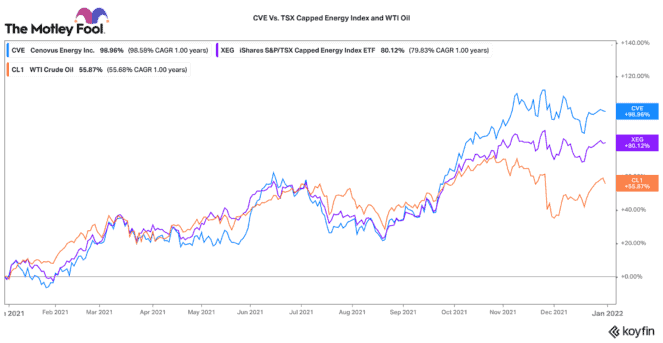

Canadian energy stocks enjoyed a massive recovery in 2021. Cenovus Energy (TSX:CVE)(NYSE:CVE) was no exception. Since January 2021, Cenovus soared from $7.75 per share to $15.50 at the end of December. That was a massive increase of 100% in the year. Since the collapse of oil in March 2020, this stock is up 545%!

This year, Cenovus outperformed the TSX Index by 79 percentage points. It beat the S&P/TSX Capped Energy Index by 20 percentage points. So, all around, it has been an excellent year for the stock and the company.

Cenovus: An integrated energy leader in Canada

Cenovus is amongst the top three integrated energy producers in Canada. The company operates conventional oil plays, huge oil sands projects, offshore production assets, an upgrading and refining business, and a broad array of energy infrastructure assets. In total, it produces around 800,000 barrels of oil equivalent (BOE) per day. It processes and refines about 500,000 barrels per day.

Why is Cenovus up 100% in 2021?

So, what made Cenovus such an exceptional stock in 2021? Well, the stock was incredibly beaten down in 2020. At the start of the year, the stock only had a market capitalization of $9 billion. Canadian energy stocks were essentially left for dead in 2020, when oil prices briefly turned negative. News of the vaccine approvals and the gradual recovery from lockdowns helped propel West Texas Intermediate oil from US$47 per barrel to around US$75 today.

In a year, Cenovus went from earning modest netbacks to yielding massive amounts of free cash flow. Today, even at current prices, Cenovus stock is yielding over 15% in free cash flow.

What’s next for this business?

Should oil prices remain around the US$70 level or better, Cenovus should be in a very attractive position. After its massive $23.6 billion acquisition of Husky Energy, the company has been selling off non-core assets and de-levering its balance sheet. By year end, Cenovus should reach its net debt target of $10 billion or less.

It further targets to reduce net debt to less than $8 billion by mid-year 2022. As it integrates the Husky assets and unlocks operational synergies, the company is primed for steady 4-6% production growth and strong free cash flow accretion.

Considering this strong position, management recently doubled its next quarterly dividend to $0.035 per share. While that is only equivalent to an approximate 1% dividend yield today, analysts believe that its quarterly dividend could rise by three or four times in the future.

Cenovus bought back 9.7 million shares in 2021. That is equivalent to $153 million! With debt declining fast, Cenovus plans to buy back 15 times that amount in 2022 (around 146 million shares). That would essentially reduce its share count by over 7%!

The Foolish bottom line

All in all, Cenovus has been doing all the right things. The company looks well positioned to continue to perform well in 2022. Yet, with a price-to-earnings ratio of only 6.5, Cenovus stock still trades at a discount to its larger peers like Canadian Natural Resources and Suncor. If energy fundamentals remain strong in 2022, this stock could still be set for another high double-digit year of upside.