While the S&P/TSX Composite Index is down only 1% this year, it has been much uglier for many Canadian stocks. Technology, growth, and small-cap stocks have been the worst-hit victims of the market rout. Many of Canada’s top technology stocks (like Shopify) are down by more than 50% this year.

No one can predict when the stock market will start to bottom. However, given the amount of carnage for many stocks, it appears like we are getting close. The market is already weighing a worst-case economic scenario. As a result, there is decent room for stocks to surprise to the upside, especially in the back half of the year.

Don’t time the market: Just buy quality Canadian stocks as they become cheaper

Often, it is hard to find the bottom, so I like to average into a position. I may buy a third of position initially, then learn more about the business. If I like what I see and it keeps getting cheaper, then I may add again. If the market starts to rebound and favourable momentum returns, I can always complete the position.

It is extremely hard to time the market in the short term. However, by picking quality stocks and averaging into a position, you can ensure that you average an attractive cost base for a longer-term returns.

Royal Bank: A top Canadian financial stock

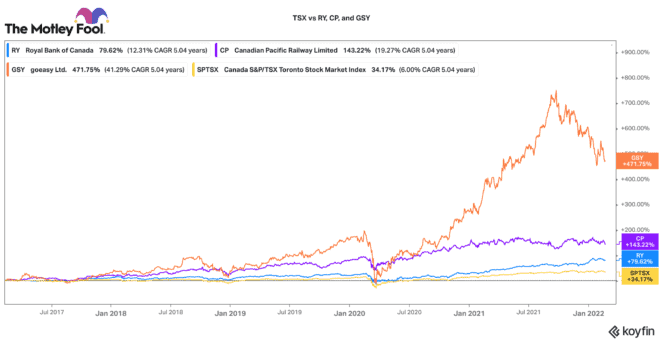

One Canadian stock that is starting to look interesting after a decent 6% decline is Royal Bank of Canada (TSX:RY)(NYSE:RY). After Shopify’s recent decline, it has recovered its place as Canada’s largest stock with a market capitalization of $202 billion. I would not call RBC the cheapest bank stock. Yet there is a strength in its size, quality, and diversity of operations.

Over the past 10 years, it has consistently grown earnings per share by a 13% compounded annual growth rate. At the same time, it has grown its dividend payout by an average 7.6% annual rate. Today, it pays a nice 3.4% dividend. Given its strong balance sheet and stable operations, it is likely that its dividend will continue growing for the foreseeable future.

Canadian Pacific Railway: A top transport stock

Another great staple for any Canadian stock portfolio is Canadian Pacific Railway (TSX:CP)(NYSE:CP). Some may be surprised, but its stock has compounded a 19.9% annual return for the past 10 years. For a boring railroad, that is impressive. The fact is, it is not just a boring railroad. While CP is one of the smallest railroads in North America, it is one of the best-managed railroads in North America.

It is set to become much larger once its takeover of Kansas City Southern is approved by regulators. After, it will have the only rail line to connect Canada, the United States, and Mexico. That should provide a strong competitive advantage and ample growth ahead. For a solid infrastructure stock to buy and hold for the long run, CP looks like a good bet today.

goeasy: A top growth stock

If you are looking for a piece of growth in your portfolio, goeasy (TSX:GSY) is a Canadian mid-cap stock that looks interesting. Like CP, it has a history of delivering strong returns. Since 2012, it has risen over 1,900%. That is a 35% compounded annual return! It is Canada’s leading provider of non-prime loans and leasing services. Most major banks have dropped non-prime lending services, so goeasy has been able to capture market share across the country.

Over the years, it has built out an omni-channel lending platform that makes loans accessible and easy. Likewise, it has been diversifying its loan portfolio to a wider array of segments. Lastly, it has its eyes on expansion into new geographic markets. Despite its exciting growth, this Canadian stock only trades for nine times earnings. On a growth-to-value basis, this is one of the most attractive stocks you will find today.