Canadians love dividend stocks, and I totally understand why. Our stock market is filled with great banking, insurance, energy, utilities, and telecom stocks that have offered high yields, a long history of consistent payouts, and ever-increasing dividend payments.

That being said, managing a portfolio of 15-30 dividend stocks can be tiring and tedious. Manually rebalancing them, reinvesting dividends, and keeping up with each company’s news can be daunting to prospective investors.

The good news is that various fund providers such as BlackRock have exchange-traded funds (ETFs) that do all the hard work for you. These ETFs hold a basket of dividend stocks according to their criteria. By purchasing a share of these ETFs, you own a slice of that basket.

Let’s put my two favourite Canadian dividend ETFs head to head and see which one is the better buy in 2022.

The contenders

I’ll be pitting iShares S&P/TSX Composite High Dividend Index ETF (TSX:XEI) against iShares S&P/TSX Canadian Dividend Aristocrats Index ETF (TSX:CDZ). Both ETFs are very popular and offer exposure to a portfolio of Canadian dividend-paying companies. However, their construction differs a little.

Let’s look at XEI first. This ETF seeks long-term capital growth by replicating the performance of the S&P/TSX Composite High Dividend Index, net of expenses. The focus here is on high monthly dividend income. XEI holds a portfolio of 76 underlying companies selected for high yield by their market cap weight.

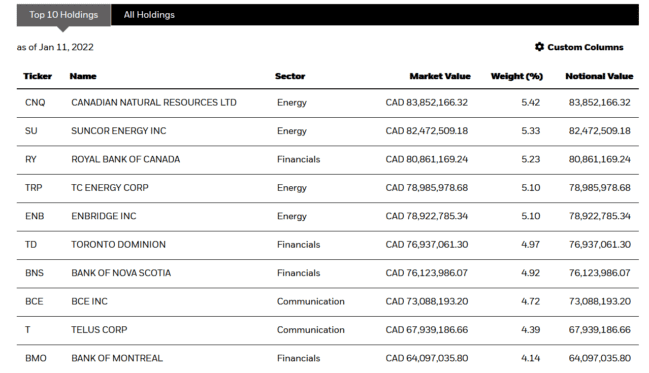

Here are XEI’s top 10 holdings:

However, CDZ opts for different criteria, seeking to replicate the S&P/TSX Canadian Dividend Aristocrats Index, less fees and expenses. What this means is that CDZ only holds 86 large-cap Canadian stocks that have increased ordinary cash dividends every year for at least five consecutive years.

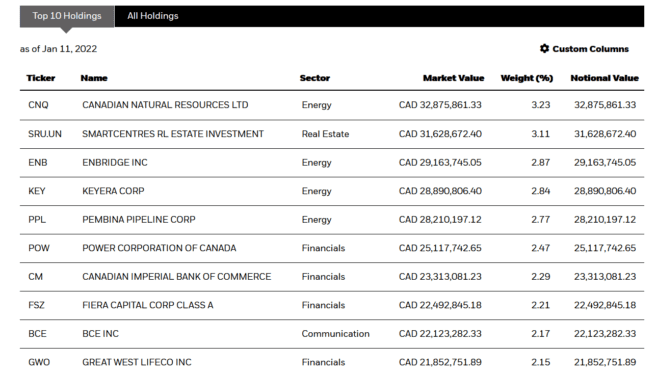

Here are CDZ’s top 10 holdings:

What the numbers say

When you choose a dividend ETF, you should examine two things: the distribution yield and the management expense ratio (MER). Aside from the quality of the underlying holdings (a non-issue with these two funds), these factors represent sources of risk and drag you can control.

When it comes to yield, XEI has CDZ beat, with 3.70% vs. 3.15%. Of course, overall capital appreciation with dividends reinvested is the bigger picture, so we need to revisit this later once we look at their total return.

When it comes to MER, XEI again beats CDZ, with 0.22% vs 0.66%. CDZ’s MER is three times higher than XEI! While this might not seem like a lot, over time, the higher fees can compound significantly to reduce your gains.

How have they performed?

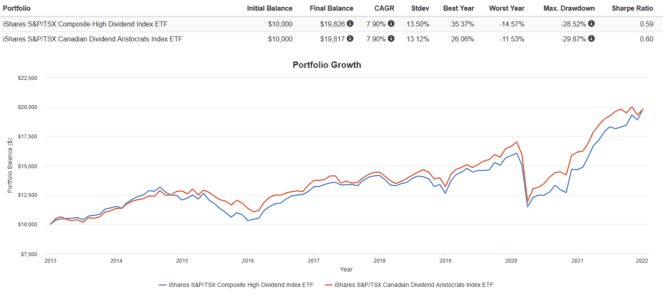

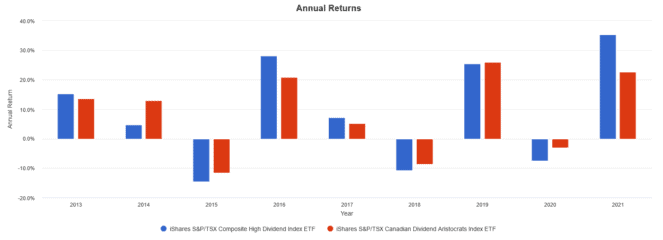

A word of caution: the backtest results provide below are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Hypothetical returns do not reflect trading costs, transaction fees, or actual taxes due on investment returns.

From 2013 to present, with all dividends reinvested, both funds were essentially neck and neck, with very similar returns, risk, and drawdowns. CDZ pulled ahead slightly in the recent years, likely due to the recent dividend increases announced by its underlying stocks.

The Foolish takeaway

You can’t go wrong with buying and holding either ETF. Both hold a stable, well-managed, and profitable portfolio of 70-90 Canadian dividend stocks. Since 2013, both ETFS have displayed about the exact same performance, with a similar risk-to-return profile.

It comes down to what you prefer for a dividend-growth portfolio — high current yields or consistent dividend increases? Personally, if I had to pick one, I would go with XEI, solely due to its lower MER and higher assets under management (AUM). Over time, I expect these attributes to help it pull ahead of CDZ.

Regardless, BlackRock has done an excellent job with both ETFs. Canadian dividend investors should seriously consider making either of these the core of their portfolios.