Dividends — they’re an investor’s best friend. I mean, there are so many benefits to dividend income. For example, this income is a supplement to your regular income. Also, it puts the compounding mechanism into play. In other words, your dividend income can be reinvested. This creates its own earnings. And the cycle continues. Stocks that have strong and consistent dividend growth are the rock stars of compounding. They’re the dividend stocks to own.

In this Motley Fool article, I present two stocks. They’ve hiked their dividends for more than 40 consecutive years. And they’re two of the best dividend stocks in Canada.

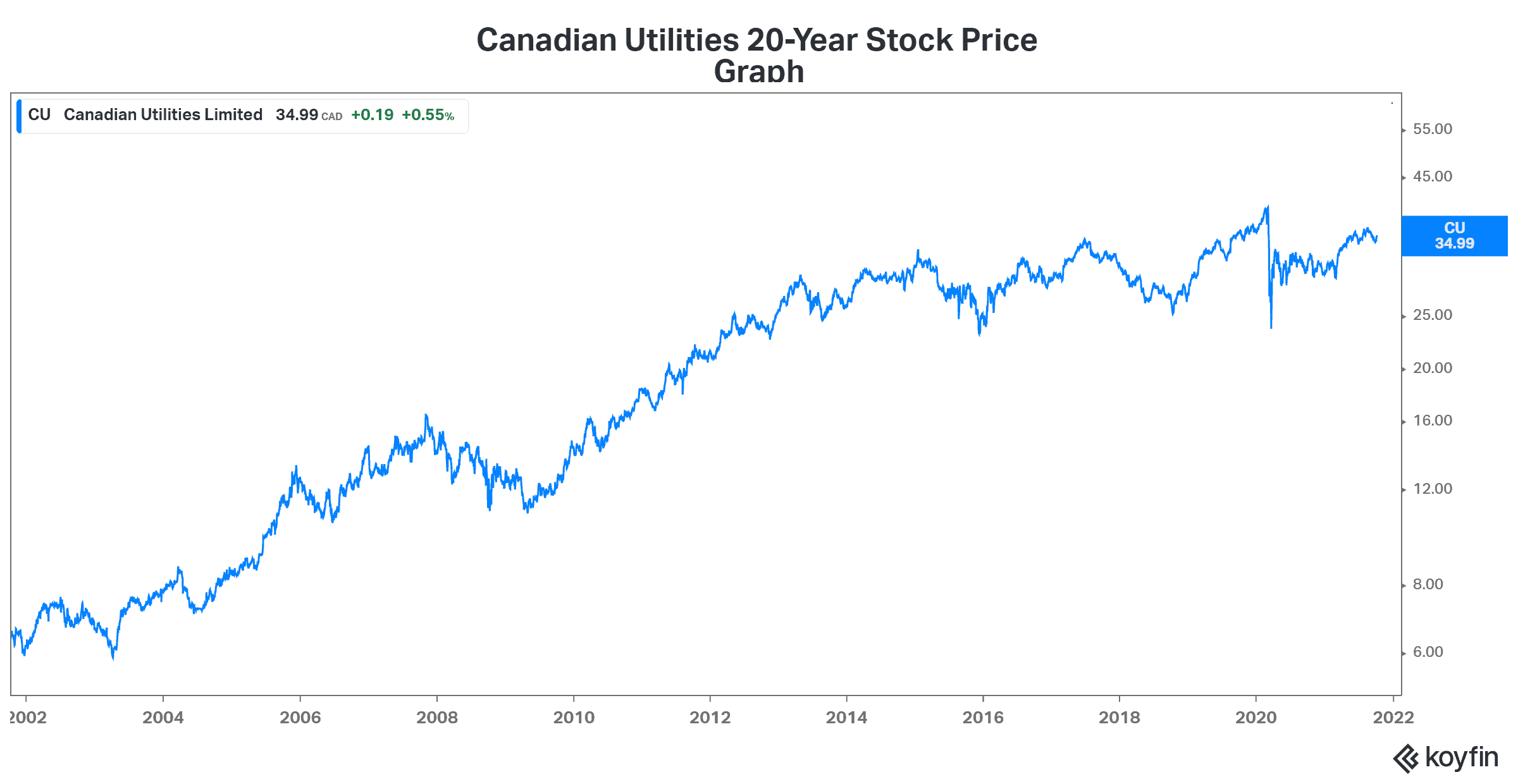

Canadian Utilities stock: 49 years of dividend growth

Canadian Utilities (TSX:CU) is a $20 billion diversified global energy infrastructure company. It has a portfolio of utilities and natural gas infrastructure assets. These assets provide an extremely defensive income stream. For example, 86% of the company’s earnings is regulated. The rest of the earnings are under long-term contracts.

The current dividend yield on the stock is a very generous 5%. Yet this company is the epitome of stability and predictability. This seems to be a contradiction. How can such a stable company have such a high dividend yield? Well, digging a little deeper, I find two issues. The first is Canadian Utilities’s payout ratio, which is well over 100%. The second is its elevated debt load, which is a burden. But do these issues really sour the investment case for Canadian Utilities?

First, let’s tackle the dividend-payout ratio. This payout ratio is calculated by dividing dividends paid by net income. But sometimes, the earnings payout ratio is not a good reflection of what’s going on. For example, net income can be manipulated. I argue here that the cash payout ratio is a much more accurate reflection of reality. There are many reasons for this. First, dividends are paid with cash flow. Also, the cash payout ratio takes capital expenditures into account. It’s a much better representation of what’s going on.

So, in the case of Canadian Utilities, its cash flow payout ratio is healthy, at under 75%. In short, a dividend yield of 5% is really amazing considering that investors are not taking on much risk with this stock.

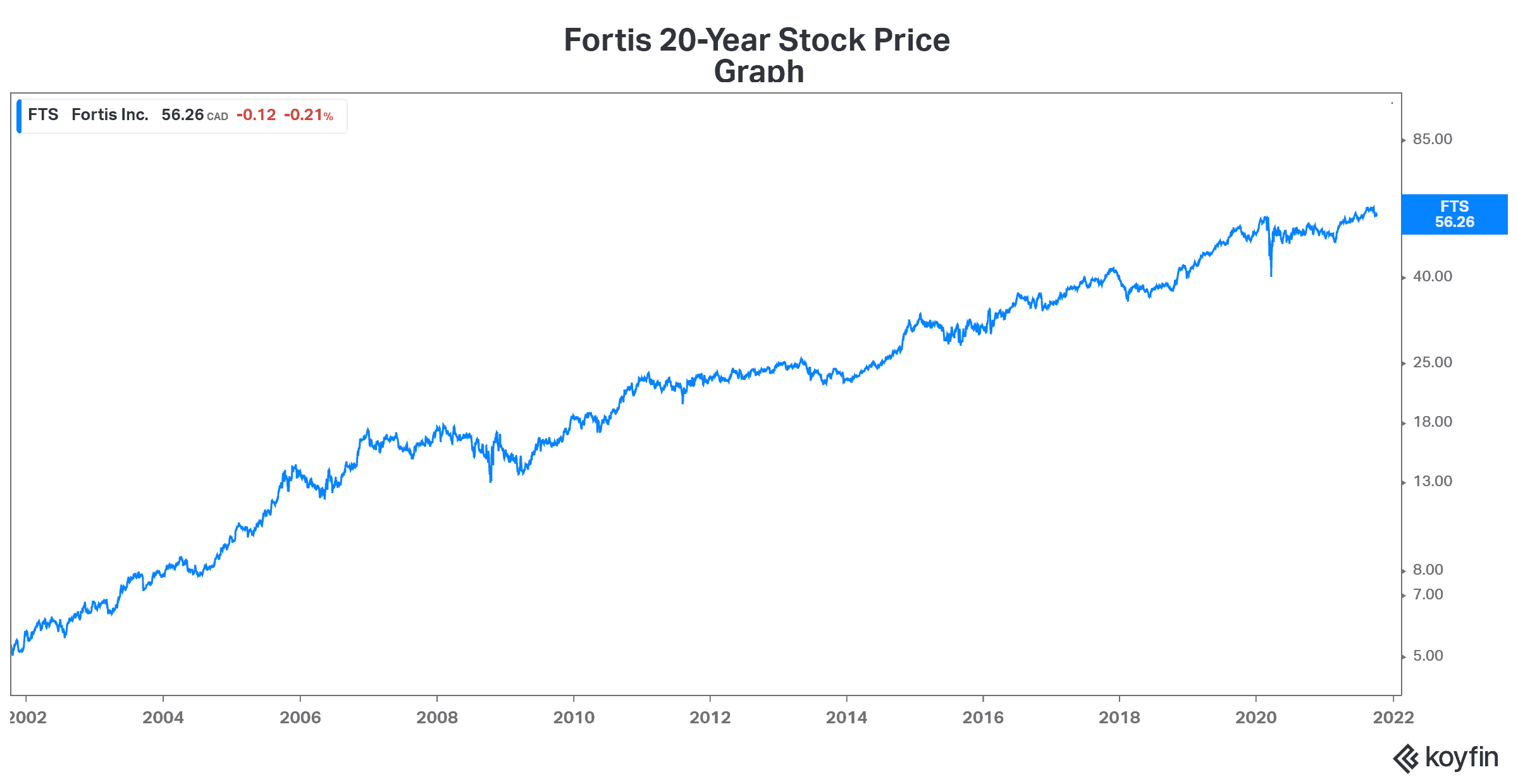

Fortis stock: Dividend growth and security at its finest

Fortis (TSX:FTS)(NYSE:FTS) is a leading North American regulated gas and electric utility company. The Motley Fool has covered this dividend stock extensively. It’s a leading dividend stock that’s yielding just under 4%. Furthermore, it has 47 years of dividend growth under its belt.

Like Canadian Utilities, Fortis is also a utility giant that offers stability and predictability. This is due to its highly regulated revenue stream. This predictability has enabled Fortis’s dividend growth. In fact, Fortis’s plans for long-term growth are also coming to life because of this.

For example, Fortis’s five-year plan is to invest $19.5 billion back into the business. This plan aims to further position Fortis for energy delivery and clean energy infrastructure. It basically aims to fortify the company’s position in the future of energy. The focus is clean energy and natural gas. Ultimately, this will ensure continued dividend growth for many years to come.

Motley Fool: The bottom line

Fortis and Canadian Utilities are pillars of strength. In short, their track records of dividend growth really speak for themselves. They’re essentially two of the best dividend stocks in Canada.