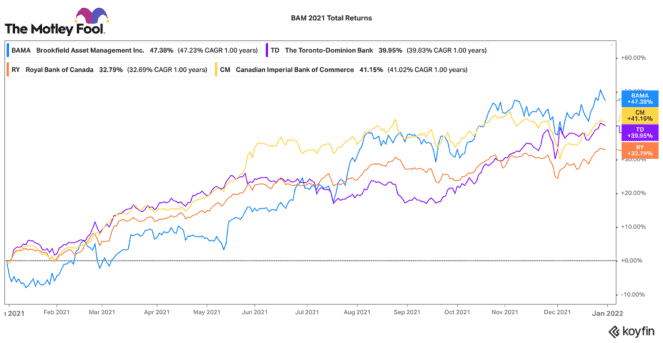

2021 was a great year for Canadian financial stocks, especially for Brookfield Asset Management (TSX:BAM.A)(NYSE:BAM). While Canada’s top banks (like Royal Bank of Canada and Toronto-Dominion Bank) delivered around 33% total returns in 2021, Brookfield produced a 47% total return.

Brookfield has outperformed Canadian banks for years

Frankly, that should not be much of a surprise. Brookfield has outperformed Canada’s top banks consistently for years. Over the past five years, Brookfield has produced a 22.7% compounded annual growth rate (CAGR). That is nearly double Royal Bank’s 12.4% CAGR over the same time frame.

While Brookfield is considered a financial stock, it is a totally different beast from the Canadian banks. Brookfield is one of the largest asset managers in the world. It has $650 billion of assets under management. Today, with a price of $76 per share, it has a market capitalization of $120 billion.

A pioneer asset manager

Brookfield has been a major pioneer in the asset management industry. Rather than investing in traditional stocks or bonds, it has focused on real and specialized alternative assets. Today, its publicly traded businesses and private investment funds are focused on real estate, renewables, infrastructure, private equity, distressed debt, insurance, and transition investing.

As interest rates have declined over the past decade, real asset values have climbed. Likewise, investment demand for higher-yielding alternative assets has skyrocketed. Both retail and institutional investors who own bond-heavy portfolios are losing money after inflation right now. On the inverse, BAM provides both publicly listed entities and alternative funds that provide relatively low-risk, high-yielding returns.

Brookfield is a smart value investor

This has been one major reason for Brookfield’s strong market-beating stock performance. However, I don’t want undermine Brookfield’s top management team, which is led by CEO Bruce Flatt. Brookfield is very disciplined with capital allocation. For years, it has taken a value-focused, counter-cyclical investing approach.

During good times, it recycles assets for significant profits. It waits patiently for economic declines and deploys its balance sheet when assets are depressed and dirt cheap. The great thing is that today, the company has expertise and scale across the globe. Consequently, it can invest opportunistically whenever there is attractive value (there is always an opportunity somewhere).

Record-breaking growth in 2021

In 2021, Brookfield has enjoyed record-breaking fundraising ($34 billion in its most recent quarter). Fortunately, as Brookfield gets larger, it also has more opportunities to sell and cross-sell diversified products to investors. It can do this at very little additional cost, so its margins are set to rise as well.

This trend is creating very strong financial results. For the past 12 months, Brookfield grew funds from operation per share by 84% to $4.97. Its distributable earnings increased 95% to $6.6 billion or $4.23 per share. For the past five years, it has grown distributable earnings per share by a 32% CAGR!

The Foolish takeaway

All in all, Brookfield is far more than just a boring financial stock. It is a diversified investment platform that gets more profitable the more it scales. While interest rates are expected to rise soon, Brookfield has a history of outperforming when interest rates are moderate (3-5% range). This top Canadian stock is up 45% this year, but its primed to continue beating the TSX Index for many years to come. It is a top Canadian stock pick for 2022 and beyond.