The Canada Revenue Agency (CRA) just announced an exciting new change to the Tax-Free Savings Account (TFSA). The TFSA contribution limit has once again been raised by $6,000 for next year. That means if you were 18 years old or more in 2009, you can contribute a grand cumulated total of $81,500 to your TFSA!

Pay no tax on a $6,000 investment in 2022

Why does this matter to you? Well, every opportunity a Canadian has to increase their TFSA contribution should be a reason to celebrate. There is no other federally regulated account where investors can contribute, invest, and pay no tax!

In the TFSA, you can invest in everything from GICs to bonds to mutual funds/indexes to individual stocks. The great part is that any interest, dividend, or capital gain earned is safe from the CRA. In fact, with the TFSA, you don’t even need to report income to the CRA either. So, investing through the TFSA also helps streamline your tax season.

The TFSA is the best way to compound wealth

The best part about the TFSA is that investors can truly compound their wealth. By not paying any tax on investment returns, you are in essence saving 10-30% (depending on your income bracket) of your gains. Over a lifetime, that can be worth a fortune! If you want to build long-term wealth, maximize your TFSA contributions and let that capital compound through investing.

If you are looking for ways to invest the recent $6,000 increase, two conservative stock ideas for a TFSA portfolio are Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP) and Royal Bank of Canada (TSX:RY)(NYSE:RY).

A top TFSA stock for total returns

Brookfield Infrastructure is a great way to get global exposure to high-quality infrastructure assets. BIP owns a portfolio of ports, railroads, pipelines, power poles, cell towers, and data centres. This is a great TFSA stock to own during a time of inflation. Over 70% of its assets have inflation-indexed contracts. Likewise, when the economy is heating up, it also gets the benefit of higher volume utilization through its assets as well.

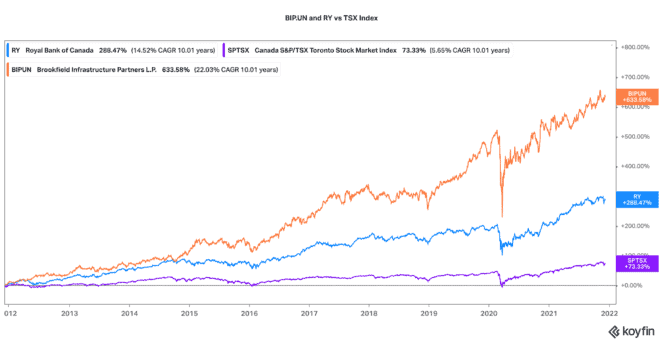

BIP has a strong history of total returns. Over the past 10 years, it has delivered a 650% return. 40% of that return came from dividend distributions. BIP has a strong history of growing its dividend annually in the high-single-digit range. The stock has recently pulled back, and it looks attractive with a 3.6% dividend today.

A dividend stalwart

Canadian banks have likewise been a stable TFSA investment for years and years. Given their strong governance and solid financial structure, they should continue to be good investments going forward. As the largest Canadian bank, Royal Bank of Canada is a good stalwart to own.

Sure, it is not a flashy high-growth technology stock. Yet, it has a dominant retail presence in Canada and a very strong capital markets business. It has steadily produced a 14.5% compounded annual growth rate of returns for the past decade. It has vastly beat the S&P/TSX Composite Index for years.

RBC just raised its quarterly dividend by 11% last week. That puts its forward dividend yield at 3.7%. Likewise, this TFSA stock just authorized the buyback of 3% of its outstanding shares. Combine all this, and this bank should continue to deliver attractive market-leading returns for years to come.