Did you know that the Canadian stock market only comprises 3% of the world’s total stock market by market cap weight? I’m guessing that you probably didn’t, seeing as most Canadians maintain a significant home-country bias in their portfolios. By that, I mean overweighting their allocation to Canadian stocks.

While a small to moderate Canadian home-country bias has been shown to reduce volatility and currency risk, too much can subject your portfolio to other sources of risk — namely, concentration risk. The Canadian market is heavily dependent on a select few energy and financial stocks, which can drag your entire portfolio down if they do poorly.

The goal here is to diversify globally by buying stocks from all across the world. Thankfully, with the advent of exchange-traded funds (ETFs), you don’t have to spend a tonne of money or do too much research to accomplish this. Let’s take a look at my top two picks from Vanguard and BlackRock.

Vanguard FTSE Global All Cap Ex Canada Index ETF

Vanguard FTSE Global All Cap Ex Canada Index ETF (TSX:VXC) is a great one-ticket solution to owning the global stock market. As its name would imply, Canadian stocks are excluded here. This allows you to pick and choose your Canadian allocation using another ETF or a hand-picked selection of individual stocks.

VXC contains a total of 11,251 stocks of all market caps (mostly large caps), split between the following geographies: North America (excluding Canada) at 61.40%, Europe at 16.80%, Pacific at 11.30%, Emerging Markets at 10.30%, and the Middle East at 0.20%. For a 0.21% management expense ratio (MER), you get some great diversification.

Keep in mind that holding VXC will also incur a 15% foreign withholding tax on the dividends paid out, as they are non-Canadian distributions. The current yield of 1.36% already reflects this tax, but it does cause a small drag on performance as an additional hidden fee of sorts.

BlackRock iShares MSCI All Country World Ex Canada Index ETF

BlackRock iShares MSCI All Country World Ex Canada Index ETF (TSX:XAW) differs from VXC in that it tracks a different index — MSCI vs. FTSE. For investors, this difference is likely to be inconsequential, and I wouldn’t lose much sleep over it. Like VXC, XAW excludes Canadian stocks, making it a good alternative for world equity exposure.

XAW contains a total of 9,440 stocks from all market caps (once again, biased towards large caps) split among the same geographies as VXC. Small differences in the exact percentage weights exist but are unlikely to affect performance. The fund currently has a MER of 0.22%, or a measly single basis point higher than VXC.

Like VXC, holding XAW also incurs a 15% foreign withholding tax on the non-Canadian distributions paid out. Once again, the current yield of 1.78% already reflects this deduction, so it’s not much to worry about, unless your account is very large.

Head to head

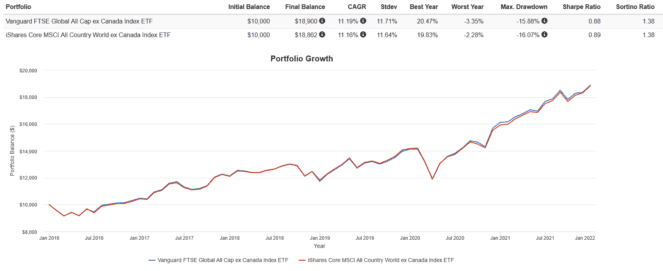

Below you can see the performance of both funds since 2016 (the earliest inception date of XAW).

As expected, they are very close, with nearly identical CAGR, volatility, drawdowns, and Sharpe ratios. Discrepancies that arise as a result of tracking error, fund turnover, sampling methodology, and currency fluctuations should even out over time.

Really, deciding between them can boil down to a coin flip. Personally, I like Vanguard better due to its history of investor advocacy and lowering fees.

The Foolish takeaway

The smart Canadian investor holds a globally diversified stock portfolio consisting of a Canadian equity fund and a all-world ex-Canada fund. Doing so reduces country-specific risk, volatility, and boosts long-term gains.

The performance of various stock markets around the world is cyclical, with countries taking turns outperforming and then falling behind. Hence, investing globally is the best idea out there, and buying and holding VXC or XAW will help you execute that.