Companies that increase their dividends over time create shareholder value. Therefore, knowing which companies are increasing dividends is key. We simply need this information in our search for top stocks to buy. This year has been a very productive one. The TSX is trading at all-time highs. Also, investors have been benefitting from companies who are rapidly returning capital to shareholders — companies like Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) and Sun Life Financial (TSX:SLF)(NYSE:SLF).

Without further ado, let’s look into these two stocks that have recently significantly hiked their dividends by 20-25%.

Canadian Natural Resources stock: An oil and gas leader that’s also a top dividend stock

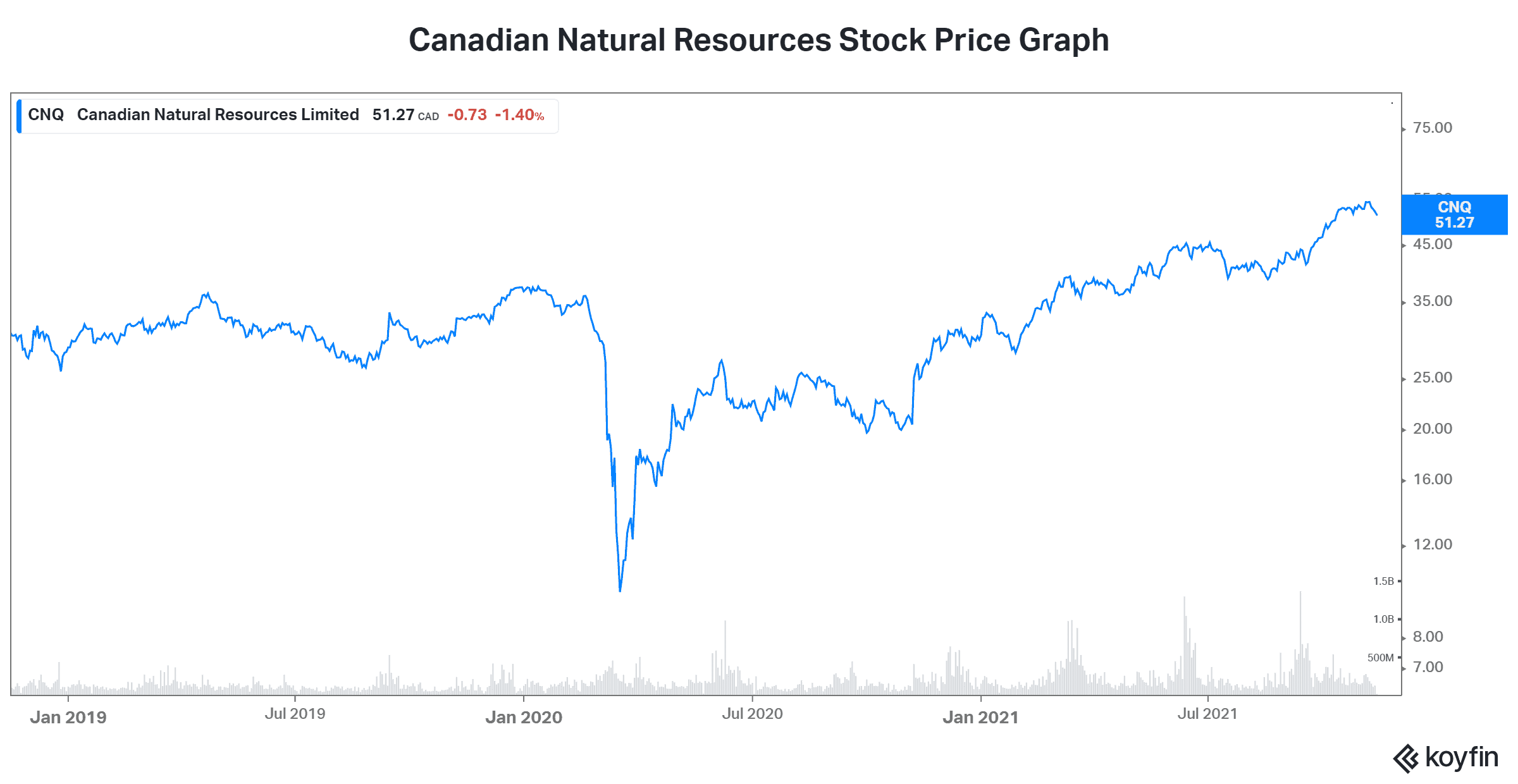

The first stock that I want to discuss is Canadian oil and gas giant Canadian Natural Resources. CNQ is a $60 billion, top-tier Canadian oil and gas company. It’s also an example of how a well-run and well-managed oil and gas company can create tons of shareholder value. As you know, the oil and gas sector has been shining in 2021. With this, we have seen rising dividends across the board. After many consecutive years of raising its dividend, CNQ just announced a big whopper of an increase, payable in January. In fact, its 25% dividend increase that is a reflection of booming times.

So, this increase represents the 22nd year of consecutive increases. It’s also the largest one yet. Clearly, this increase can be maintained over time, as Canadian Natural’s long-life assets will be able to support it. This is because cash flows associated with these assets are stable, steady, and resilient. They require comparatively low capital expenditures and provide a high degree of predictability.

At this time, Canadian Natural’s dividend yield is an attractive 4.5%. Also, CNQ stock has soared almost 70% in 2021. What does this mean for investors? Well, oil is trading at $80. Natural gas is also reaching heights that it hasn’t hit in a very long time. Clearly, the supply/demand imbalance in the oil and gas sector remains. This means low supply and high demand. Therefore commodity prices continue to be pushed higher. It will actually take a while to work through this and for things to rebalance. Expect more good things from CNQ as cash flows continue to soar.

Sun Life Financial stock: A dividend stock that’s free from restrictions

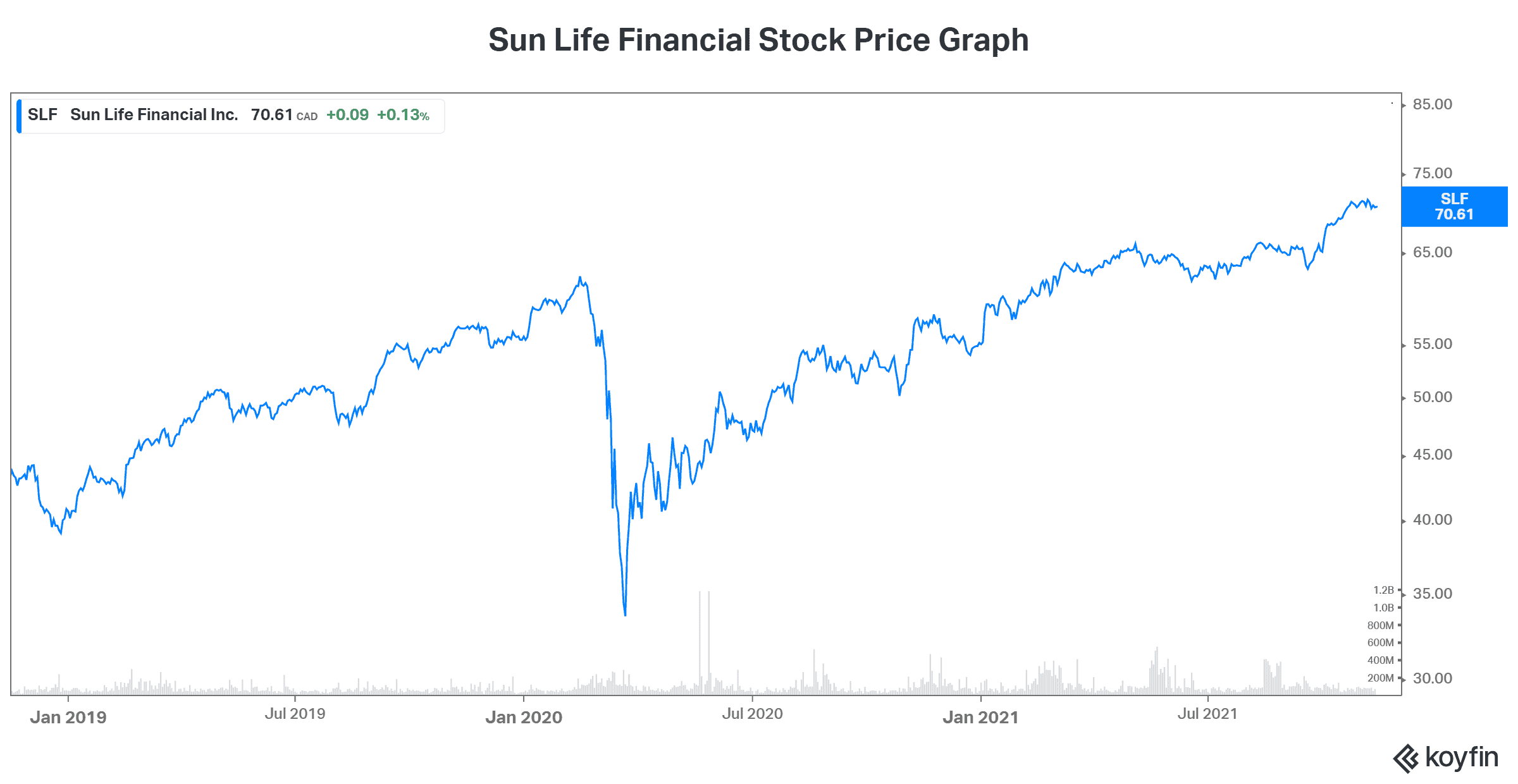

Sun Life Financial is a global financial services company that provides insurance, wealth, and asset management solutions. It’s been a Canadian leader for many years. Today, Sun Life’s business continues to perform well, creating shareholder value. A recent catalyst for the stock was the fact that regulatory curbs on capital distributions were eased.

This brought about a 20% increase in Sun Life’s dividend. In fact, it’s annual dividend now stands at $2.64 for a dividend yield of 3.7%. That’s pretty good. On top of this, Sun Life’s business continues to perform well. Despite record-low interest rates, things are looking good. In fact, Q3 earnings per share rose 7%. This was driven by a 23% rise in earnings from its asset management business. And it offset losses, resulting from the pandemic and weather events. Consequently, Sun Life’s stock price has soared to new highs.

So, at the end of the day, Sun Life has continued to impress. Its most recent dividend increase is a reflection of this.

Motley Fool: The bottom line

Stocks that have increasing dividends outperform. They provide investors with solid capital gains as well as increasing income. Canadian Natural Resources stock and Sun Life stock both have a solid financial standing. And they’re giving back to shareholders in a big way.