2022 has been marked by significant volatility already. If you are worried, why not take shelter in some safe, reliable passive income stocks? TSX stocks that pay reliable and hopefully growing streams of dividends are perfect in this type of environment.

Passive income is perfect in a volatile stock market

Firstly, a passive income stock that consistently raises its dividend is a great hedge against inflation. While GDP rises, so too does your income stream. In essence, a dividend-growth stock is a perfect way to offset the loss of buying power from inflation.

Secondly, owning passive income stocks ensures you capture a tangible return when the market is dipping. Despite a market correction, high-quality passive income stocks keep paying out dividends and distributions. Some exposure to dividend stocks is a great way to offset volatility in your portfolio.

Hence, passive income stocks are a great anchor for any Canadian’s portfolio. Just buy them, tuck them away, and enjoy the reliable income for years and years. Fortunately, Canada is full of great dividend-paying companies. Here are three that you can buy now, tuck away, and easily hold for forever.

Brookfield Infrastructure: A top dividend-growth stock

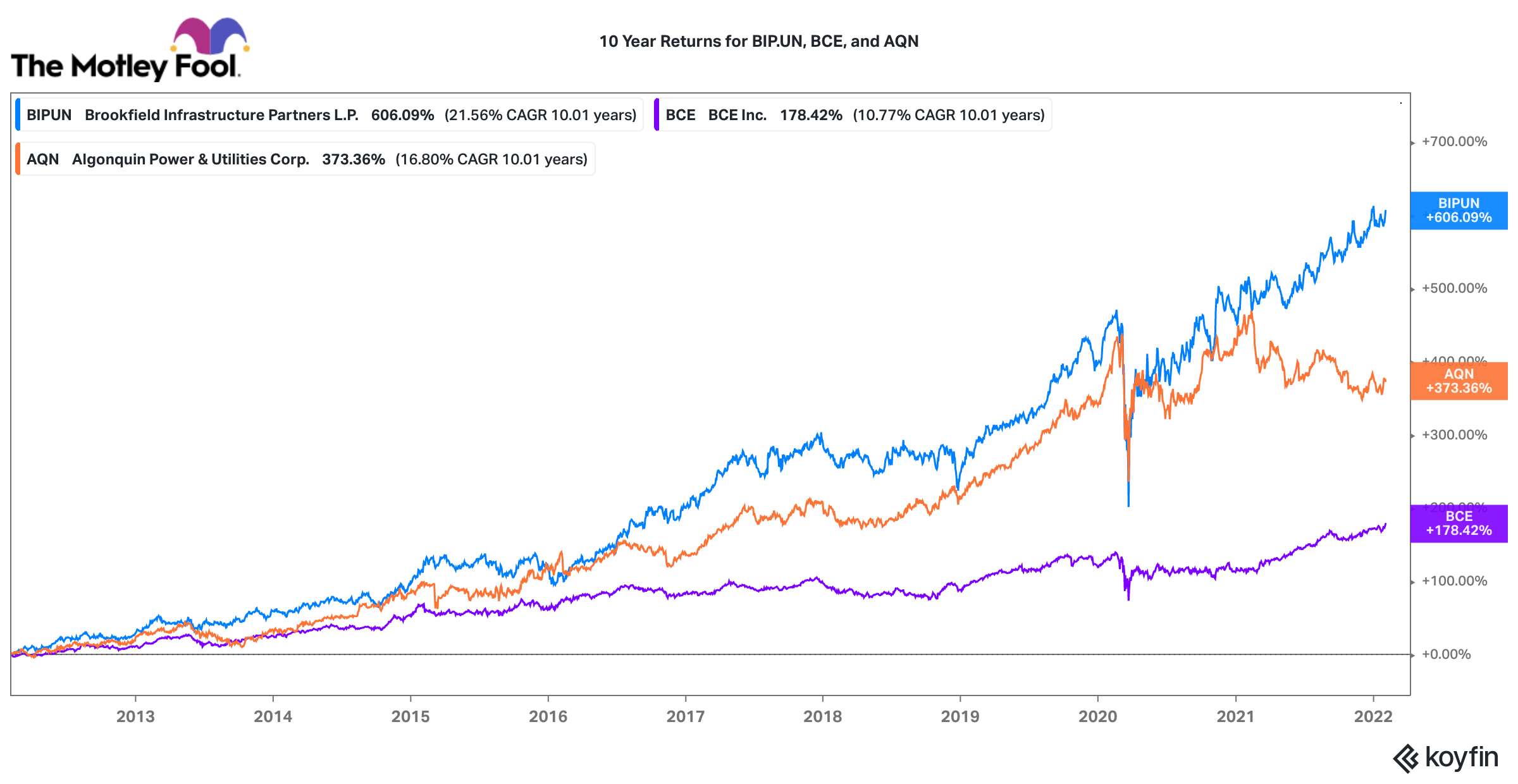

Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP) is just about as good as it gets when it comes to passive income. In fact, in terms of total returns it has been an exceptional performer. Over the past 10 years, it has delivered a 604% total return to patient shareholders. Of that total return, 265% was actually derived from Brookfield’s rising stream of dividends.

Brookfield Infrastructure operates a diverse array of crucial infrastructure assets (like ports, railroads, gas processing plants, power infrastructure, and data centres). Over 70% of its revenue base is inflation-indexed, so when costs rise, its revenues do as well.

It just produced a very strong fourth-quarter and year-end result and raised its dividend 6%. Today, this passive income stock pays a solid 3.5% dividend.

BCE: A reliable passive income giant

BCE (TSX:BCE)(NYSE:BCE) is Canada’s largest telecom stock with a market capitalization over $61 billion. Its returns have significantly lagged Brookfield Infrastructures. Over the past 10 years, it has only delivered a 178% total return. However, if you are only interested in low-risk passive income, this is a great stock to own.

Cellular coverage and internet are as vital as water, natural gas, and electricity in today’s modern world. Consequently, BCE consistently captures very predictable streams of cash that support its attractive 5.3% dividend.

BCE is primed to benefit from the recovery out of the pandemic and also from the roll-out of the 5G spectrum across Canada. It has a long history of raising its dividend. In its recent fourth-quarter results yesterday, BCE raised its quarterly dividend by 5%.

Algonquin Power: A diversified, safe utility for dividend growth

If you are looking for an undervalued passive income stock, Algonquin Power (TSX:AQN)(NYSE:AQN) is an interesting long-term bet. Its stock is down nearly 18% over the past year. In fact, the stock is trading at its highest free cash flow yield and dividend yield since the middle of 2019.

Algonquin operates a diverse water, natural gas, and electric utility platform across North America. It generally acquires under-utilized utilities, reworks their operational model, and then reaps higher rates of return going forward. It also owns a rapidly growing renewable power portfolio that spans across Canada, the U.S., and Europe.

The company has cash flow reliability from its utilities and earnings upside from its renewable power pipeline. Consequently, this is a great long-term play on a greener energy future. Today, this stock pays an attractive 4.7% dividend. Management expects to grow that dividend by 7%-9% annually.