One of the hottest Canadian stocks over the last year has been BlackBerry (TSX:BB)(NYSE:BB), especially after the significant rallies it has seen over the last 12 months. However, despite BlackBerry being a highly popular stock, there are several companies that are much better to own and which you can plan to hold for years until retirement.

The key to finding businesses you can have confidence owning is to identify ones that have strong competitive advantages and can continue to grow and earn attractive cash flows for decades.

And although BlackBerry could eventually become that type of stock, at the moment, it faces many challenges in addition to significant competition.

So if you’re looking to find high-quality Canadian growth stocks that you can own until retirement, here are two of the best to consider over BlackBerry today.

A top Canadian infrastructure company

One of the best growth stocks in Canada for long-term investors has to be Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP). Brookfield owns a massive portfolio of utility, transportation, midstream, and data infrastructure assets in countries worldwide.

This portfolio of assets is not just unique. It’s also managed by a high-quality team of professionals. So there are several reasons to buy Brookfield over BlackBerry stock today.

First off, because it has many fixed costs, but much of its revenue is tied to inflation, Brookfield can actually benefit from the current economic environment.

In addition, while tech stocks, like BlackBerry, are falling out of favour, Brookfield is an excellent investment for this environment. It’s a top defensive stock due to all the essential services its assets provide, but the way the fund is managed also makes it a top growth stock.

Management is consistently recycling cash and finding new investments. Brookfield ideally looks for assets that are undervalued or underperforming but have potential. It can then come in, improve the operations, which help to grow the valuation meaningfully.

These improved assets can then generate more income for the fund, or if the price is right, Brookfield can decide to sell the assets and use the cash to invest in new opportunities. This is why its stated investment objective is to grow investors’ capital by 15% over the long run.

It’s an excellent stock for long-term investors. There may be a year or two of lower growth, but in the long run, it will grow your capital exceptionally well, all while being highly reliable and defensive.

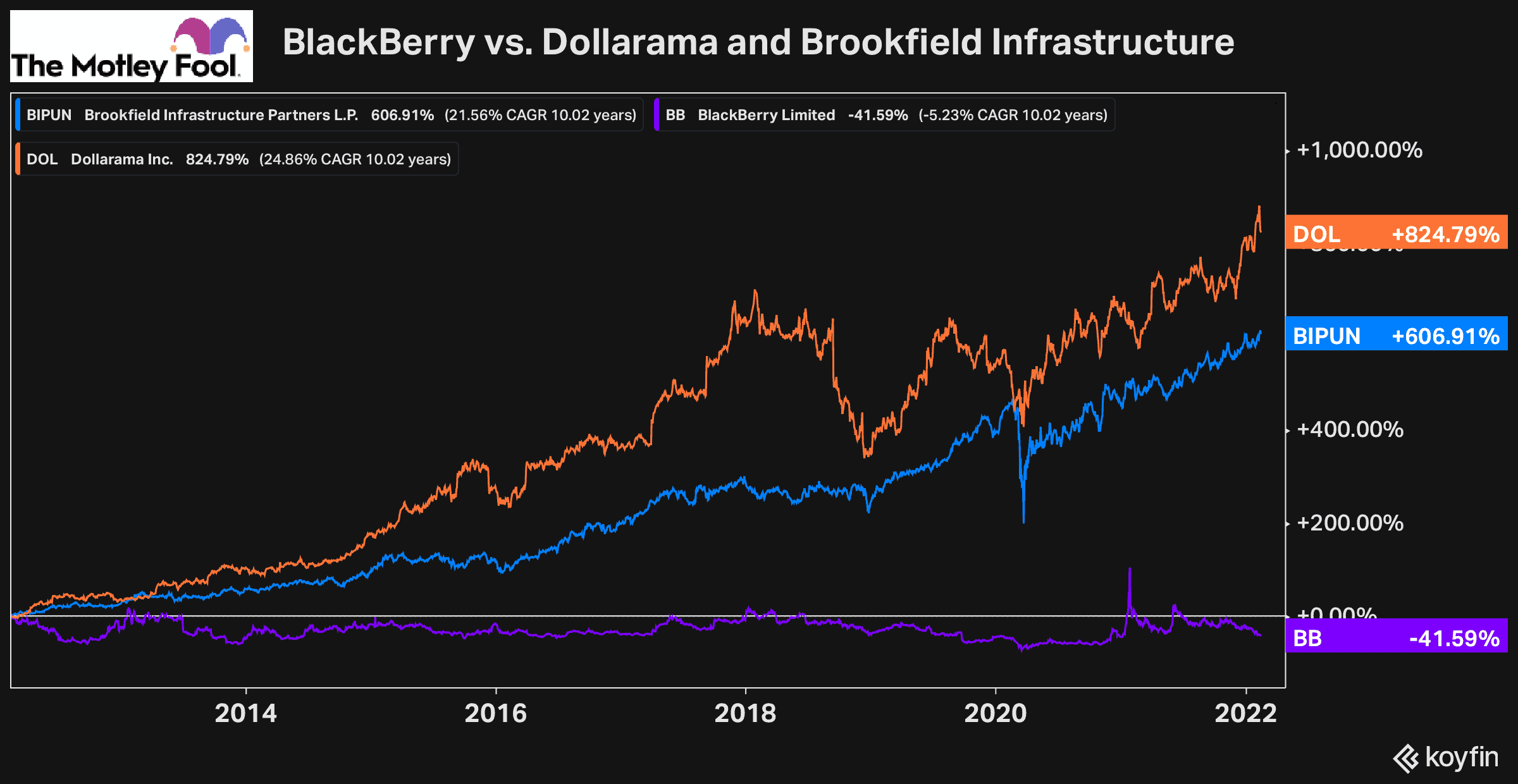

It has massively outperformed BlackBerry stock over the last year, the last three years, the last five years, and the last 10 years. And I’d expect that to continue going forward.

So rather than speculate on BlackBerry stock today, Brookfield Infrastructure Partners seems like a no-brainer investment.

A top Canadian retail stock to buy instead of Blackberry

In addition to Brookfield, Dollarama (TSX:DOL) is another excellent growth stock that also has several reasons why it’s worth a buy today.

First off, like Brookfield, it can also perform well in this economic environment. While Dollarama may see costs rise with inflation, it will likely see sales volumes rise as more consumers look to offset inflation by shopping at dollar stores rather than more expensive big-box competitors.

This is one of the reasons Dollarama has grown so rapidly over the last decade. In addition to excellent execution and merchandising internally, consumer trends and habits have encouraged shoppers to shop around and save money on essential goods, therefore having more cash to either save, or spend on discretionary items. This trend should only continue, which is why there is such a bright future for Dollarama.

After such a strong expansion across Canada over the last 15 years, though, you could argue that the growth will eventually slow down. However, Dollarama already looks to be addressing this by investing in dollar store chains outside of Canada, such as Dollar City, a Latin-American dollar store chain.

Due to this strong execution by Dollarama, just like Brookfield, it has massively outperformed BlackBerry stock in all the same periods. And as you can see by the 10-year chart above, even with the massive spike BlackBerry’s stock saw last year, these two continue to outperform.

So if you’re looking to buy a high-quality growth stock you can own until retirement, Brookfield Infrastructure and Dollarama are two of the best.