Cyber Monday is a marketing phrase first used in the United States to name the Monday after Black Friday — that is, the Friday immediately following Thanksgiving Thursday. It was created by retailers to encourage people to shop online on Monday. Cyber Monday will be on November 29 this year. There will be big sales on that day that you won’t want to miss. But you should also think about adding Shopify (TSX:SHOP)(NYSE:SHOP) and Amazon (NASDAQ:AMZN) to your shopping list. Those two e-commerce stocks should benefit from a surge in online sales on Cyber Monday.

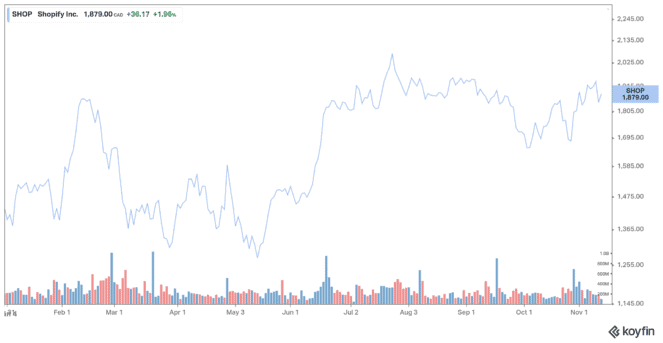

Shopify

Shopify expects its users’ sales to grow faster than the rest of the market as the holiday season approaches.

Following the forecast of increased sales for the holidays this year, a Shopify survey of Black Friday and Cyber Monday spending found that consumers expect to spend $787 during the popular shopping weekend this year — over $100 more than in 2020.

Most survey respondents (94%) said they plan to shop online for Black Friday and Cyber Monday, and almost two-thirds (65%) said they will shop in-store.

Shopify continues to follow what’s hot. During the third quarter, it introduced the new Shopify marketplaces to improve cross-border commerce.

The cloud-based e-commerce platform did not provide specific guidance but maintains that growth will continue in a more normalized fashion, albeit at a slower pace than set in 2020.

And while management doesn’t say how much, the fourth quarter is still expected to contribute the most to full-year revenue, although it’s a more even distribution throughout the year. That’s actually good for the long-term health of the business. With full-year adjusted operating profit expected to surpass the all-time high of $437 million reached last year, it is clear that Shopify is on a healthy and profitable path.

The market seems to fully understand that just because a business isn’t growing at a set pace in an extraordinary year does not mean that it does not continue to grow. This seems to be the direction Shopify is heading and why its business remains on fire. Shopify remains one of the top tech stocks to buy.

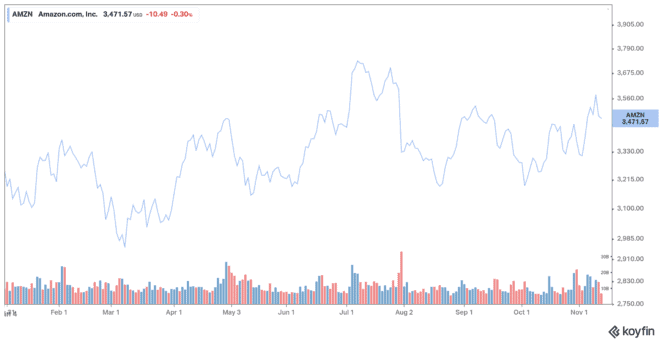

Amazon

Amazon is still the king of e-commerce. The company has been good at growing demand for its products and services and building customer loyalty. With Prime membership expected to reach nearly seven in 10 U.S. households by 2025, Amazon is the clear candidate for seizing the most growth opportunities.

On the cloud side, market leader Amazon is doing really well. Amazon Web Services was instrumental in keeping the company’s total operating profits afloat in the third quarter. As the cloud space is expected to grow at a CAGR of nearly 20% through at least 2028, the Seattle-based company is expected to benefit.

Barry Schwartz, chief investment officer with Baskin Wealth Management, named Amazon as one of his top stocks for the year ahead. He said: “And Amazon is investing for the future. That’s what Amazon does. It doesn’t worry about transitory or temporary costs, and at some point we think the sales are just going to rise so quickly that the operating leverage is going to start to kick in and Amazon’s going to have no choice but to gush profits. As well, the exposure to cloud computing, that’s where the real money is made for Amazon. They have pretty amazing margins in that part of the business, and that’s still growing.”

The e-commerce king announced last week the opening of a new robotics manufacturing plant in Westborough, Massachusetts, saying the plant will provide more than 200 new manufacturing jobs in the region.

Amazon’s recent pullback could be an opportunity for long-term shareholders.