Diversification can mitigate many sources of risk, such as the risk from investing only in a single stock, only in a single sector, or only in a single country. What it cannot mitigate is market risk — the degree that your portfolio is affected by how the broader market moves. No matter how high quality your stock picks are, or how many stocks your index exchange-traded fund (ETF) holds, a bear market will usually lead your portfolio to incur some losses.

The perfect stock for the role

When it comes to mitigating the risk of a market correction, we need to look for assets that have a slightly negative correlation with our stock portfolio. That is, when our stocks zig, they zag. This is called a hedge. We’re hoping that it goes up slightly over time so as to not lose value, but, more importantly, it should function as a parachute in times of crisis. When the market tanks, we want it to go up in value, so we can sell it at a profit and use the proceeds to rebalance into our stock position at a low price.

Barrick Gold (TSX:ABX)(NYSE:GOLD) is our best candidate here. As Canada’s leading gold miner, it operates 16 sites across 13 countries, with over 71 million ounces of proven and probable reserves. Although subject to fluctuations in the spot gold price, the company has very healthy fundamentals, having met or beaten market consensus on its financial and operating results for 11 consecutive quarters as of Q3 2021.

Barrick Gold current boasts an operating margin of 41.70%, profit margin of 16.60%, ROA of 4.20%, ROE of 8.40%, and ROI of 13.70 — impressive financial ratios for its sector. With an outstanding current ratio of four and long-term debt-to-equity ratio of 0.22, the company’s balance sheet is healthy and sustainable compared to its peers.

Why it’s a great hedge

Beyond its solid fundamentals, Barrick Gold performs extraordinarily well as a hedge during times of crisis owing to its low to sometimes negative correlation with the broader stock market. Currently, Barrick Gold has a beta of -0.09, which implies a low magnitude, inverse relationship with how the market moves. In other words, it has the possibility of outperforming when the market underperforms.

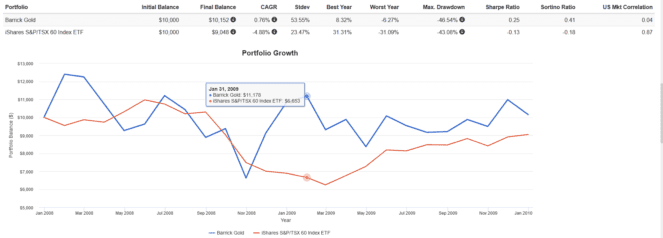

For a thought exercise, Iet’s see how Barrick Gold performed during times of crisis versus iShares S&P/TSX 60 Index ETF (TSX:XIU), by examining their performance during two major market corrections on Portfolio Visualizer.

During the 2008 Great Financial Crisis, the “flight-to-safety” phenomenon, where investors shed risky assets caused in-demand, “safe” assets like gold and U.S. Treasuries to spike. We see here that during the crash, Barrick Gold shot up sharply — inverse of the index.

Once again, the same held true during the 2020 COVID-19 crash. Barrick Gold rose sharply, while the broad index took a tumble. It was one of the few stocks in the Canadian market to not end up in the red during the initial downturn.

The Foolish takeaway

The low negative beta of Barrick Gold stock, coupled with its uncorrelation with U.S. markets and the “flight-to-safety” phenomenon make it an excellent choice for hedging against a market correction. Because the company has excellent fundamentals and a profitable business, its stock could be a good alternative to gold bullion or gold ETFs in a portfolio. Investors should consider allocating a small portion of their portfolios to it.

During a correction, the rise in share price can be sold at a profit and used to tactically re-balance into other equities when they are low. Holding this stock over the long term may also smooth out your returns by reducing portfolio volatility. However, it is important to size your position and portfolio allocation carefully. Too much could reduce overall returns, as the stock tends to underperform the broad index on a risk-adjusted basis.