TSX stocks are being shaken by both domestic and global political concerns in 2022. Certainly, many of these events and issues are concerning. However, I don’t believe they are a reason to completely exit the stock market.

With interest rates at historic lows, most investments in bonds are earning a negative return. Likewise, with inflation soaring, the value of cash in a savings account is also losing buying power every day.

Fortunately, investors can still invest in a relatively low-risk manner. The TSX Index has several wonderful, defensive dividend stocks that provide stable streams of passive income and modest capital upside. If you are worried about further stock market volatility, here are three defensive income stocks that could outperform in 2022.

TELUS: A top TSX dividend-growth stock

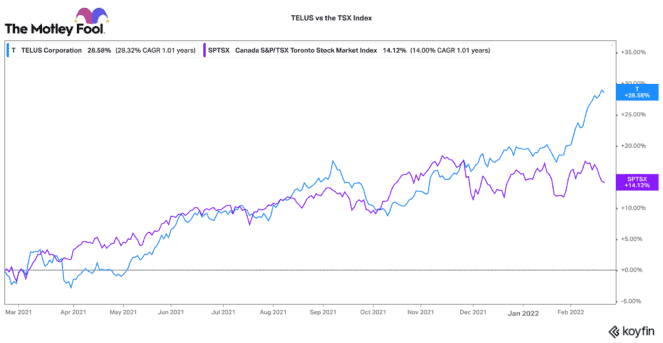

While many growth stocks are hitting 52-week lows, TELUS (TSX:T)(NYSE:TU) has been soaring to new all-time highs. TELUS recently delivered year-end results that largely beat the market’s expectations. In the fourth quarter, it saw its fastest increase in customer additions on record. Total year-end revenues, net income, and adjusted EBITDA increased 9.8%, 35%, and 6.4%, respectively.

However, it was the outlook that got the market excited. TELUS is expecting operating revenues and adjusted EBITDA to grow by 8-10% in 2022. That is a faster pace than 2021 and faster than most peers. The company has invested heavily to expand its fibre-optic network across Canada. As that capital project near completion, TELUS should see outsized free cash flow returns.

That should translate into strong dividend growth as well. This TSX stock pays an attractive 4% yield today. It has a great history of raising its dividend by about 8% every year for the past decade.

Algonquin Power: A good value buy today

Another defensive income stock to buy today on the TSX is Algonquin Power (TSX:AQN)(NYSE:AQN). This stock has declined nearly 15% over the past year. As a result, its valuation has de-risked, and it trades a reasonable price today. In fact, it is offering a 4.8% dividend yield today, which is the highest it has been since 2019.

Algonquin operates a mix of regulated utilities across North America. These operations provide a relatively stable mix of cash flows that support its dividend. It also has a growing portfolio of renewable power projects. These two asset segments help provide a quality mix of reliability and growth.

Algonquin has a long history of growing its dividend by around 10% a year. That pace will likely regulate lower, but high single-digit dividend growth should continue in the future.

Canadian Natural Resources: A top TSX energy stock with a strong dividend

Given geopolitical tensions, weak supply, and increasing demand, oil prices are quickly rising. In fact, it is not unrealistic that oil could hit over US$100 per barrel at some point in 2022. This would be very favourable for a top energy producer like Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ).

Many consider CNQ as one of the best-run energy companies in Canada. It has found a way to produce energy with factory-like efficiency at a very low cost. It also has incredibly long-life reserves, so its production capacity isn’t going anywhere. This has helped support dividend growth that has compounded by 18% annually for the past 10 years.

Today, it pays a 3.55% dividend. With oil and natural gas near multi-year highs, this TSX stock is generating a tonne of free cash flow. I expect that dividend will keep rising this year and likely beyond.