Suncor Energy (TSX:SU)(NYSE:SU) is Canada’s top integrated oil and gas company. It’s also a company that’s made good strides in cleaning up its operations as a result of big investments in clean energy. Could this be a clean energy stock in the future?

If you think that’s a big leap, you’re not alone. After all, fossil fuels and clean energy are a contradiction, right? Well, not so fast. Investors will be happy to hear that things are changing at Suncor. In fact, the change is widespread throughout the whole oil and gas sector. It’s definitely not your oil and gas sector of the past.

Suncor Energy stock: A clean energy plan

Suncor’s stated greenhouse gas emissions goal is to “..harness technology and innovation to reduce our emission intensity by 30% by 2030.” Suncor will use more co-generation facilities, which reduces waste. Also, the company will invest in technology to change the way the oil sands are extracted and processed. Finally, it will research carbon capture and conversion technologies.

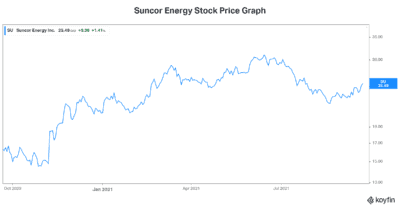

Finally, the company’s initiative also includes investing in lower carbon forms of energy. For example, Suncor has already invested in four wind power projects. It’s also evaluating solar energy projects and clean hydrogen. This energy giant is adapting to the times and transforming itself. And investors believe in the plan. Suncor Energy’s stock price has been resilient.

Suncor Energy joins the alliance

Earlier this spring, Canada’s largest oil sands producers got together. They’re on a mission to achieve net-zero greenhouse gas emissions by 2050. This alliance represents a collaboration between the government and oil sands producers such as Suncor. It includes other major producers that, in total, operate approximately 90% of Canada’s oil sands production.

There are different ways to achieve this goal. According to Suncor, carbon capture and sequestration will be 50% of the solution. But what are carbon capture and sequestration? Simply put, it means capturing the carbon before it enters the atmosphere or taking it from the atmosphere, and storing or using it. The infrastructure for this is key and is being built.

Ballard Power: A clean energy stock that’s already there

As far as clean energy stocks go, Ballard Power Systems (TSX:BLDP)(NASDAQ:BLDP) is one that has been in the game for a long time. It’s a leading fuel cell developer and provider whose stock has risen more than 280% in the last five years. This has been a time of recognition and validation for Ballard.

Fuel cells were just a concept when I first heard of Ballard stock many years ago. These were the days when oil and gas companies like Suncor Energy were denying climate change. Fuel cells were a ground-breaking concept, but still just a concept. Ballard’s goal was always ambitious — to decarbonize vehicles. It was a goal that was ahead of its time when I first heard of the stock. The market wasn’t ready. And mostly, the world wasn’t ready.

Today, the world is ready. Global mandates to reduce carbon emissions replace the prior apathetic attitude. More specifically, the hydrogen/fuel cell movement has been gathering steam in the last few years. From buses to trains to marine vehicles, Ballard’s fuel cells are making waves cleaning up transportation. Countries are getting on board. In fact, they’re investing heavily in this initiative. Auto companies are also investing in fuel cells. They’re looking for electric vehicles with zero emissions. And Ballard’s fuel cell has thus far not disappointed.

The bottom line

The clean energy revolution is upon us. It’s finally here. Even oil and gas companies are joining the cause. Suncor Energy is a prime example of a company that has come around and is intent on doing it right. On the other end of the spectrum is Ballard Power, which has been working on clean energy for decades.

Both of these stocks are doing great things for the environment and for shareholders’ pocketbooks. Suncor Energy’s stock price is undervalued today. Ballard’s stock has a big upside as the fuel cell market continues to gain momentum.