Energy stocks like Suncor Energy (TSX:SU)(NYSE:SU) have been strong again in the last month. This is due to the live events in the Russia/Ukraine crisis. It’s been driving a surge in the crude oil price and oil and gas stocks, with no end in sight. As Russia moves into Ukraine in what appears to be a full-scale aggression, oil is soaring. The fear is that Russian oil supply will be disrupted. Since Russia produces 10% of global oil supply, this fear is real.

So, which energy stocks are the best stocks to buy as oil and gas prices skyrocket?

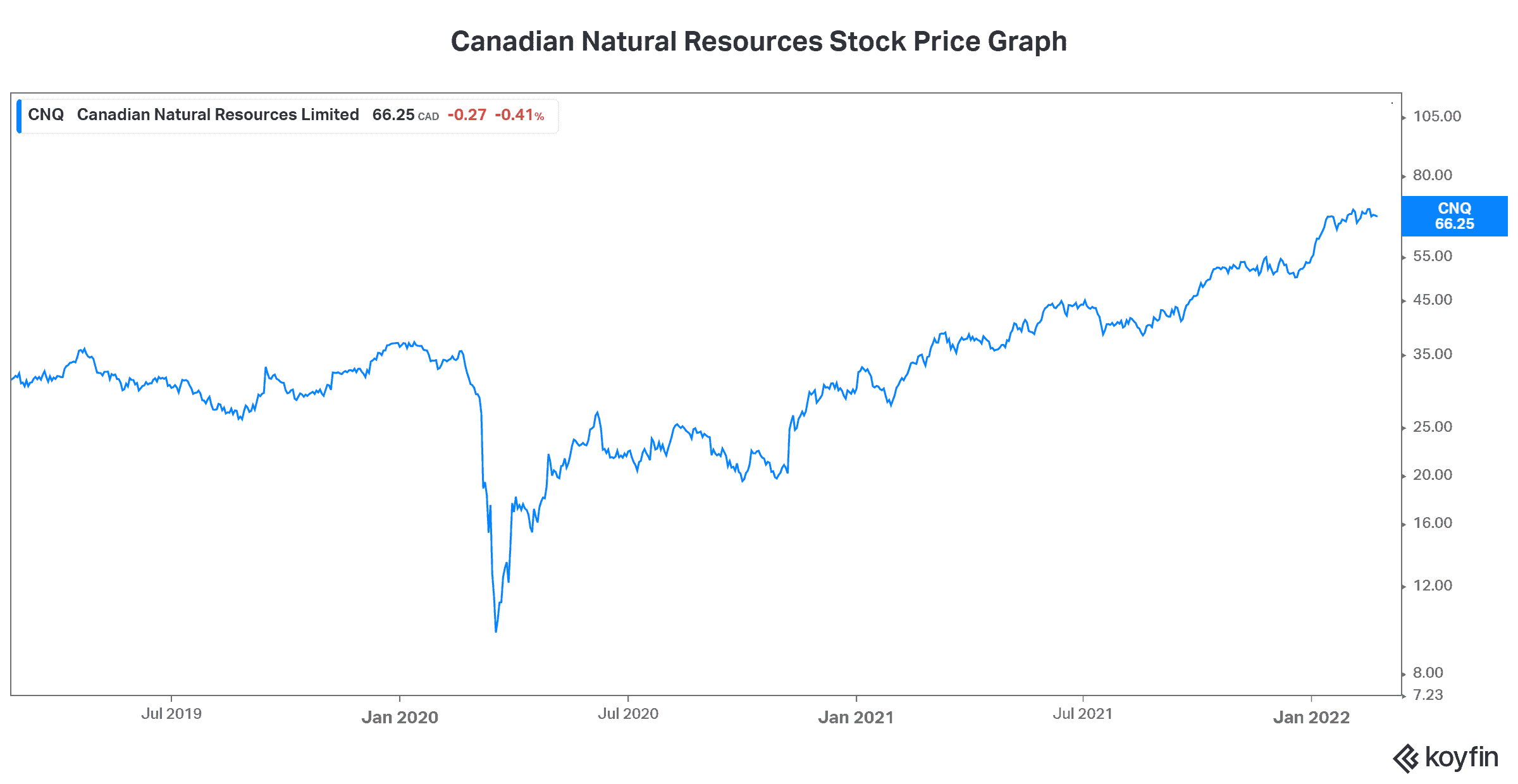

Canadian Natural Resources: This best-in-class energy stock is a top one to own

Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) is a $78 billion, top-tier Canadian oil and gas company. CNQ stock has rallied 23% so far in 2022, and it looks to be headed higher still. As oil and gas prices skyrocket, Canadian Natural Resources is a top energy stock to own. This is due to a number of factors that set this company apart from the rest.

Firstly, CNQ’s long-life, low-decline assets make it extremely resilient. This means that CNQ generates strong cash flows through all commodity cycles. Today, cash flows are soaring. Simply put, Canadian Natural Resources is in the sweet spot. Its operationally solid and efficient assets are the backbone of the company. The rising crude oil price is what’s driving this strong rally in Canadian Natural Resources stock. As the recent Russia/Ukraine crisis is intensifying the already very bullish oil price cycle, energy stocks are being driven even higher.

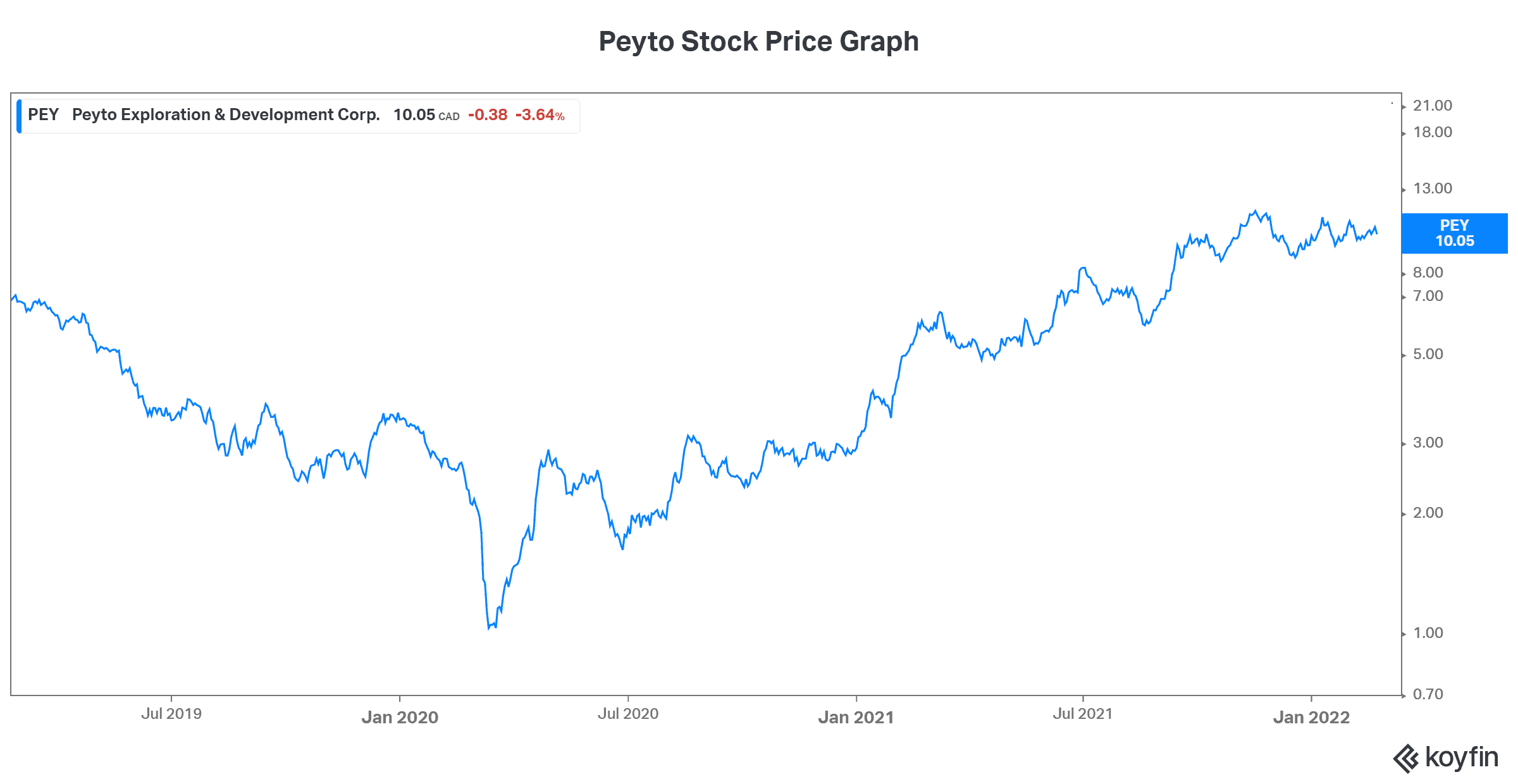

Peyto Exploration and Development: A natural gas leader benefitting from strong prices

While all the talk is about the crude oil price and its rise past $100, we should also acknowledge the strength in natural gas prices. In fact, the price of natural gas has risen 73% in the last year, and it’s up almost 4% today alone. The Russia/Ukraine crisis has lifted natural gas prices higher today, but in my view, the strengthening fundamentals will keep them even higher.

So, in the face of rapidly rising natural gas prices and the rapidly improving natural gas fundamentals, we should consider buying natural gas stocks. These are stocks like Peyto Exploration and Development (TSX:PEY). Peyto is an energy stock with a natural gas focus. It is, in fact, it’s one of Canada’s lowest-cost natural gas producers.

In the first nine months of 2021, Peyto’s cash flows increased 110%. This kind of growth is huge. And it’s fueling dividend increases and an accelerated return of capital to shareholders. Peyto’s dividend yield is currently a very juicy 5.8%.

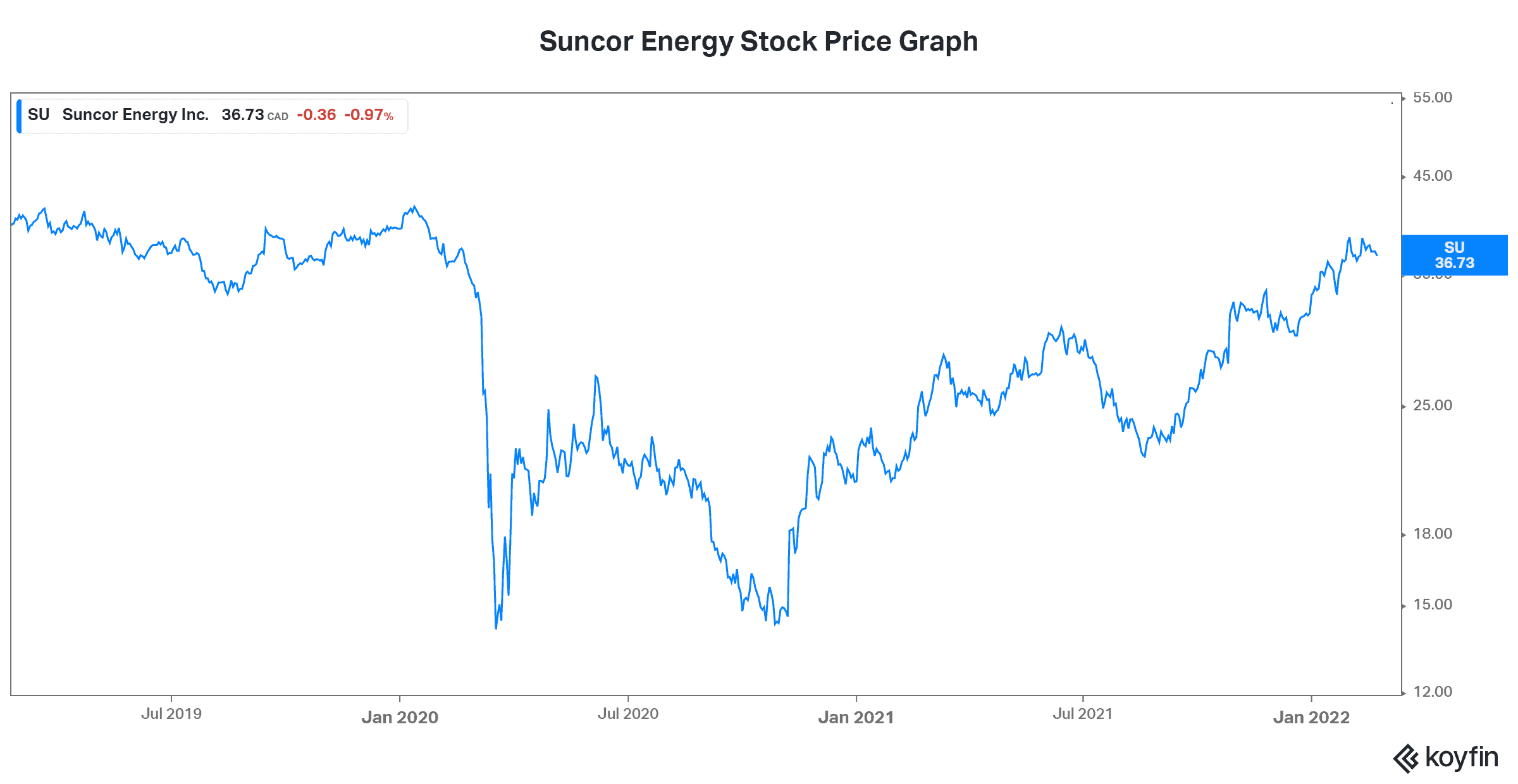

Suncor Energy: The go-to energy stock

Suncor Energy is probably the most well-known Canadian energy stock. It is this way for the simple reason that Suncor is an integrated oil and gas company. This means that it’s less volatile and more predictable than your typical energy company. So, naturally, it’s the one that investors flock to.

Suncor is now operating at a free cash flow margin of almost 15%, as the company’s integrated business model continues to generate strong cash flows. With the most recent strengthening of oil prices, we can expect this to soar even higher. Suncor currently has a dividend yield of 4.6%, with the strong possibility of dividend hikes in the future. The bullish oil and gas environment was just made even more bullish with the rising Russia/Ukraine crisis. Hopefully, this crisis will be resolved soon, but, in the meantime, we can expect continued strength in oil and gas prices. This will, in turn, drive Suncor Energy stock higher.

Motley Fool: The bottom line

The final point to be made here is that the Russia/Ukraine crisis is not the main reason for my oil and gas optimism. The main reason is strong supply/demand characteristics of the industry. A persistent lack of investment coupled with a surge in demand has culminated to create this bullish oil and gas cycle. In my view, these fundamentals will stick around for a while, as it takes time to address the imbalance. Buy Suncor Energy stock and the other two energy stocks listed in this article, so you too can benefit from it.