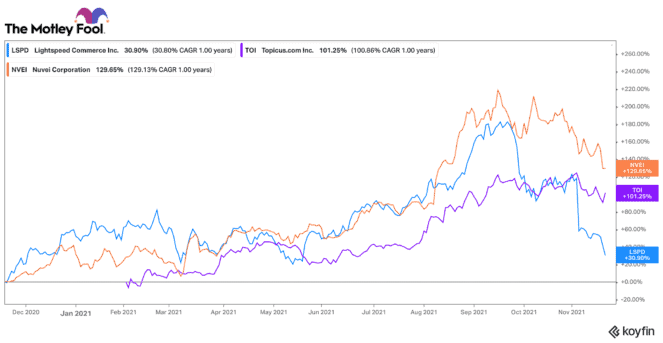

Lightspeed Commerce (TSX:LSPD)(NYSE:LSPD) stock had an incredible rise over the summer. From June to September, its stock rose 75%. The problem is, since the end of September, Lightspeed stock has basically given up all its gains, only a bit faster.

Why is Lightspeed stock down 54%?

So, what is the deal? Lightspeed’s stock crash started with a short report. The report indicated that Lightspeed was extremely overvalued, especially considering it may not approach profitability for years.

Lightspeed posted a heavy loss in its recent second quarter, and that further accelerated investor’s angst about the business. Finally, payments stocks generally have been facing negative sentiment due to some bad press, increased competition, and hard-to-beat comparable results from last year.

Why Lightspeed stock is not a buy today

Lightspeed continues to post some strong triple-digit revenue growth, but rising costs and supply chain challenges are pressuring margins. Profitability looks more difficult to achieve than even before. Given the negative stock momentum, I would continue to be cautious with Lightspeed. It may rebound if Lightspeed’s management can prove otherwise. However, until then, Lightspeed stock could still have downside.

Nuvei: Fast growing and profitable

One growth stock that has declined, but I would be interested to buy is Nuvei (TSX:NVEI)(NASDAQ:NVEI). Over the past month, it has declined almost 20%. Like Lightspeed, this stock is in the payments industry. However, it provides a platform for enabling transactions across currency (including crypto), payment method, and geographic market.

It just reported very strong quarterly results. Transaction volumes increased year over year by 88% to $21.6 billion. Revenues grew by 97%. Like Lightspeed, Nuvei is growing very fast. The difference is it is also scaling up profits the larger it gets. Year to date, Nuvei has produced $0.64 per in profits per share compared to a loss last year.

Likewise, since the start of the year, its adjusted EBITDA has grown 102% to $225 million. Its adjusted EBITDA margins continue to rise over 40%. Clearly, scale is making this business more profitable, not less. Given a strong platform, scalability, and a profitable business strategy, Nuvei stock looks more attractive than Lightspeed.

Topicus.com: Constellation Software’s playbook in Europe

Topicus.com (TSXV:TOI) is another growth stock that has seen some recent weakness. Before buying more Lightspeed stock, I would take a look at this business. Topicus.com stock is down 8% over the past month. This stock has become popular because of its relationship to one of Canada’s best tech stocks, Constellation Software. It was spun-off from Constellation early this year.

Topicus.com is replicating Constellation’s vertical market software consolidation strategy. However, it has a focus singularly in Europe. The company has performed well this year, but it is perhaps growing slower than some expected. Consequently, its stock has seen some weakness.

Yet, it has a great management team full of top capital allocators. Likewise, Topicus has a unique focus on organic growth that Constellation does not. Europe is not as exposed to the venture capital industry like in North America, so Topicus should have a competitive edge when it comes to acquiring growth.

Unlike Lightspeed, Topicus is also profitable. Its vertical software businesses generally produce a ton of consistent, recurring free cash flows that capture high profit margins. Consequently, if I was to buy a stock on weakness, my preference would be towards Topicus.com for a long-term growth stock hold.