Air Canada (TSX:AC) was hit hard by the pandemic, as travel restrictions dampened traffic. But as more people get vaccinated, and as Canadians can travel again, Air Canada is slowly recovering.

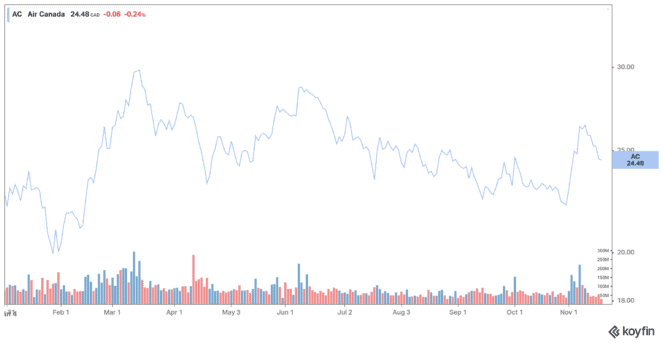

Overall, Air Canada’s stock price has trended higher for 2021, generating a return of approximately 10% year to date.

Higher revenue, smaller loss

Air Canada’s latest quarterly results show improvement in the airline business.

Indeed, Air Canada reported a smaller loss and higher revenue in the third quarter, as the travel recovery accelerates.

Operating revenue for the third quarter of 2021 came in at $2.103 billion, nearly three times the operating revenue of $757 million reported in the third quarter of 2020.

It is still a far cry from the $5.5 billion in revenue for the same quarter in 2019, as the skies begin to open again amid the COVID-19 pandemic.

Meanwhile, due to positive months in August and September, the company limited its EBITDA loss to $67 million, well ahead of the consensus estimate of a loss of $119 million and Paradigm’s projection of a loss of $190 million, and well ahead. the reported year-over-year loss of $554 million, although it was still well below the $1.5 billion positive EBITDA in the same quarter of 2019.

However, an encouraging sign for Air Canada is that its previous cash expenditure turned into a cash generation of $153 million for the most recent quarter, or $1.6 million per day compared to the initial forecast of Air Canada’s cash consumption ranging from $3 million to $5 million per day. In total, the company was left with $14.4 billion in unrestricted cash ($9.5 billion in cash and cash equivalents), aided by a series of fundraising deals for gross proceeds of $7.1 billion.

Air Canada reported a net loss of $640 million, or $1.79 per share, for the quarter ended September 30, compared to a loss of $685 million of $2.31 per share in the prior-year quarter.

The seating capacity increased 87% compared to the same period in 2020 but is down 66% compared to 2019.

CEO commentary

Air Canada president and CEO Michael Rousseau said:

“We are encouraged by favourable third-quarter revenue and traffic trends, with strong increases in key geographic passenger segments, a record performance freight and significant improvements for Air Canada Vacations and Aeroplan. The combination of these factors, along with effective cost controls, resulted in free cash flow of $153 million for the quarter, significantly better than expected and compared to the third quarter of 2020.”

The Canadian airline closed a series of financing deals in August, allowing it to reduce its cost of borrowing, extend the maturities of its corporate debt, and raise gross proceeds of about $7.1 billion. At the end of the third quarter of 2021, Air Canada had approximately $9.5 billion in available cash on its balance sheet.

Air Canada is a buy

The airline has been rebuilt to withstand the shocks it has faced over the past year and a half and will likely continue to face short-term bumps in its recovery. But its longer-term outlook is better. With a forward P/E of 8.3, Air Canada is an undervalued stock. Strong growth is in the cards for 2022, with sales expected to rise by 144.2% and earnings by 91.1%. It’s time to buy shares before the stock heats up again. Air Canada is a must-own stock as travel heats up.