2022 has come with many big changes. Energy stocks are strong, tech stocks are weaker, and value stocks may finally be beginning to make a comeback. So, what does that mean for Motley Fool investors? Well, the recent stock market changes have resulted in some real bargains to be had. After all, value stocks have always looked good.

Without further ado, here are three value stocks to start 2022 on a richer and happier note.

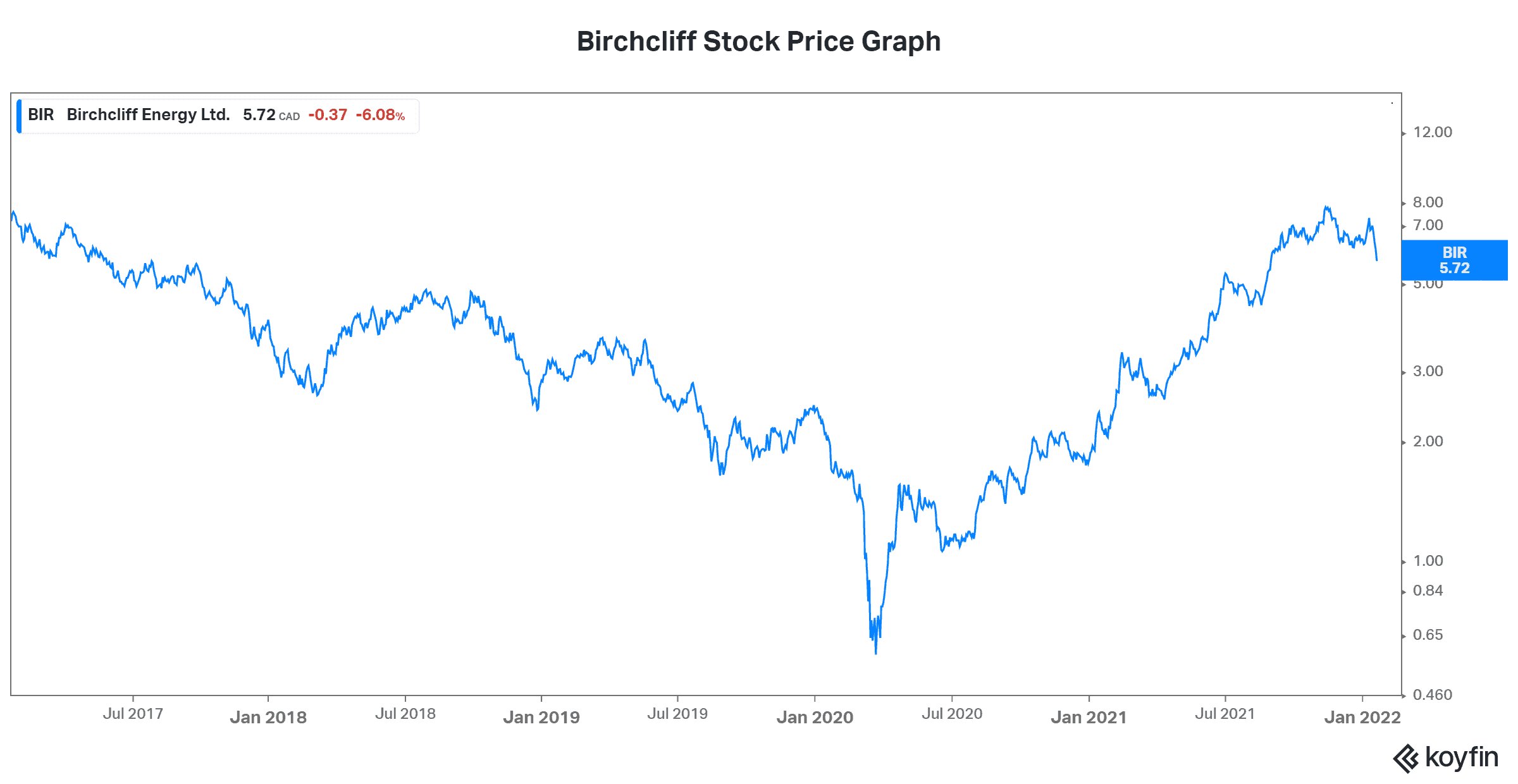

Value stock #1: Birchcliff Energy stock

Natural gas prices have been exploding in the last few months. This has been a symptom of a the great supply/demand imbalance. Persistent underinvestment in the industry hit supply. Then the reopening of the economy as the pandemic eased caused a surge in demand. As a result, natural gas prices have been soaring.

Energy stocks like Birchcliff Energy (TSX:BIR) have been undervalued for some time now. Birchcliff Energy is a natural gas producer based in prolific basins in Western Canada. Its production is heavily weighted toward natural gas at an almost 80% weighting. This leaves Birchcliff with significant exposure to these rapidly rising natural gas prices.

In 2022, I believe these stocks will go from being dead money to be the best value stocks out there. I mean, natural gas stocks like Birchcliff are awash in cash. They’re paying off debt more rapidly than we can blink. And they’re returning cash to shareholders. One analyst at CIBC even said that Birchcliff’s “dividend could grow six-fold by 2023.” That’s a big increase. Yet Birchcliff stock is a value stock that’s trading at very depressed multiples — something that I believe will be rectified soon.

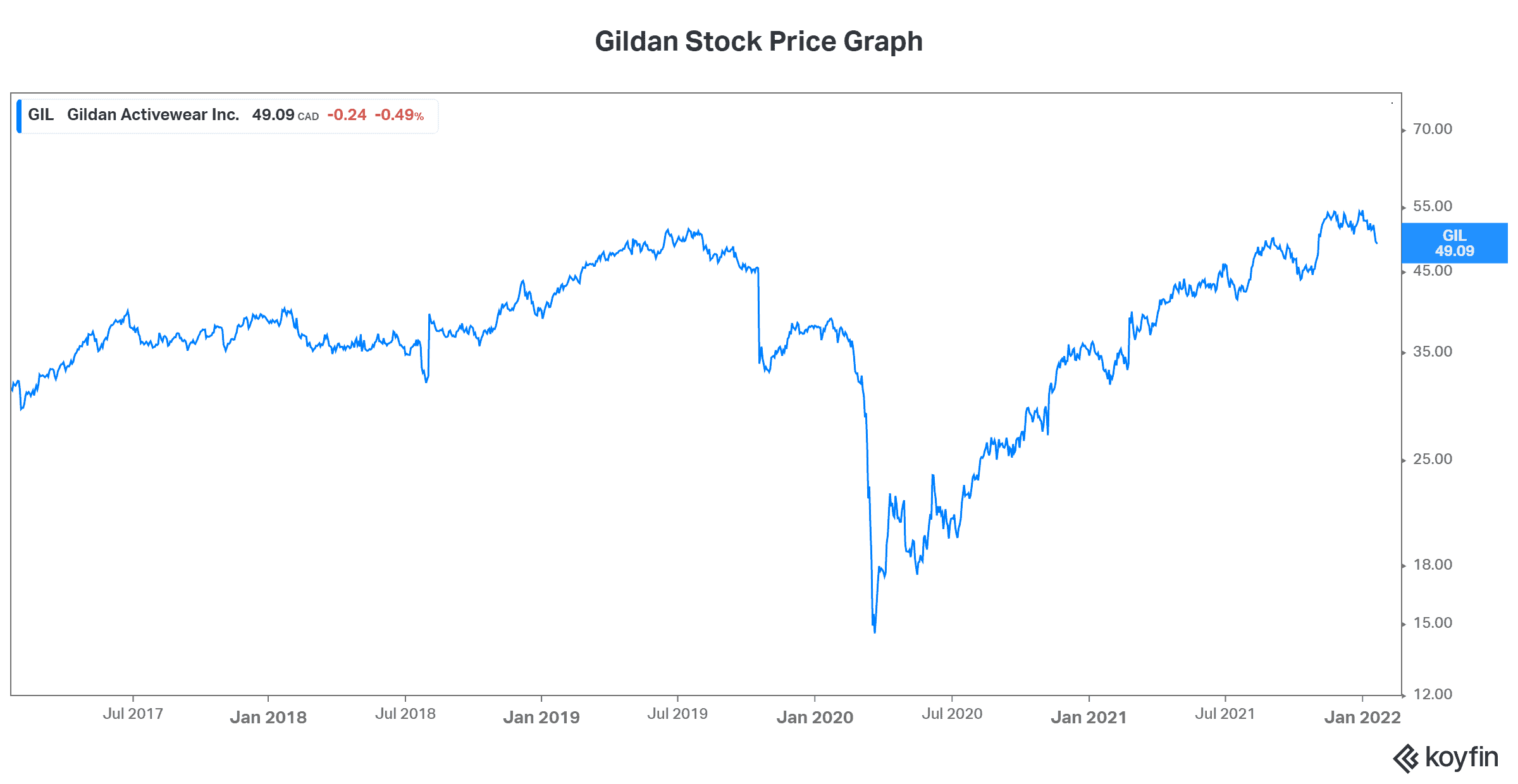

Value stock #2: Gildan Activewear stock

Gildan Activewear (TSX:GIL)(NYSE:GIL) is a vertically integrated manufacturer of everyday apparel, selling products under a variety of well-known brands. This inexpensive and essential list of apparel products has proven to be quite defensive over the years. Gildan’s business is a high-margin one, and the company has been performing above expectations for some time now.

So, why is Gildan stock so undervalued? I mean, the stock price continues it impressive run! Yet it can’t catch up to fundamentals. Simply put, earnings and cash flow growth are skyrocketing. In 2022, Gildan stock’s low valuation, I believe, will be rectified by the market. That means that I would expect solid returns for this undervalued stock. A company that’s generating healthy earnings growth and profitability will not remain valued at a 15 times earnings multiple for long.

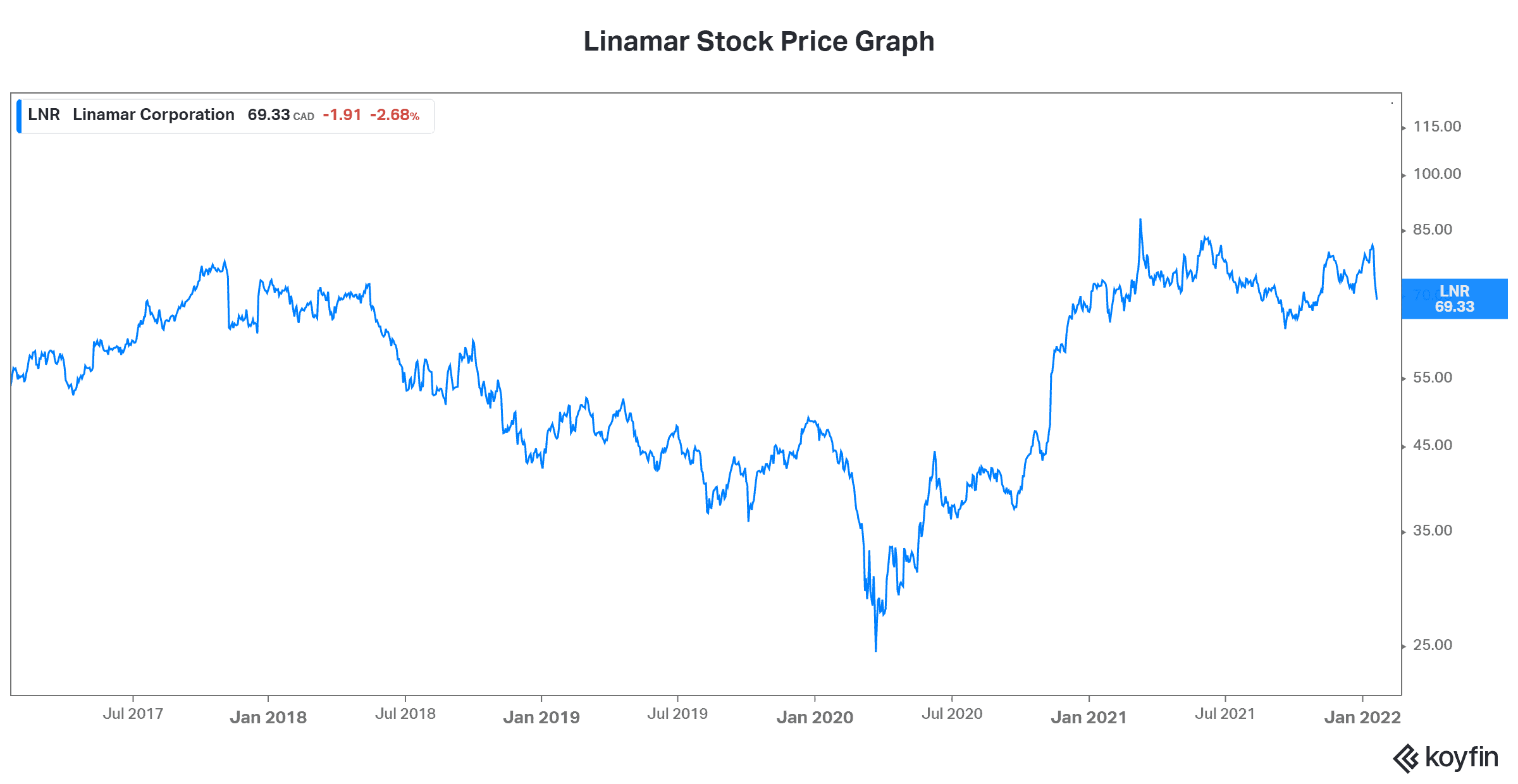

Value stock #3: Linamar stock

Linamar (TSX:LNR) is a Canadian-based auto parts company that’s also highly undervalued. It’s also a very well-run company that has been at the forefront of operational best practices for decades. So, why is it trading at a mere nine times earnings? Well, the auto industry has been having some real supply chain issues, so from that perspective, Linamar stock’s low valuation is understandable. But make no mistake, these supply chain issues are short-term problems. Many industry watchers expect them to be worked through as the year progresses.

As an auto supplier, Linamar is aware of how vulnerable it is. Uncomfortable with its dependence on the auto industry and the auto cycle, Linamar has made efforts to diversify. This is how its industrial segment was born. This segment manufactures equipment for the construction and agriculture industries. It certainly provides a nice area of diversification away from the auto industry.

Today, Linamar’s undervalued stock status is an opportunity for investors. This high-quality company won’t remain depressed for long. It has operational excellence and vision on its side.

Motley Fool: The bottom line

The three value stocks discussed in this Motley Fool article are screaming value buys, in my view. They’re all high-quality companies that are doing to right things, even when their operating environment is challenging. I think that buying these value stocks will help you grow your wealth in 2022 and be richer and happier as a result.