2021 has been an interesting year. The pandemic is winding down. People and societies are getting back to normal. And oil and gas prices are soaring. It’s really no surprise, then, that Canadian energy stocks have been soaring. These stocks are truly Canadian stocks. I mean, the oil and gas industry is still one of Canada’s most important industries. It’s only now that we are being reminded of this. Because how can we ignore the fact that oil and gas stocks are on a tear? We can’t and we shouldn’t.

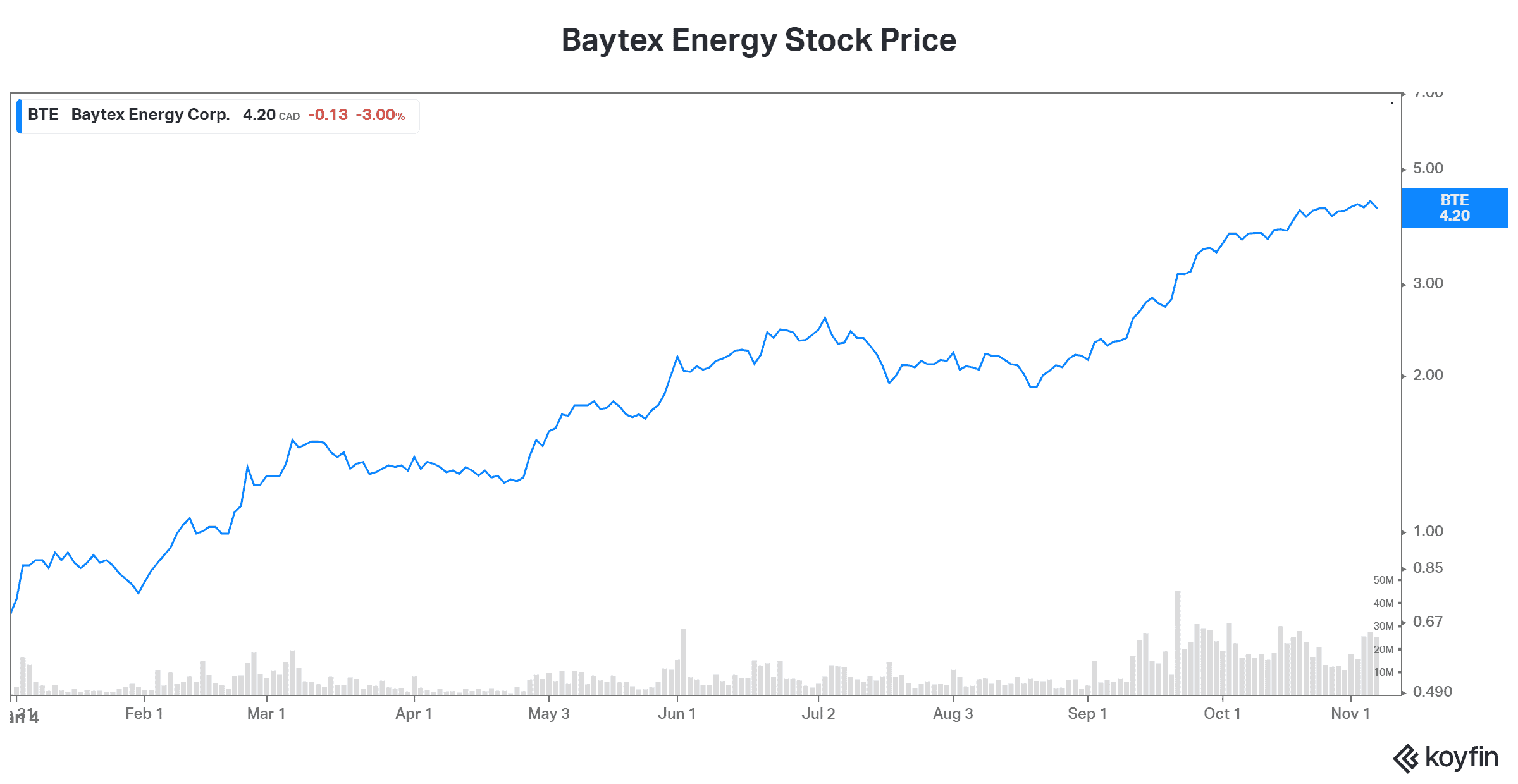

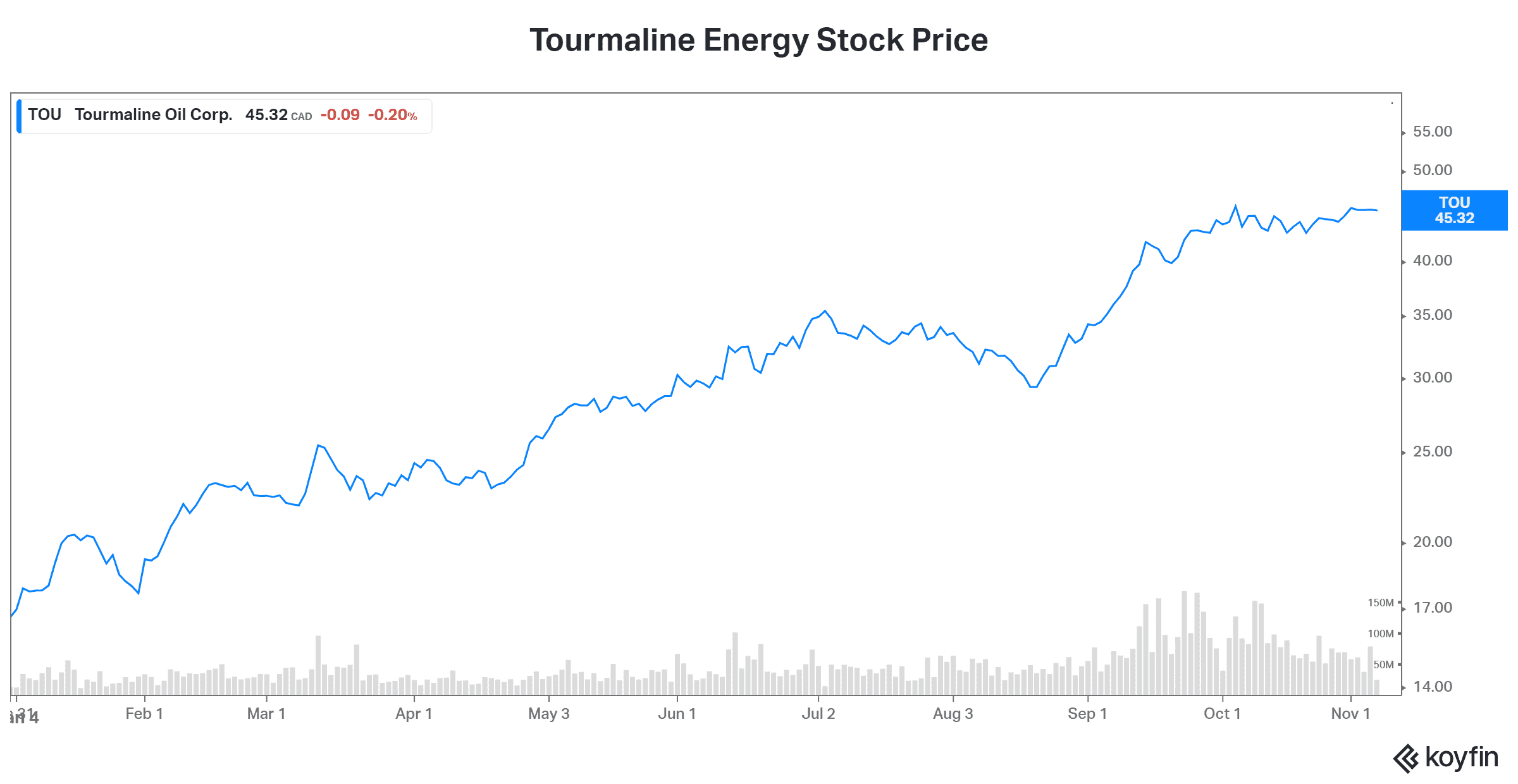

In this Motley Fool article, I introduce two Canadian stocks that have been skyrocketing in 2021. Baytex Energy (TSX:BTE)(NYSE:BTE) is up 525% and Tourmaline Oil (TSX:TOU) is up over 170%.

Read on to learn more, because this momentum is only beginning.

Baytex Energy stock: A dirt-cheap Canadian stock

What can I say about Baytex Energy? This is a $2.4 billion Canadian oil and gas company. It has a high-quality oil portfolio with 10 or more years of drilling inventory. It also has strong capital efficiencies and flexibility on discretionary capital. But things weren’t always this good. In the not-too-distant past, Baytex was drowning in debt, and its very survival was in question.

So that’s probably why Baytex stock has done so well in 2021 – up 525%. It was coming from such a sad, undervalued state. Today, Baytex is benefitting from its diversified portfolio of assets. It’s also benefitting from soaring oil and gas prices.

Baytex’s recent Q3 results release today was nothing short of impressive. Cash flows doubled. The debt level was slashed. In turn, this has led Baytex to talk about returning cash to shareholders – a common theme in the oil and gas world these days. Add this Canadian stock to your list of energy stocks to buy, as a dividend is coming soon and it’s trading at dirt-cheap valuations.

Tourmaline stock: This Canadian stock is booming along with the natural gas industry

Tourmaline is a mid-tier Canadian natural gas producer. It is, in fact, a high-quality natural gas producer (almost 90% natural gas) with only marginal oil production. This natural gas-heavy production profile is serving Tourmaline really well in 2021. Tourmaline stock has rallied over 170% this year – and there’s more to come.

Natural gas prices are still going up. Looking ahead, this momentum shows no signs of stopping as supply remains low and demand is soaring. In fact, Tourmaline’s third-quarter 2021 results demonstrate this very bullish situation. Tourmaline’s cash flow increased more than 170%, with an abundance of cash left over after capital expenditures to ramp up shareholder returns. In fact, Tourmaline paid out a special dividend in October. Furthermore, the company expects that these special dividends will keep coming – and Tourmaline stock should continue to rise as they do.

Canadian energy stocks making headway on their environmental impact

There can be no discussion of an oil and gas company would be complete without mentioning the environment. Canadian companies are working hard at cleaning up their acts. And they’re making progress. Canadian oil and gas are increasingly the cleanest in the world. We should applaud that. It’s good from an ethical perspective and a financial perspective.

Essentially, Canadian oil and gas are not only supplying Canada but are increasingly being exported. The rationale is simple. Some countries still get their energy from coal. Canada’s natural gas is a much cleaner alternative, yet it’s still relatively cheap. And this is a million-dollar opportunity for companies like Tourmaline, for example. Tourmaline’s production is one of the suppliers to Altagas’s RIPET facility. This facility exports propane and butane to markets in Asia. These exports are growing at a really healthy clip.

Canadian energy stocks are coming back with a vengeance in 2021. There are many good opportunities in this sector today as the momentum can be expected to continue. Consider buying one or two or a bigger, more diversified basket of these Canadian stocks. The sector is returning cash to shareholders on a massive scale and it’s a significant opportunity.