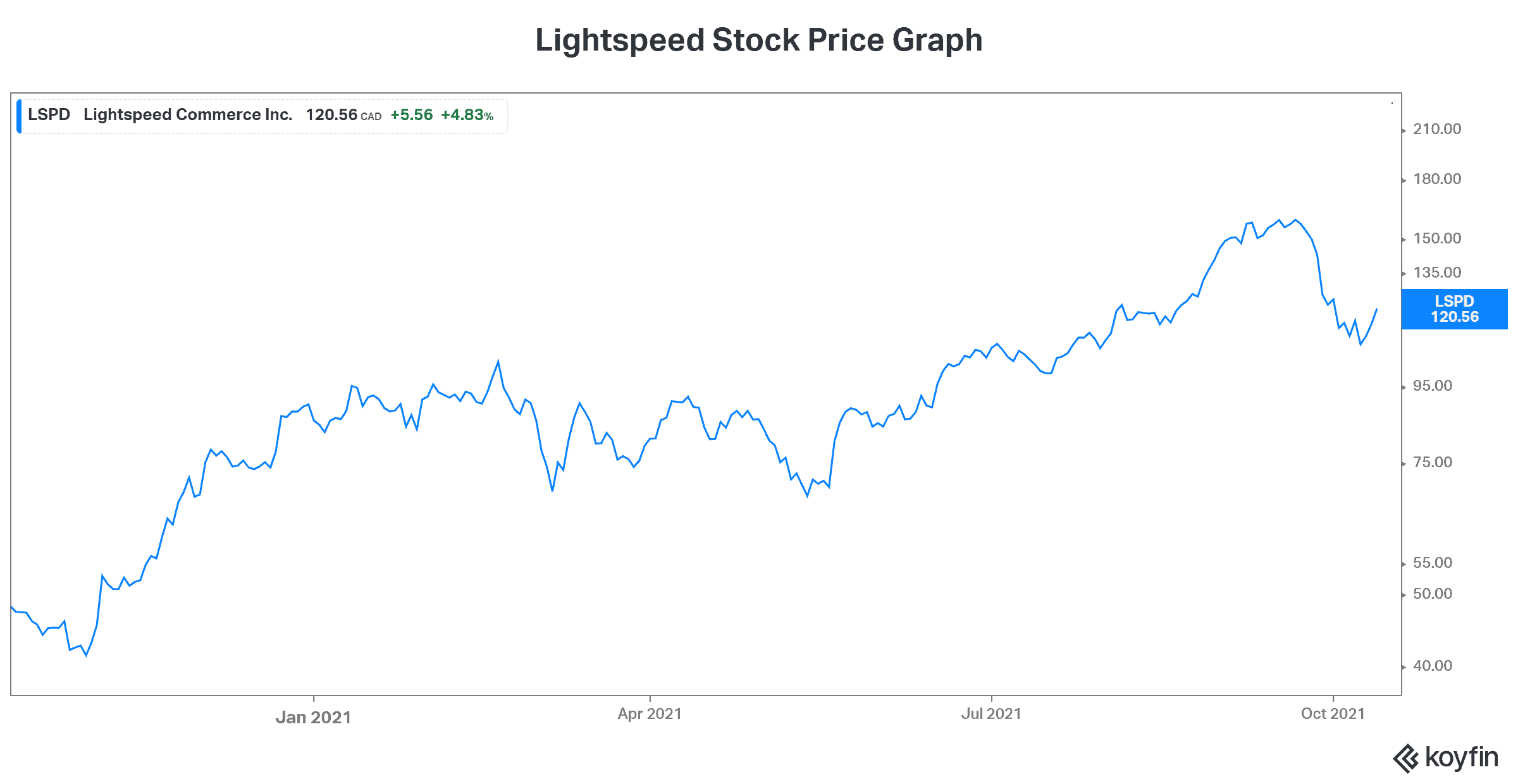

Lightspeed Commerce (TSX:LSPD)NYSE:LSPD), formerly known as Lightspeed POS stock, is a one-stop e-commerce platform. Its software platforms have helped retailers and restaurants and have also helped countless small- and medium-sized businesses drive their businesses. But this is not what Lightspeed has been in the news for recently. It has, in fact, been overshadowed by a short-seller report. The stock has tumbled almost 30% from its highs. And Motley Fool investors have been shaken.

This Motley Fool article discusses my three reasons why I’m warning you to stay away from Lightspeed stock. Please read on so I can explain.

Lightspeed stock: Catching the falling knife is a risky game

Lightspeed stock is down 30% in just one month. This may lead some to ask whether this is a great buying opportunity. Well, maybe. But here’s what I’m thinking instead. When sentiment turns on a stock, it can be swift. It can also be drastic. Lightspeed stock is a sitting duck as far as valuations go.

I mean, when sentiment turns, the highest valued stocks get disproportionately hit. One can argue that sentiment, in general, has been quite high in the stock market. And this is a good thing — until high expectations bid up stock prices so high that they become impossible to live up to. I think we’re nearing this point again for the market. I think we’re definitely there for Lightspeed stock. In short, it’s due for a pullback. I don’t imagine that this pullback will be short-lived either. A re-setting of expectations takes time and very often pain.

Short-seller report is an overhang for Lightspeed stock

The short-seller report that has shaken Lightspeed stock is not the problem. It is, instead, a symptom of the problem. A market that’s fuelled by never-ending optimistic exuberance is a problem. A stock that’s heading higher based on overly-optimistic expectations is a problem. Right now, I’m brought back to the world of cannabis bubbles. This was not too long ago, but many seem to have forgotten. Valuations that go too high too fast are a dangerous thing.

So Lightspeed stock has fallen 30% in just one month. But let’s not forget, it’s still up 28% in 2021. And almost 500% in the last three years, when it was still known as Lightspeed pos stock. This is a success story any way you look at it. The question is, how high is too high? And is it really reasonable for this stock to continue higher? It’s true, revenue is skyrocketing. But, net losses are accelerating. And the company is dealing with cash burn.

All of this is “normal” for a new company. But let’s not forget, it highlights a risk profile that may be too great for some investors. On top of this, we have Lightspeed stock’s valuation. I mean, it trades at an almost 50 times sales multiple. Also, it trades at a six times book value. Add the company’s lack of earnings and cash flow to this, and we can see why there’s reason to be wary.

Lightspeed faces stiff competition

The global e-commerce software industry is huge. We should all be very clear on that. It was valued at US$6.2 billion in 2019. It’s projected to grow at a compound annual growth rate (CAGR) of over 15% over the next few years. But as with any fast-growing market, there’s bound to be competition. The e-commerce software market is pretty fragmented. And competitive pressures are accelerating as new and old players vie for a bigger piece of the pie.

The bottom line

My problem with Lightspeed stock has nothing to do with its underlying business. As for the short-seller report, only time will tell if it had any truth to it. My problem is, in fact, with this classic tale of over-optimism driving sharp stock price rallies. This means that we’re paying up today for growth that’s maybe coming many years in the future.

This, by definition, raises the risk profile of a stock. I prefer to sit this out at this point. I recommend waiting until the dust settles before reconsidering.