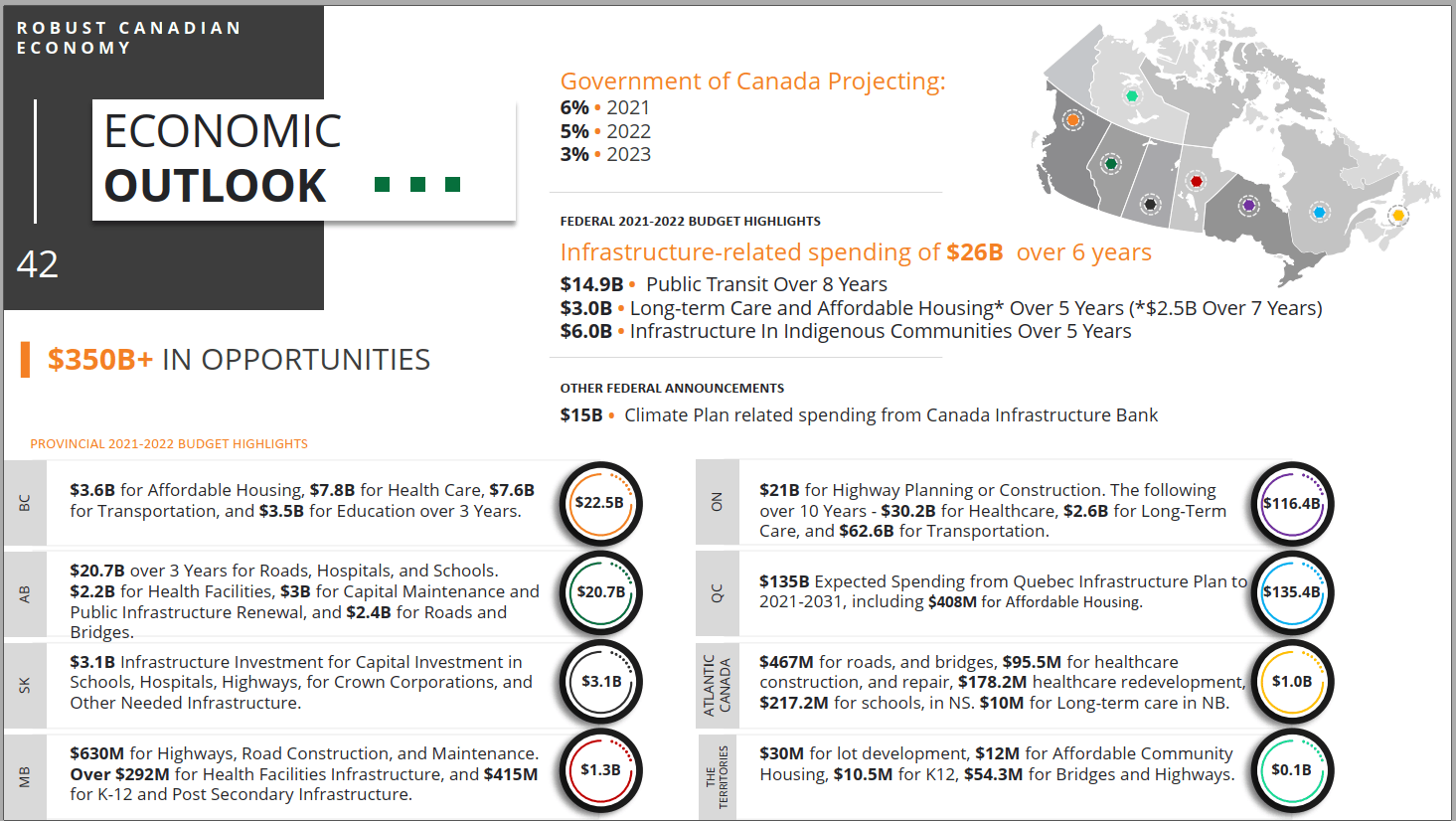

Canadian public sector spending will make a strong showing this decade. Actually, the federal and provincial governments in Canada have announced over $350 billion (US$275.8 billion) in budgeted infrastructure spending over the next few years.

Announced budgets include Quebec’s $35 billion infrastructure plan for 2021 to 2031, Alberta’s $20.7 billion three-year budget for roads, hospitals, and clinics, and Ontario’s $116.4 billion 10-year budget for highways, transportation, and healthcare infrastructure.

While the Canadian opportunity isn’t as big as the U.S. infrastructure bill, it’s more than half the record amount. And it’s a big and significant number.

Canadian contractors will welcome the great opportunity to make good money this decade, and so should their stock investors and those bullish on real estate investment prospects.

Let’s have a look at the two Canadian stocks that are strong buy candidates for October 2021.

Bird Construction

Bird Construction (TSX:BDT) is a general contractor serving the Canadian construction market. It is active in heavy civil construction, vertical infrastructure projects, repair and maintenance services, as well as new construction projects for industrial, commercial, and institutional markets.

Bird reported a marked increase in revenue and expanding profit margins over the past four consecutive quarters. Better still, adjusted EBITDA increased from 0.8% of revenue exit 2018 to 6% by the second quarter of this year.

A recent strategic acquisition of Dagma Construction for $32 million is expected to “..expand Bird’s capabilities and relationships in Canada’s largest civil infrastructure market,” the company highlighted in an investor presentation on September 9.

The deal could be accretive to earnings and cash flow during the very first full year of integration.

Bird Construction’s stock price has risen by 27% so far this year. Wall Street analysts are still bullish on BDT stock with a current average analyst price target of $12 a share indicating a potential 21.7% upside over the next 12 months.

What’s more, Bird Construction pays a well-covered C$0.033 per share monthly dividend that yields 3.9% annually. It’s great for passive income.

SNC-Lavalin

Another strong buy candidate in the Canadian construction space is the SNC-Lavalin Group (TSX:SNC) stock.

A current market capitalization of over $6.3 billion makes the company one of the largest listed engineering and construction companies in Canada. The company earns about 71% of its revenue from public clients.

In an investor presentation of September 28, management highlighted a spectacular 60% total sales win rate (between January 1, 2021, and August 31, 2021) on key Canadian client project bids. The company remains a favourite to win design and engineering contracts in North American infrastructure projects, especially after transforming its ethical profile.

SNC de-risked its business profile by exiting lump-sum turnkey projects. Its core engineering, design, and project management business line reported a record revenue backlog of $3.6 billion by June 2021. Quarterly revenues broke out of a declining trend with an 8.3% year-over-year sales growth during the second quarter of 2021. Current management focus is on improving free cash flow generation and regaining investment-grade credit rating for the business.

Here is a quality stock worth buying in October. SNC-Lavalin stock price has gained about 65% so far this year. An average analyst price target of $42.78 a share indicates a potential 20% upside over the next 12 months.