The natural gas price is soaring. In fact, it’s up 85% in the last year. As a result, we have seen our energy needs become more expensive. We’ve also seen is soaring natural gas stock prices. The oil and gas market is in a state. Low supply combined with rising demand has brought about the perfect storm. It’s made certain natural gas stocks, such as AltaGas (TSX:ALA), the best stocks to buy now.

AltaGas stock: A natural gas stock plus so much more

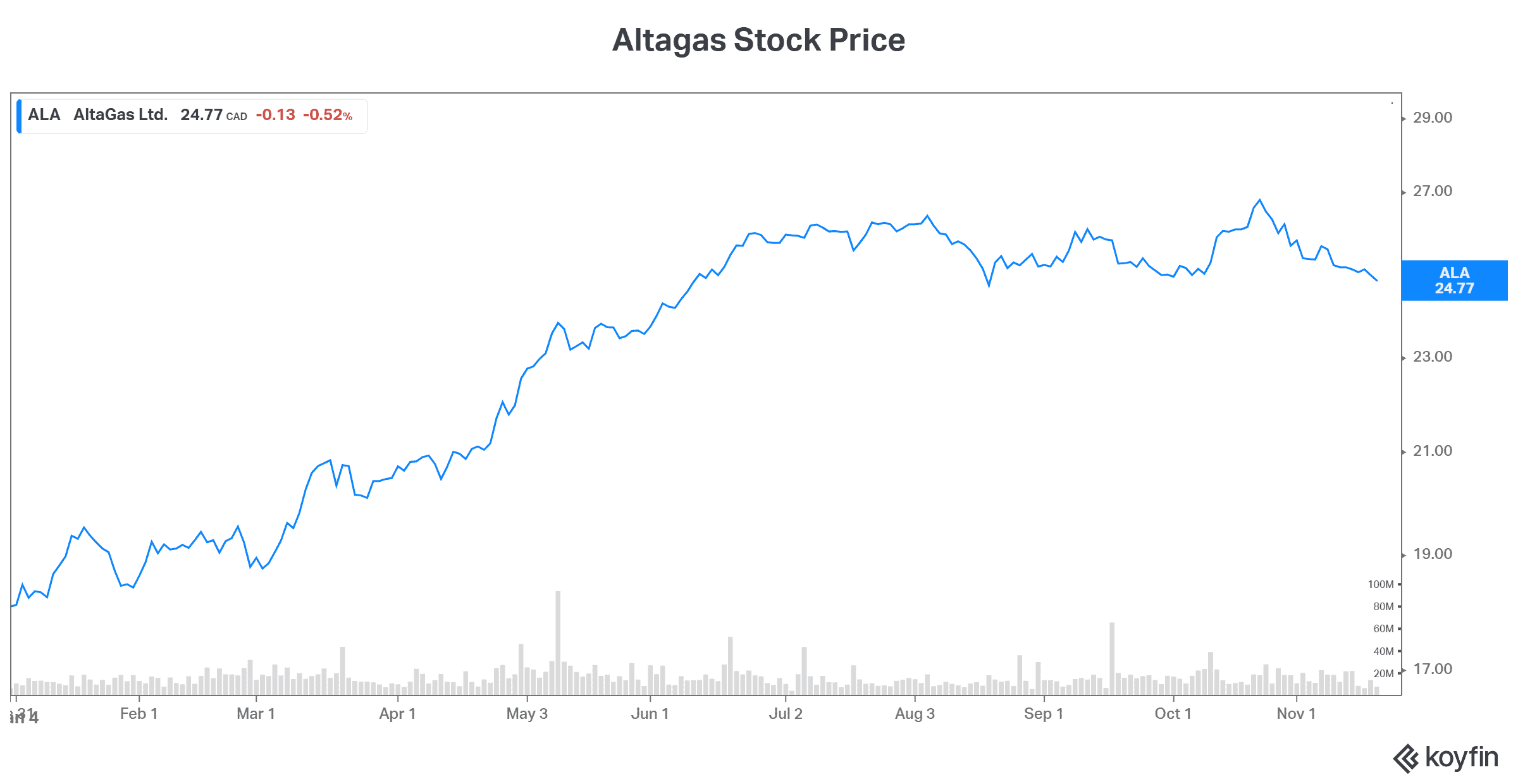

AltaGas stock is up 33% this year. A number of factors are driving this. The first is AltaGas’s booming propane export business. The second is AltaGas’s solid utility business. Put together, these businesses form a strong and growing entity.

The company’s midstream business is located in Western Canada. It includes natural gas processing and export facilities. These assets are located in some of the fastest-growing markets in North America, including the Montney and Marcellus/Utica basins. Propane is a by-product of domestic natural gas processing. AltaGas is selling this by-product to places like Asia, where it’s in high demand. In fact, propane prices are up well over 100% in 2021 as a reflection of this positive supply/demand situation.

With a dividend yield of 4%, rapidly falling debt levels, and steadily rising EBITDA, AltaGas stock is clearly one of the best stocks to buy right now.

Cenovus Energy stock: The best stock to buy right now for its diversification and synergies

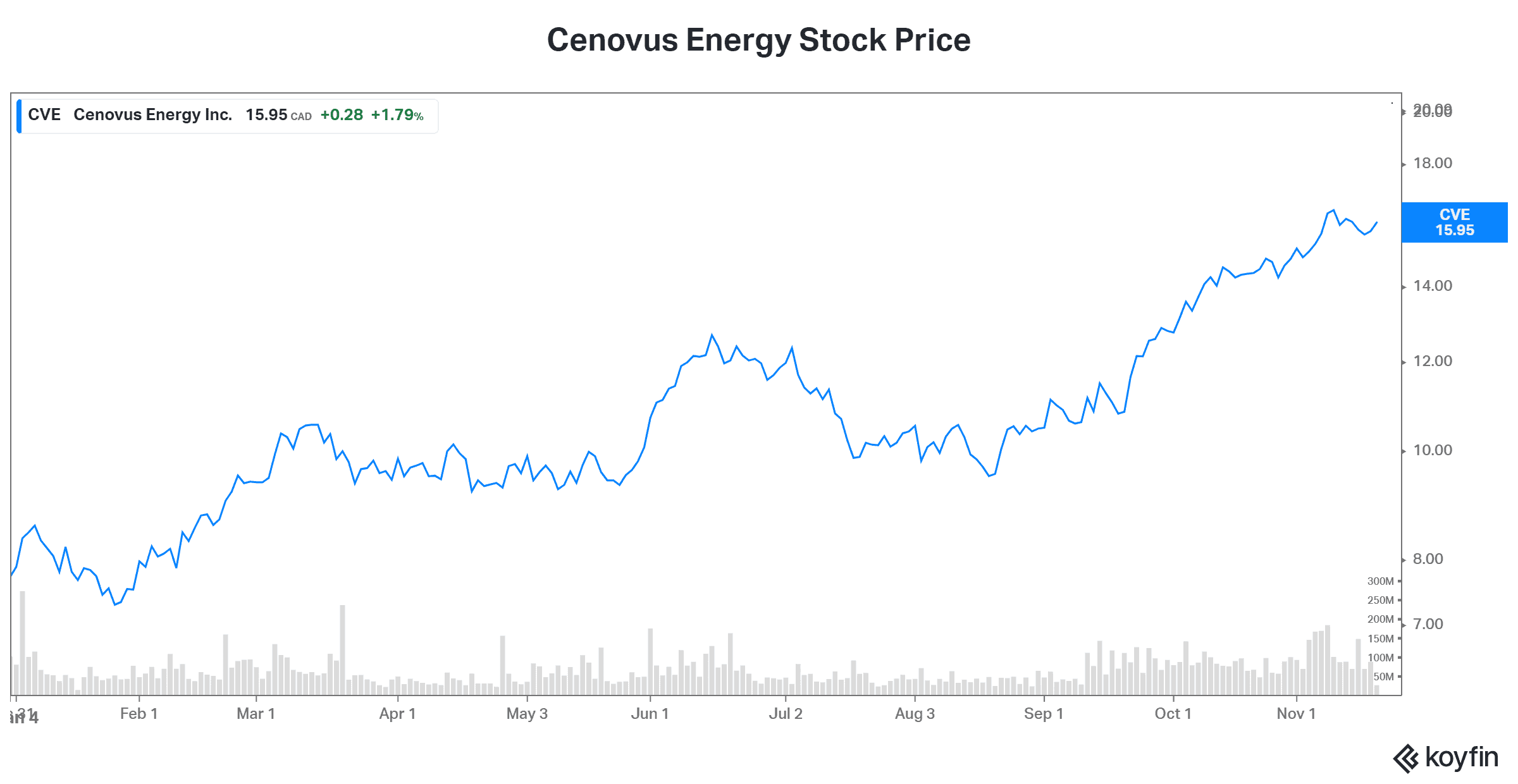

Cenovus Energy (TSX:CVE)(NYSE:CVE) has also risen big time in 2021. In fact, it’s up more than 100%.

It’s the third-largest Canadian oil and gas producer. It’s also the second-largest Canadian-based refiner and upgrader. Cenovus’s most recent quarterly results were positive on all fronts. Cash flows continued to soar. Also, synergies from the Husky acquisition came through. And finally, Cenovus ramped up shareholder returns. The details are clear: cash flow from operations increased almost 200%. More importantly, adjusted funds flow increased 475%. And Cenovus’s dividend doubled. The energy cycle appears to just be beginning as oil and gas prices continue their ascent.

Peyto stock: The best stock to buy right now for its soaring cash flows

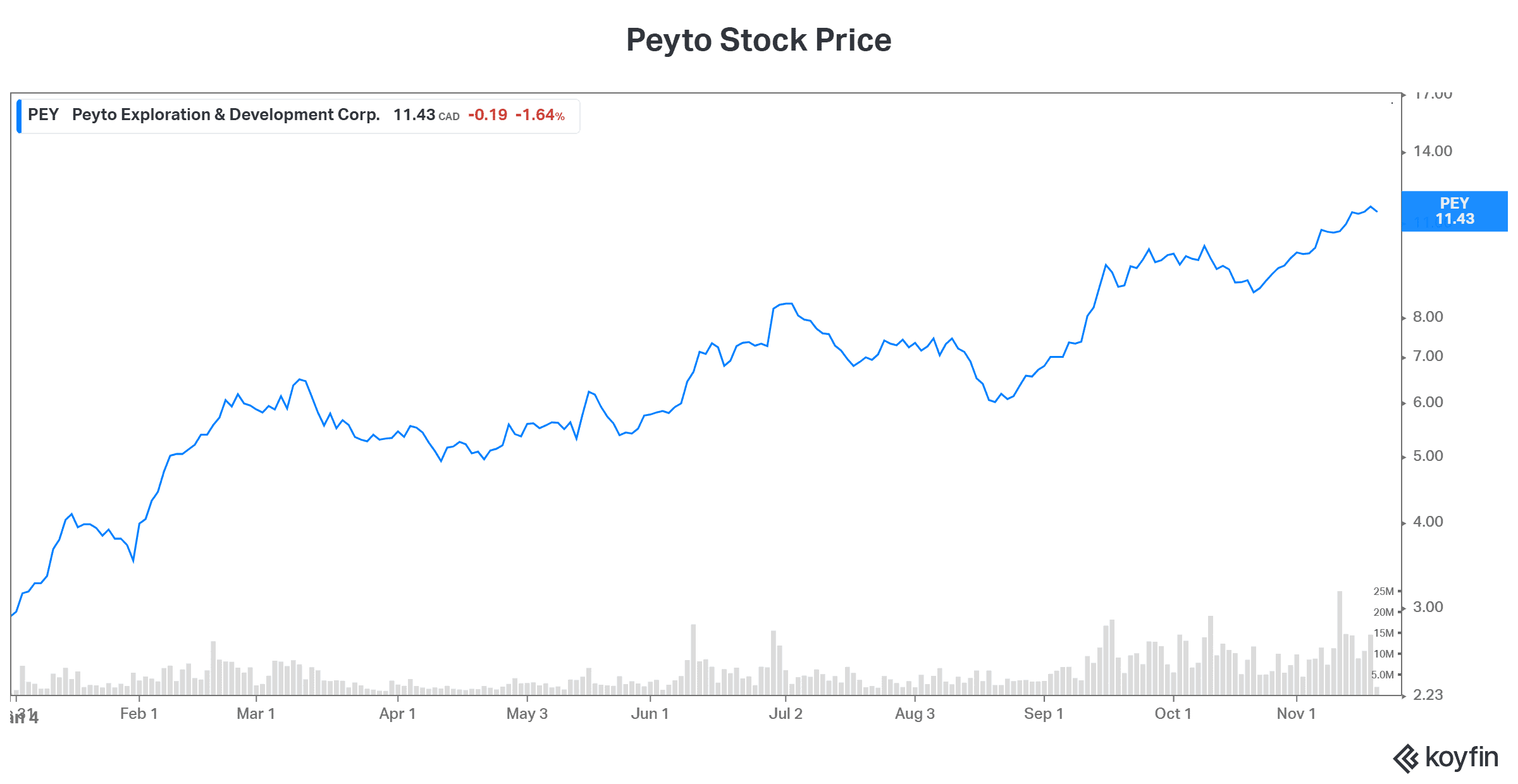

As a company where natural gas makes up the vast majority of its production, Peyto Exploration and Development (TSX:PEY) has had it good in 2021. With the rise in the natural gas price, Peyto’s stock price has soared 285% so far this year — with no signs of stopping.

This is because, in fact, the natural gas price has come back with a vengeance. There’s growing global recognition that it will be the fuel that will help with the energy transition. And there’s simply no better place to get higher-quality, low-cost, and cleaner natural gas than Canada.

Peyto Exploration & Development is one of Canada’s lowest-cost natural gas producers. It operates in a very prolific resource basin that’s characterized by predictable production profiles, low-risk exploration, and a long reserve life. This translates into a very strong and lucrative cash flow-generation profile. It is for these reasons that Peyto stock is one of the best stocks to buy right now.

Motley Fool: The bottom line

With the natural gas price rising as fast and as strong as it is, energy stocks are making a real comeback. The best stocks to buy right now have exposure to the soaring natural gas price. They’re also well run with a bright future.