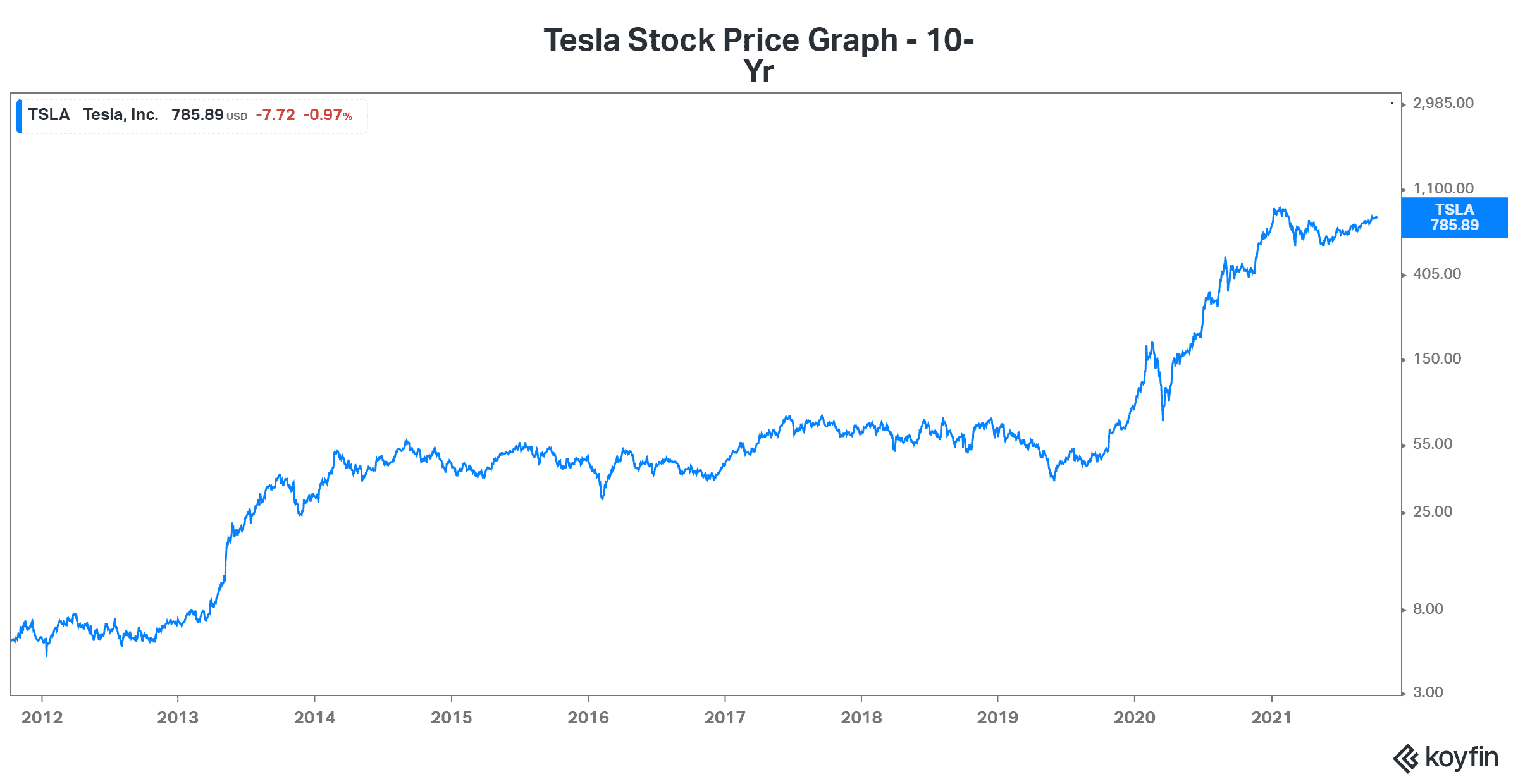

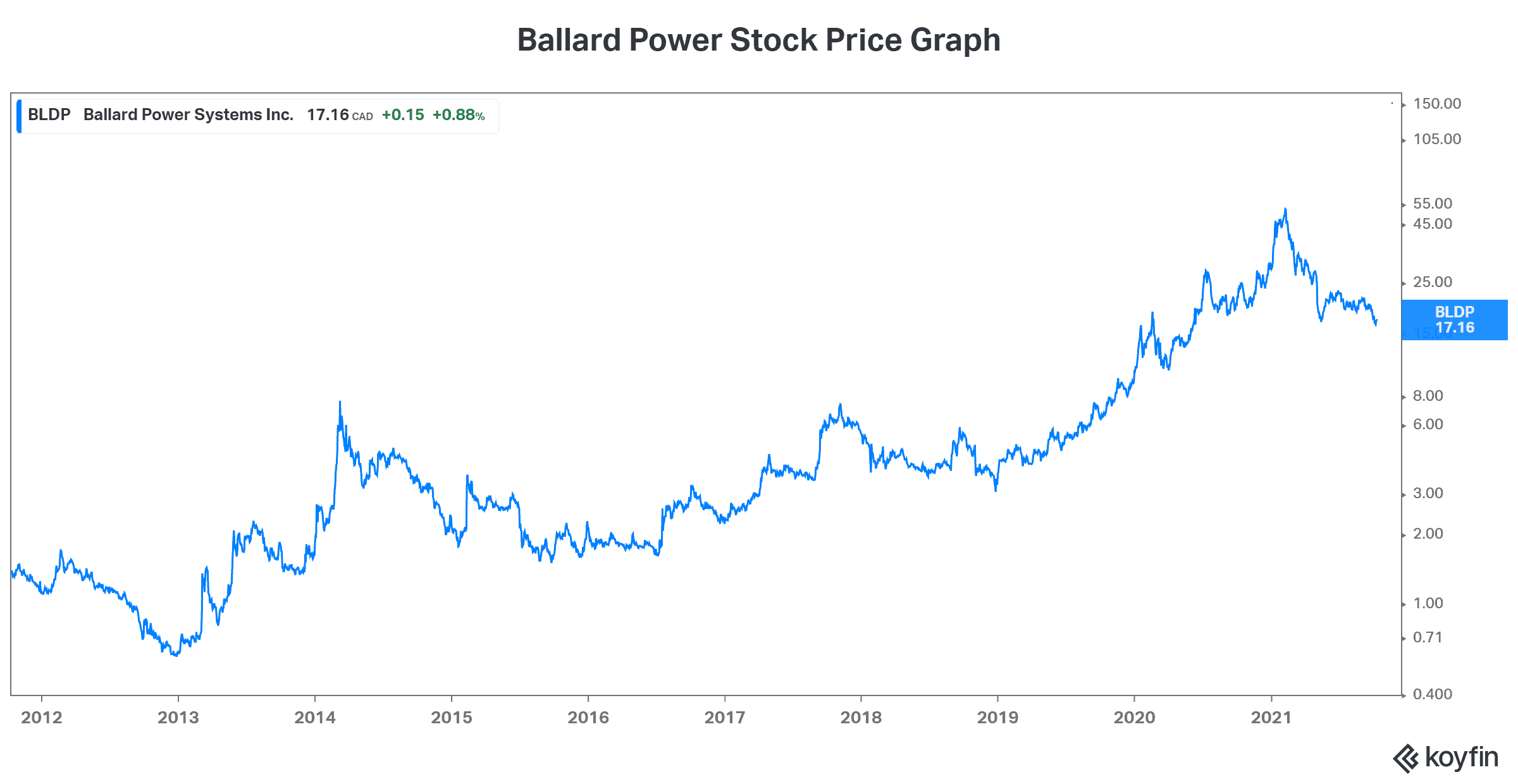

Tesla (NASDAQ:TSLA) is a star performer. It’s the type of growth stock we all wish we would have bought 10 years ago. Obviously, because Tesla’s stock price has returned 14,000% for its shareholders since then. For those investors looking for the next big performer, check out fuel cell provider Ballard Power Systems (TSX:BLDP)(NASDAQ:BLDP). For comparison purposes, Ballard Power stock has returned 900% over the last decade.

Ballard has actually been around a very long time. But now, the fuel cell market is ready to explode. Things are different. Read on to see why Ballard Power could produce 10x returns from here – and why it may be the next big growth stock.

Tesla stock had its doubters along the way

Tesla’s stock price run has been breathtaking. In hindsight, it looks easy, right? It seems like it was a breeze for Tesla shareholders, doesn’t it? On the contrary, it was anything but easy. Along the way, there were doubters. Like there always are. Tesla was losing significant amounts of money. Accordingly, Tesla’s stock price languished for many years. The company felt like an experiment that might not get off the ground.

So in reality, there were many “reasons” to sell the stock along the way. Investors had to be strong in their conviction and they needed nerves of steel. They had to have confidence that Tesla’s electric car would be a money-making reality. For those investors, the payoff has been huge.

Ballard Power’s story feels very similar to Tesla’s. Ballard is in the fuel cell business. Like Tesla, Ballard is aiming to clean up the world’s transportation vehicles. Tesla is doing this via its battery-powered energy. Ballard is doing this with fuel cells. In fact, Ballard is a leading global provider of innovative clean energy and fuel cell solutions. This is an exciting industry with massive growth potential. But it’s also an industry that is in the early stages.

Why is Ballard Power stock the next Tesla?

Tesla reported net losses for many, many years. Until only recently, these losses kept mounting. Investors were worried – and rightly so. It was clearly a high-risk situation. But as we learned in Investing 101, the higher the return potential, the higher the risk assumed. The key is to take calculated risks and diversify your investments.

At this time, Ballard is racking up the net losses. To many investors, the company just feels like a concept. But let me run through what makes Ballard a real force that’s succeeding in its mission to clean up transportation vehicles. Also, let me walk through why it makes business sense.Finally,, I want to point out the growth potential that exists.

So Ballard has taken its place in the fuel cell industry. Today, it’s the leading global fuel cell provider with an approximate 80% market share. Ballard’s fuel cells are in buses and trucks and trains. They’re deployed all over the world. You see, the political environment has never been better for clean energy companies – especially fuel cell companies. From the business side of things, fuel cell costs have come down dramatically. Also, fuel cells have many years of performance data that prove the concept. Simply put, they’re the best clean energy source for heavy-duty vehicles. One day, they may even be the best choice for automobiles, displacing Tesla. But for now, this means buses, trucks, trains, ships, and more.

Industry experts estimate that the fuel cell market will grow at an annual rate of more than 20%. In short, the next few years will see a steep growth trajectory. Ballard is set up nicely here, making it an attractive growth stock. The company has industry-leading partnerships with automakers, governments, and other relevant manufacturers.

The bottom line

For Ballard Power stock to perform like Tesla, we need a few things to happen. We need to see revenue growth accelerate. We also need to see improving bottom-line numbers. In the meantime, there will be naysayers and they will make shareholders nervous. But hang in there. I believe shareholders of Ballard will be rewarded. Even Tesla stock shareholders had to be patient. The payoff potential is huge.