Exchange-traded funds (ETFs) are great for expressing a thematic investment strategy. They can be an active bet on which market sectors are likely to outperform, such as tech, energy, banking, or even marijuana!

A lesser-known sector tilt is towards the global water industry. As the most important commodity in our lives, water has several characteristics that make it desirable as an investment — it is scarce with a finite supply, it can be owned and controlled by private parties, and it can be sold.

Now, I’m not encouraging you to go out and fill a storage locker with bottles of water. There’s a better, easier way to invest in this precious commodity: iShares Global Water Index ETF (TSX:CWW).

The best ETF for Canadian water investors

CWW gives Canadian investors easy, one-stop-shop exposure to 50 water industry stocks from developed markets around the world. It seeks to replicate the performance of the S&P Global Water Index, net of fees.

These stocks include water utilities, infrastructure, materials, and equipment companies. Around 51% of the stocks held are from the U.S., while 15% are from the U.K., and 9% are from France. Companies in Switzerland, China, Japan, Italy, Canada, the Netherlands, and Australia are included, too.

CWW currently has assets under management (AUM) of $358 million, which is sufficient for liquidity and trading purposes. The fund will cost you a management expense ratio (MER) of 0.66% a year to hold, which is expensive compared to index funds, but not so much for a thematic fund. CWW also has a 12-month trailing distribution yield of 3.05%.

How does it perform?

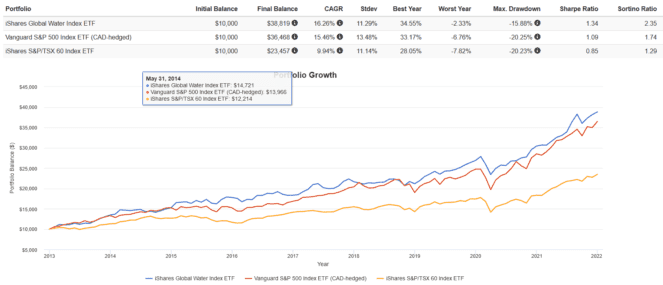

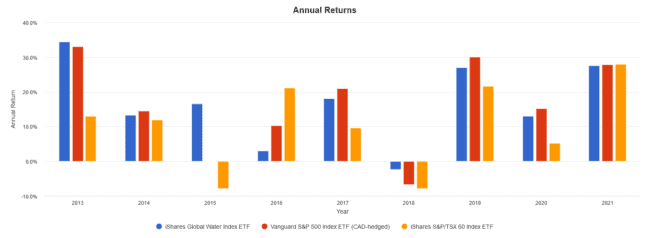

A word of caution: the backtest results provide below are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Hypothetical returns do not reflect trading costs, transaction fees, or actual taxes due on investment returns.

That being said, from 2013 to present, CWW has significantly outperformed both the S&P/TSX 60 Index and the S&P 500 Index, with a higher CAGR, lower volatility, smaller drawdowns, and a better Sharpe ratio.

The Foolish takeaway

If you have a strong investment thesis around the global water industry, CWW may be a good way to express that view. By buying CWW, you’re making a bet that the water sector will outperform the broad market. While this could occur during some market cycles, you should also be ready for periods of underperformance and high volatility.

With just 50 holdings all concentrated in one sector, CWW isn’t diversified at all, and could expose you to more risk than an index fund would. That being said, with more risk usually comes more return. If you are bullish on water and have a long-term perspective, then CWW could be an excellent ETF to buy and hold.