The Tax-Free Savings Account (TFSA) has been an incredible tool for helping Canadians build wealth. There is no better way to compound investment returns than by paying no tax on gains, interest, or dividends. All your returns are yours, and you get to reinvest them with no bill from the Canada Revenue Agency (CRA).

For the past few years, the CRA has raised the TFSA contribution limit annually by $6,000. Today, a Canadian who was 18 years or older in 2009 can contribute a grand total of $75,500 to their TFSA.

The TFSA contribution increase should be announced soon

The CRA generally raises the TFSA contribution every year. We are getting to the time of the year where the CRA will announce its next contribution limit increase for 2022. The annual contribution increase is actually indexed to inflation and then rounded to the nearest $500. Considering that inflation has been rising rapidly in 2021, there may be a slight chance of the contribution limit increasing over the $6,000 in 2020.

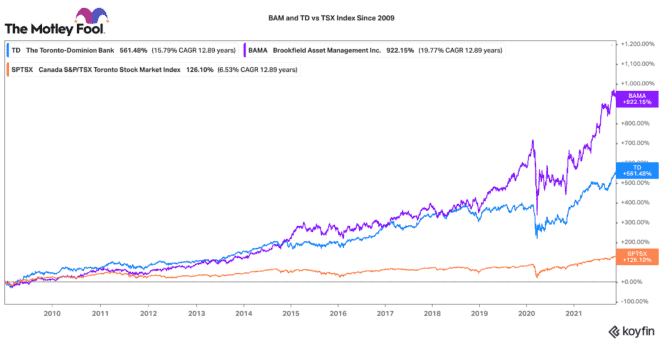

If you have some cash to contribute, now is a great time to plan how you want to invest it. Two stocks that look like a great fit for a TFSA are Brookfield Asset Management (TSX:BAM.A)(NYSE:BAM) and Toronto-Dominion Bank (TSX:TD)(NYSE:TD).

Brookfield Asset Management: An ideal TFSA growth stock

Brookfield has it all. As one of the world’s largest alternative asset managers, it provides investors a naturally diversified operational platform. It owns and operates assets like renewables, real estate, infrastructure, private equity, specialized debt solutions, and insurance. While it has publicly listed entities (which are industry leaders), it also manages funds for large pension funds and sovereign wealth funds.

Brookfield collects fees for managing these assets. It also gets an equity stake alongside its investors and then collects a carried interest when assets are monetized. The more money Brookfield manages (currently over $650 billion), the more opportunity it has to collect fees and carried interest over time. Some of its legacy funds are maturing, so it is starting to realize significant carried gains right now.

In a low interest rate environment, this TFSA stock should do very well. In fact, management hopes to double its distributable earnings and intrinsic value in five years or less. For a solid way to double your money in half a decade, this is a great stock to own.

TD Bank: A solid choice for total returns

Toronto-Dominion Bank may not be a flashy, exciting stock. However, it has a long history of delivering solid total returns for investors. Had you bought TD when the TFSA was created in 2009, you’d be sitting on a nice 563% return. That is a compounded annual return of nearly 16%. That certainly beats the S&P/TSX Composite Index’s annual return of 6.5% over that time frame.

TD has built a great banking franchise across Canada and the United States. Its diverse offerings for customers make it a great “one-stop-shop” bank. TD operated very prudently through the pandemic, and today it has ample capital to invest and reward shareholders.

Now that Canadian regulators have released pandemic-related capital restrictions, TD should soon announce some substantial share buybacks and perhaps even a dividend hike. Today, it pays a 3.4% dividend. TD has a long history of raising its dividend every year. It is a great income stock to buy and hold in your TFSA for a very long time