The Bank of Canada (BoC) raised interest rates to 0.50% following the results of their March 2nd policy deliberations. A combination of high inflation (5.1%) and GDP growth (6.75%) meant that the BoC had to pull the trigger on a 0.25% increase.

What does this mean for your portfolio? Well for one, bond yields will be increasing. This causes the price of bonds to decrease, as price and yield have an inverse relationship. When it comes to stocks, overvalued pandemic-era growth and tech sector stocks will likely face strong headwinds moving forwards.

Why we want insurance stocks

However, not all market sectors are affected badly by rising interest rates. Certain ones, like the insurance industry, have historically shown improved profitability in a rising interest rate environment. In fact, the greater the rate hikes, the greater the growth, with increases in price-to-earnings ratios and margins.

Combined with a healthy divided yield and history of consistent payout increases, Canada’s insurance stocks could be an excellent defensive play when the rest of the market and U.S. indexes are trading more or less sideways. Buying now could be a great way to lock in a low yield on cost, as the valuation of many of these stocks is quite attractive.

The best candidates for the role

My top two TSX insurance stock picks would be Manulife Financial Corp (TSX:MFC)(NYSE:MFC) and Sun Life Financial Inc (TSX:SLF)(NYSE:SLF).

Both companies provide insurance, wealth, and asset management solutions to individuals and corporate clients worldwide. They offer products like term and permanent life, as well as personal health, dental, critical illness, long-term care, and disability insurance products.

MFC and SLF also provide reinsurance products; investment counselling and portfolio management services; mutual funds and segregated funds; trust and banking services; real estate property brokerage and appraisal services; and merchant banking services to the aforementioned clients.

I’ve provided a head-to-head breakdown on some of their key metrics below:

- Market cap: MFC has a market cap of $50 billion, while SFC has a market cap of $38 billion

- Beta: MFC has a beta of 1.20, while SFC has a beta of 0.98

- Dividend: MFC has a yield of 4.36% and payout ratio of 33%, while SFC has a yield of 3.50%, and a payout ratio of 34%

- Profitability: MFC has a profit margin of 11.12%, while SFC has a profit margin of 11.31%

- Valuation: MFC has a forward P/E of 7.32 and P/B of 0.99, while SFC has a forward P/E of 10.37, and a P/B of 1.64

The Foolish takeaway

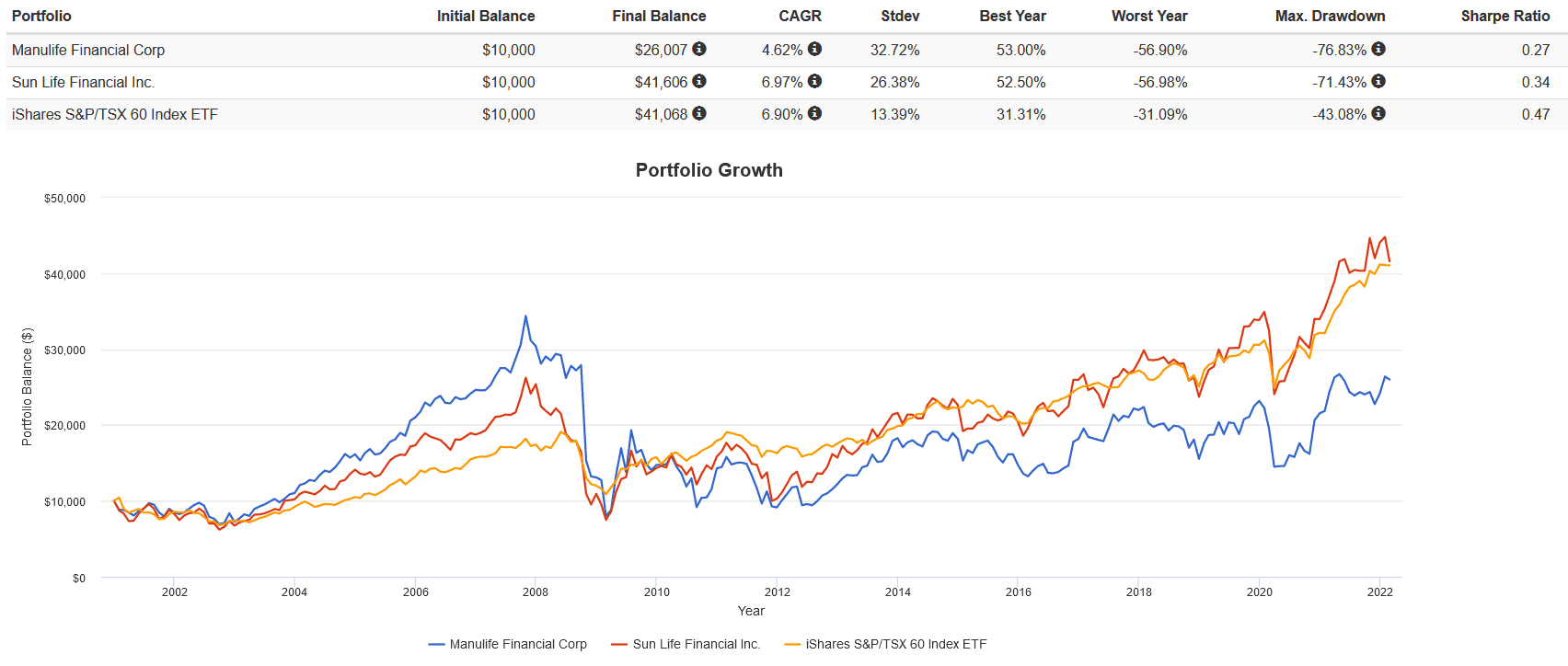

A word of caution: the backtest results provide below are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Hypothetical returns do not reflect trading costs, transaction fees, or actual taxes due on investment returns.

That being said, from 2001 to present with dividends reinvested, both SLF and MFC underperformed the S&P/TSX 60, with lower returns, higher volatility, and worse drawdowns.

If you’re a younger investors, I would advise holding the index, ideally through an exchange-traded fund (ETF). If you’re seeking income versus capital appreciation, or implementing a dividend growth strategy, MFC and SLF might be a better bet.