The recent stock market dip has made some great buying opportunities for Tax-Free Savings Account (TFSA) investors. It is rare that top-quality stocks pull back and become cheap. When they do, it is a great time to bulk up on the best.

TFSAs are the best accounts for compounding

The TFSA is an ideal account to compound investment wealth, because there is zero tax obligation. Any dividend, interest income, or capital gain earned stays with you and compounds upon itself (as long as you don’t withdraw). If you are 18 years or older, you can contribute to a TFSA. The sooner you start, the faster your wealth can snowball.

Consequently, it is a great place to put quality stocks that predictably and reliably go up over long periods of time. If you are looking to improve the quality of your TFSA portfolio, here are three relatively cheap quality stocks to buy today and never sell.

Brookfield Asset Management: A TFSA anchor

Brookfield Asset Management (TSX:BAM.A)(NYSE:BAM) is a great anchor stock for any TFSA portfolio. The company has an extremely high-quality platform managing alternative assets like real estate, infrastructure, renewable power, private equity, specialty debt, and insurance. Consequently, in and of itself, investors get to own a diversified business platform.

I like Brookfield because it is a counter-cyclical business. When markets/economies are weak, it utilizes its excess capital to buy bargain cheap assets. When the market is peaking, it sells assets at considerable profits and then holds the cash for the next downturn.

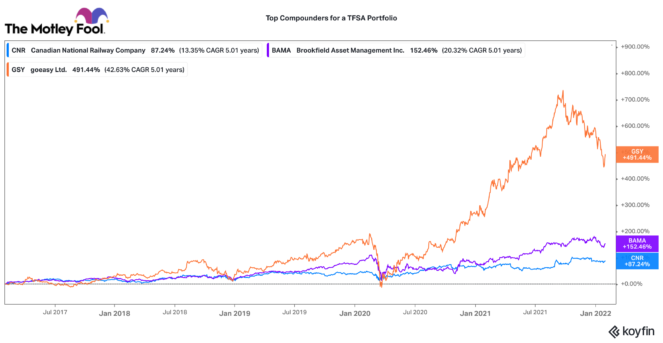

Its high-quality, high-yielding investment platform has attracted a lot of investment institutions who can’t meet yield targets by owning bonds. This has helped drive compounded annual distributable earnings-per-share growth of 32% over the past five years. This stock has recently pulled back 8%, so the recent dip presents an attractive long-term entry point.

Canadian National Railway

Another high-quality TFSA stock Canadians should consider is Canadian National Railway (TSX:CNR)(NYSE:CNI). While railroad stocks are not exactly the most exciting businesses, they have been great compounders for decades. Over the past 10 years, it has delivered a 17% compounded annual total return to shareholders.

It operates in a natural duopoly in Canada, so it has a very strong competitive moat. CN has been working on improving efficiencies and adding on services to its network. After an activist investor’s involvement, the company is adding a new CEO and a new forward vision. Already, it is projecting strong 20% earnings-per-share growth in 2022.

CN stock is down 5% in the recent market pullback. That is presenting a decent discount for a long-term, high-quality business.

goeasy: Growth at a great price

If you are looking for a bit more growth, goeasy (TSX:GSY) is a cheap stock to consider. It is one of Canada’s largest providers of leasing and non-prime lending services. Over the past 10 years, this stock has delivered an exceptional 39% compounded annual average total return. It has delivered a 1,939% capital return (not including dividends) over that time frame.

Large Canadian banks have exited the non-prime loan segment, leaving it wide open for goeasy to take market share. It now has an omni-channel (online and store-front) lending platform that is making a wide array of loans available to Canadians across the country.

The company should see strong 15-20% annual earnings growth for many years ahead. Yet it is very cheap after a nearly 25% pullback. It only trades with a price-to-earnings ratio of 9.8 times today. For growth and value, this is a top TFSA stock to buy and hold forever.